How do you know if your payment collection processes are successful or not? You could measure your ability to collect on your accounts receivable. Many companies simply look at their AR balance to determine the success of their collections. But this doesn’t take into consideration the amounts that are past due versus current amounts. The collection effectiveness index (CEI) is a measure that shows how successful you are in collecting both your current and past due accounts receivable. Using this index, you can spot trends in your credit performance and work to improve your policies and processes.

What is Collection Effectiveness Index?

The collection effectiveness index, or CEI, is a key performance indicator (KPI) that measures a company’s ability to collect funds from their customers. It shows how well the company is doing in its collection efforts. The index is expressed as a percentage: A higher percentage means a better collection rate.

The index is calculated by comparing the amount collected in a certain time period to the receivables available for collection during that same timeframe. If a company is able to collect most of the receivables available during the timeframe, they will have a high CEI. If most of the receivables go uncollected, they will have a low CEI.

The index is based on the dollar value of the amounts collected and unpaid, so it’s possible to have many small outstanding receivables even with a favorable collection effectiveness index.

How to calculate your CEI

Looking at a specific period of time, you need to know four numbers to calculate CEI:

- Beginning balance in Accounts Receivable (AR)

This is the amount in AR at the beginning of the period. - Credit sales during the current period

The amount of sales you made on credit during the period — the amount of new AR you added. - Balance of current receivables

The total of payments you received for credit sales made during the period. - Ending Total AR Balance

The amount in AR at the end of the period.

The CEI Formula

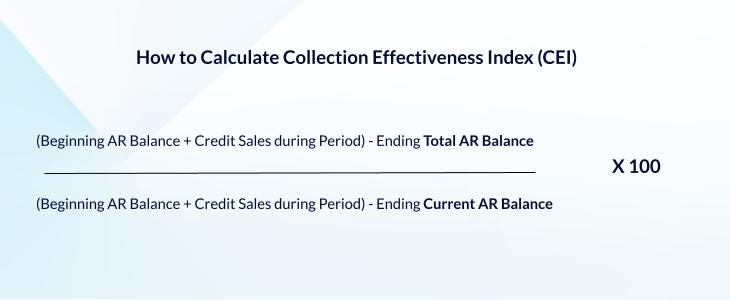

Here’s the formula to calculate your Collection Effectiveness Index for a specific period:

(Beginning AR Balance + Credit Sales during Period – Ending Total AR Balance) divided by (Beginning AR Balance + Credit Sales during Period – Ending Current AR Balance) multiplied by 100.

CEI example calculation

To illustrate how the CEI is calculated and how it’s affected by receivables collection, we’ll walk through an example.

Here are the balances and activities for April:

- Accounts Receivable Balance on March 31 = $100,000

- April Credit Sales = $25,000

- Payments Received on April Receivables = $20,000

- Payments Received for Outstanding Receivables = $50,000

Using this information, we’ll now calculate the variables we need to complete the CEI calculation:

- Beginning Receivable Balance = $100,000

- Credit Sales during April = $25,000

- Current Receivables Balance on April 30 = $5,000 ($25,000 in current credit sales minus $20,000 in payments)

- Total Receivables Balance on April 30 = $55,000 ($100,000 beginning balance plus $25,000 in sales minus $70,000 in total payments)

Here’s the first part of the CEI calculation: (Beginning Receivable Balance + Credit Sales during Period – Ending Total Receivables Balance): $100,000 + $25,000 – $55,000 = $70,000

Now for the second part: (Beginning Receivables Balance + Credit Sales during Period – Ending Current Receivables Balance): $100,000 + $25,000 – $5000 = $120,000

To finish the CEI calculation for the month, we divide $70,000 into $120,000 to get 0.58. Multiply that by 100 to get 58%.

To show how additional collections affect your collection effectiveness index, let’s say that we were able to collect $75,000 of past due invoices, instead of $50,000. This would change our Payments Received for Past Due Invoices to $75,000 and change the Ending Total Receivables Balance to $30,000 ($100,000 + $25,000 – $20,000 – $75,000).

Now when we perform the calculation for the first part of the CEI formula, we get: $100,000 plus $25,000 minus $30,000 = $95,000. Divide $95,000 by $120,000 and multiply it by 100 to get a CEI of 79%.

Since we were able to collect more past due receivables, our collection percentage went up.

Credit managers can use this index to gauge the effectiveness of their collection activities. By monitoring it on a monthly basis, managers can see trends and adjust their policies and procedures to improve collection outcomes.

CEI calculator

How to improve your CEI

Create and implement a collection policy

A collection policy determines what steps you will take to collect payments that are beyond their terms. It provides your internal team with a guide on how and when to escalate collection activities. If you don’t have a standard policy for collecting payment, this is a good place to start.

Apply your collection policy consistently

Your credit team should apply the collection policy to all customers equally. You may decide to establish a threshold for when you will implement certain solutions, but you should follow the policy consistently with every customer on every project. Choosing not to use certain solutions could affect your ability to collect later on.

Follow the lien process to protect your payment rights

A construction company’s lien rights are among their most valuable tools. In many states, protecting your lien rights means you need to send preliminary notices at the beginning of a project and additional notices when you haven’t been paid.

Even if you don’t file a lien, sometimes the threat of one can spur payment. The lien process is designed specifically for the construction industry and is much more cost-effective than filing a lawsuit.

Measure your collection success

The collection effectiveness index helps companies measure their success in collecting invoices. It can be used as a benchmark to determine when a company should reassess their collection efforts.

There are lots of things a company can do to improve invoice payment and collection success. Start with creating a collection policy, apply the policy consistently, and protect your mechanics lien rights.