Money flows in and out of a business quickly. Payments are received, checks are cut, and payroll is sent. Analyzing why money flows in and out of a company allows management to assess the profitability of the business and make key business decisions. A cash flow statement provides this analysis — and is one of the key financial statements that all businesses create.

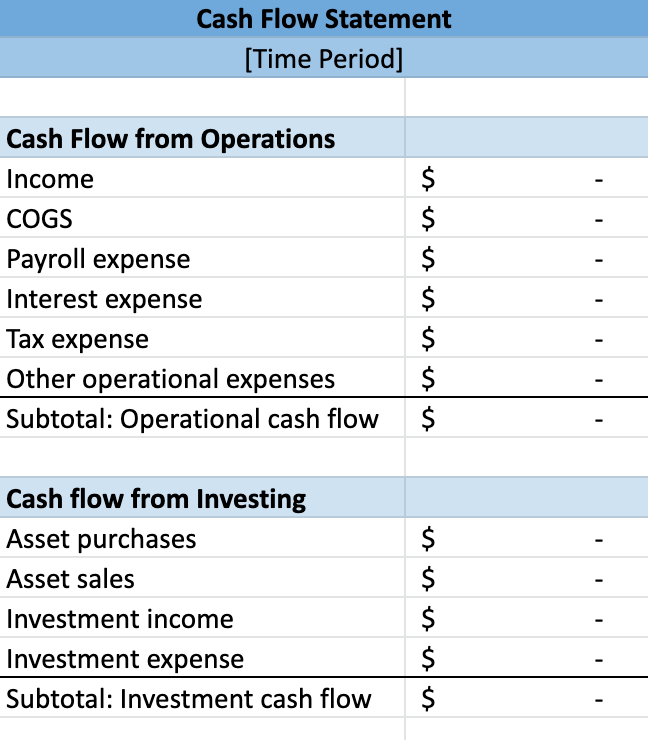

We’ll look at what a cash flow statement is, how to prepare one, and what a business can learn by creating one. We’ve also included a sample cash flow statement and a template you can use to create your own.

What is a cash flow statement?

A cash flow statement, or statement of cash flows, provides a summary of the movement of cash and cash equivalents by a company during a certain period of time. It shows actual cash coming in and going out, much like accounting on a cash basis.

For example, receiving an accounts payable invoice wouldn’t show up on a cash flow statement. However, writing a check for that invoice would.

The statement summarizes cash inflows and outflows from three different types of business activity: operations, investing, and financing. We’ll look at these in greater detail in the next section.

A cash flow statement is one of the main financial statements that a company produces, along with a balance sheet and income statement. These financial reports are used to gauge a company’s financial standing and spot trends in business operations.

Free cash flow statement template

Get a cash flow statement template to use in Google Sheets or Excel.

How to prepare a cash flow statement

As mentioned above, a cash flow statement summarizes the cash or cash equivalents that go into and out of a business. The other two financial statements — the balance sheet and income statement — are usually prepared on an accrual basis, which means expenses and income are recognized before cash actually changes hands.

Using QuickBooks? Learn how to prepare a cash flow report in QB step-by-step

However, the cash flow report requires that the company only report on cash transactions. There are two ways to calculate this cash activity.

Direct method

The direct method for calculating cash flow involves adding up all the cash transactions that take place during the time period of the report. It takes into consideration cash paid to suppliers, cash receipts from customers, and cash paid out for payroll. The amounts are calculated by reviewing various general ledger accounts and calculating the difference in the balances of those accounts over the time period.

Indirect method

The indirect method starts with a company’s income statement and adjusts certain totals to determine the cash activity during the period. These adjustments include changes to earnings before interest and taxes (EBIT) and nonoperating activities that don’t affect a company’s cash flow.

Cash flow from operations

Once you’ve determined how you’re going to calculate cash flow, you’ll begin to create the cash flow statement.

Cash flow from operating activities is the first category of cash activities that are analyzed on the statement. It may also be called cash flow from operations. It includes the receipt and spending of money that is directly related to the company’s products or services.

Examples of operating cash flows include:

- Customer payments

- Interest payments

- Income tax payments

- Payments to suppliers and service providers

- Cost of goods sold

- Salary and wages

- Rent and office supplies

Cash flow from investing activities

The second type of cash activity is from investing in assets and other financial investments. It includes the purchase and sale of equipment, fixed assets, buildings, or other investment types. It also includes loans made to vendors or received from customers.

Cash flow from financing activities

The third type of activity is from financing, and includes inflows and outflows of cash from investors, shareholder payments, dividends, and bank loans. It may also include bond sales and purchasing.

Cash flow from non-cash activities

Sometimes non-cash activities are included in a cash flow statement. These items are required to be on the cash flow statement as per GAAP (generally accepted accounting principles) and the Financial Accounting Standards Board Standard 95 requirements.

These transactions include converting debt to equity, acquiring assets by assuming liabilities such as a mortgage, capital leasing, and the exchange of assets or liabilities for other non-cash assets or liabilities. If there are non-cash activities on a cash flow statement, they should be detailed in the notes on the statement.

What does a using cash flow statement mean?

Businesses use the cash flow statement to show the liquidity of their operations. It can tell a business how much money they’re bringing in from their operations separate from other financing and investing activities. Banks and other lenders also look at this report to determine if the company has the cash it needs to take on a loan.

Cash flow statements are also used to help predict future cash flow. Businesses can analyze current and past statements to spot trends and help them make decisions regarding hiring and business development. They can also predict potential cash flow shortages, allowing them to prepare ahead of time.

Companies can also understand the quality of their income by comparing their net income to the amount of cash from operating activities. If the cash received from operating activities is higher than net income for the same time period, earnings are said to be high-quality. This means those earnings are due to increased sales or lower cost of goods sold. This calculation removes any accounting tricks or one-time cash transactions that may affect income and cash flow.

Reviewing all 3 financial statements: What do they mean?

The three financial statements — income statement, balance sheet, and cash flow statement — tell the story of a company’s finances.

- The income statement summarizes the revenue the company received and the expenses that were incurred and calculates the net income for a particular time period.

- The balance sheet gives a static view of a company’s assets, liabilities, and equity position.

- The statement of cash flows shows the flow of money caused by different types of business activities.

When analyzed together and reviewed over time, a business can use these statements to spot financial trends and make decisions for investing or expansion of the business.

For example, if income has been steadily rising for several months, the company may decide to hire additional workers or purchase equipment or a building. Conversely, if sales have been decreasing, the company may decide to lay off workers or cut other expenses.

In addition, lenders and finance companies use these reports to determine the risk involved in lending money to the company. If the company is financially healthy with adequate cash flow, then lending is a good decision. If there isn’t adequate cash flow and the company doesn’t have many assets, lending may not be advised.

For a sample of a cash flow statement, see this one from Granite Construction.

Know where your money goes

Business owners and financial managers need to be aware of where a business gets their money and where they spend it.

A cash flow statement provides insight into what business activities are creating the most cash, as well as those that are costing the company. By analyzing cash flow over several months or years, management can make better business decisions and understand the effect they will have before they take action.