Securing your lien rights on a construction project is crucial to ensuring that you get paid what you’ve earned. Throughout the progress of the project, you’ll assuredly be asked to sign one or more lien waivers in exchange for payment.

Don’t stress: This is a common practice. But depending on the state, there may be some additional rules and requirements that need to be met to properly execute a lien waiver.

Georgia is one such state, and one important document to the waiver process in Georgia is the Affidavit of Nonpayment. A contractor’s affidavit document acts as a failsafe to protect against the enforceability of a waiver if you’ve gone unpaid.

Georgia lien waivers and the Affidavit of Nonpayment

Georgia is one of just 12 states that regulate the form and content of waivers in some fashion or another. However, Georgia has a unique set of rules governing the lien waiver process. Instead of providing the typical four different forms, there are only two: Interim Payment Waivers and Final Payment Waivers.

For a full discussion on how to fill out each of these forms, check out Guide to Georgia’s Interim Payment Lien Waivers and Guide to Georgia’s Final Payment Lien Waivers.

What makes Georgia waivers particularly unique is that each form is drafted as both conditional and unconditional.

Let me explain: When you sign a Georgia lien waiver, it explicitly states that the waiver is enforceable “upon receipt of the sum of…” But there’s a catch. 90 days after the date the waiver was executed, the waiver will convert to an unconditional one — whether you’ve been paid or not. This timeframe used to be only 60 days, but as of January 2021, this deadline has been extended to 90 days.

To stop this from happening, the claimant must file an Affidavit of Nonpayment with the county recorder’s office. This includes whether the amount listed in the waiver went fully unpaid, or the claimant received only a portion of the amount.

This article will breakdown everything you need to know about filling out and filing your Georgia Affidavit of Nonpayment.

How to fill out a GA Affidavit of Nonpayment

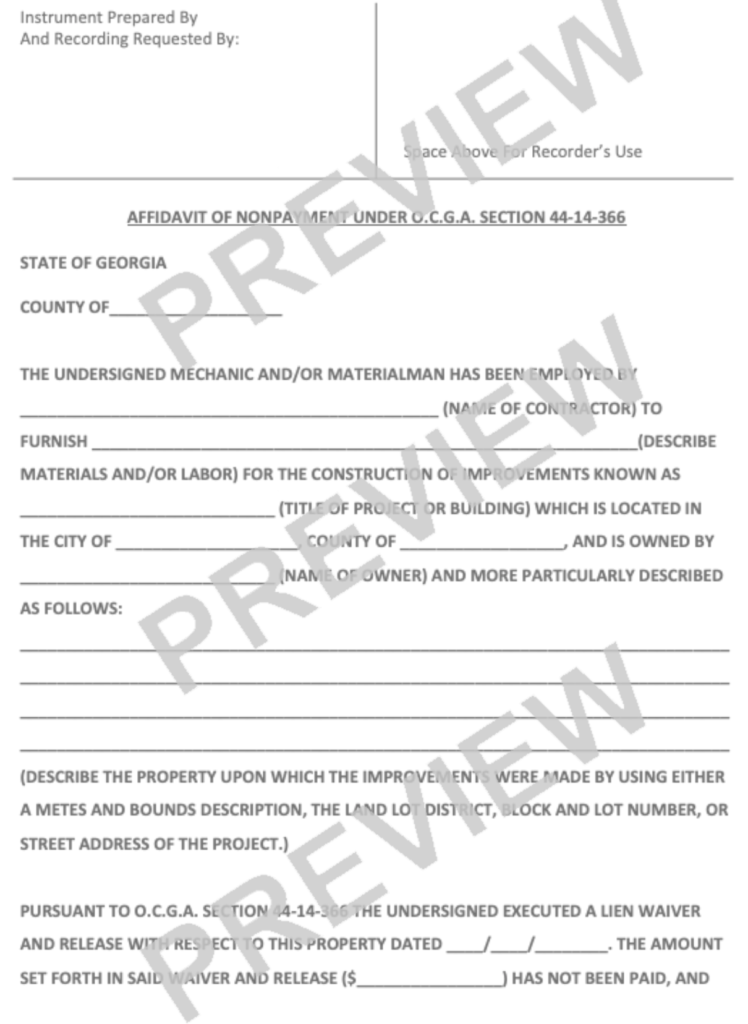

The Affidavit of Nonpayment requirements can be found under O.C.G.A. §44-14-366(f). The first step to successfully filing an Affidavit of Nonpayment is to be sure that you have the correct form and all of the required information.

Download a free Georgia Affidavit of Non-Payment form

Download a free Georgia Affidavit of Non-Payment form here.

Information needed for the Affidavit of Non-Payment form

Not only does your form need to be in the proper format for it to be filed by the clerk, but it also must be in at least 12 point font and contain all of the following information.

> County of

This is the county where the project is located. Not where your business is located or where the wavier was signed, the county where the property being improved is located.

> Name of Contractor

This is where the hiring party’s name should be included. Whoever hired you to the project (i.e. the party that you signed a contract with) should be provided here.

> Description of Labor and/or Materials

This doesn’t need to a long, itemized list of everything you’ve provided to the project. Rather, just a brief description of the labor and/or materials furnished to the project by you.

> Title of Project or Building

Did the project have a name or title? Or does the building being improved have a name? If so, add the name here. The more identifying information the better. If not, you can just fill this in as not applicable.

> Name of Owner

This is pretty straightforward. Just add the name of the owner of the real property that is being improved. You should already have the owner’s name as its required on the lien waiver in the first place.

> Property Description

This doesn’t necessarily have to be a full legal property description, i.e. metes and bounds, or block and lot numbers. A simple street address of the property being improved or constructed will suffice.

> Date Lien Waiver Executed

Here is where you’ll add the date the lien waiver in question was executed; meaning signed by you. This date should appear directly on the face of the lien waiver that went unpaid.

> Amount Set Forth in Said Lien Waiver

The dollar amount provided in this section should match up with the amount listed in the waiver that went unpaid. This is the amount of payment expected when you executed the lien waiver.

>Remaining Unpaid Balance

If you received a portion of the payment, but have yet to receive the full amount specified on the waiver in question. This section is where you will provide the remaining unpaid amounts from the waiver. If no payments have been made regarding that specific lien waiver, then this number should match the “amount set forth in lien waiver.”

>Signed, Witnessed, & Notarized

Yes, unlike the lien waivers themselves, an Affidavit of Nonpayment needs to be notarized. Not only that, but it needs to be executed in front of a witness, and signed by them. The county recorder’s office won’t record the affidavit if the affidavit is missing these key elements.

>Required Notice Language

Lastly, there is certain statutory notice language that must be included on the affidavit to be valid. This notice language provides valuable instructions on how to serve a copy of the notice after filing. The language reads as follows:

“Within seven days of filing this affidavit of nonpayment, the filing party shall send a copy of the affidavit by registered or certified mail or statutory overnight delivery to the owner of the property. If the filing party is not in privity of contract with the property owner and a notice of commencement is filed for the improvement on the property for which the filing party’s labor, services, or materials were furnished, a copy of the affidavit shall be sent to the contractor at the address shown on the notice of commencement. Whenever the owner of the property is an entity on file with the secretary of state’s corporations division, sending a copy of the lien to the company’s address of the registered agent’s address on file with the secretary of state shall be deemed sufficient.”

Where to file the Affidavit of Nonpayment

Now that you’ve filled out your Georgia Affidavit of Nonpayment form, it’s time to file. Remember, you have only 90 days from the date the waiver was signed to stop it from converting to an unconditional waiver. To do so, the form must be filed in the clerk’s office of the superior court in the county where the project is located.

Here is a list of every county clerk’s offices in the state of Georgia, along with their locations, contact information, filing fees, and more.

What to do after filing

Once filed, a copy of the notice must be served on the required parties within seven days. This is where that notice language comes in handy.

For those hired directly by the property owner, the copy only needs to be sent to the owner. For all other claimants, a copy of the notice must be sent to both the owner and the prime contractor on the project. As far as delivery methods, the copy can be sent by certified mail or statutory overnight delivery.

That’s it! It’s important for contractors and suppliers alike working in Georgia to be sure that they understand this process thoroughly — and how to effectively use an Affidavit of Nonpayment. Otherwise, they may find themselves unpaid, and with no lien rights to fall back on.