The construction industry makes up a large portion of the US economy: over 6 percent of all employment, and 4 percent of the entire nation’s GDP. With one industry playing such a key role in the direction of the nation, it makes sense to take a look at ways to improve it. And bolstering construction productivity is one of the best ways to do so.

Construction productivity in the US has been on the decline in most of the past decade, despite some signs of incline in recent years. According to the Bureau of Labor Statistics (BLS), productivity in both residential and public construction dropped more than 15% from 2015 to 2019. Commercial construction fared worse in that period, with a drop of 30%.

But there’s a complication: Construction productivity has always been hard to quantify. When it is measured, it consistently shows that productivity improvements lag far behind other industries. So what are the issues stifling construction productivity growth? What is holding the industry back, and what can business owners and those regulating the industry do about it?

Construction labor productivity statistics

Construction productivity is difficult to quantify, but when researchers are successful, it’s significantly behind comparable industries.

Three out of the four construction sectors below have shown a decline in productivity since 2007, with one showing only slightly improved numbers.

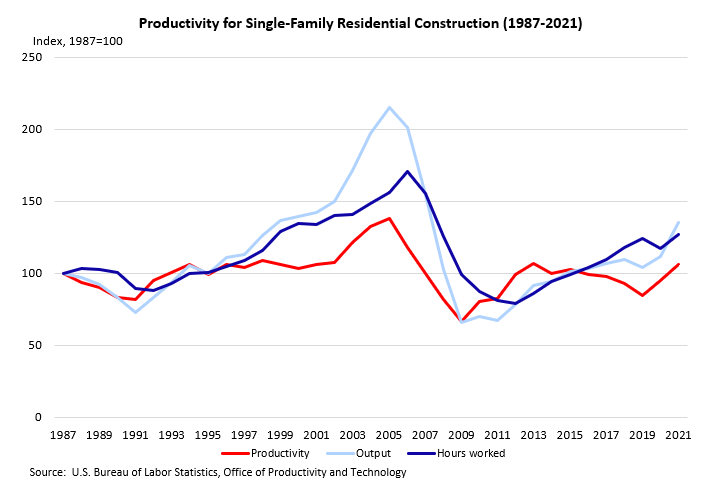

Single-family residential productivity

In the early 2000s, single-family residential productivity, output, and hours worked were at an all-time high. By 2008, output declined sharply, followed by a more gradual decline by both hours worked and productivity. All three reached the lowest points since 1987 between 2008 and 2012, rebounding briefly through 2013.

Productivity then declined steadily between 2014 and 2019 until turning around with increases in 2020 and 2021.

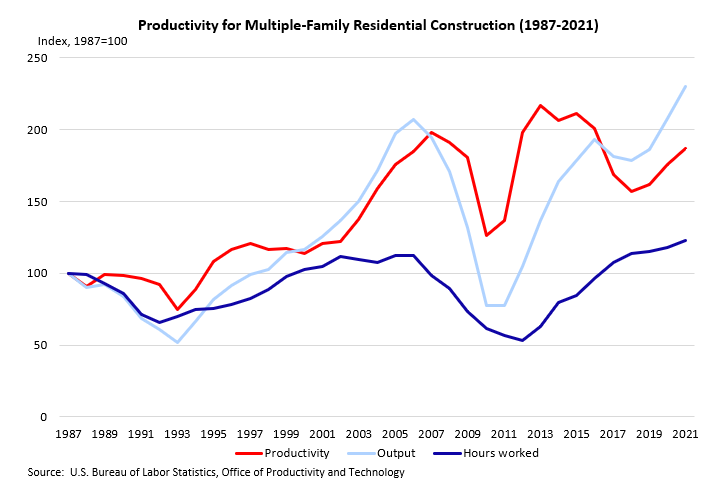

Multi-family residential productivity

Like single-family building, multi-family residential construction experienced high productivity and output in the early 2000s, with a relatively consistent number of hours worked. After a temporary decline around 2008, all three values rose again until another slight decline starting around 2016. After 2019, productivity turned around and has been on a continuous upswing.

Overall, productivity is higher than it was 30-plus years ago but not as high as it was at its peak around 2013 and 2015.

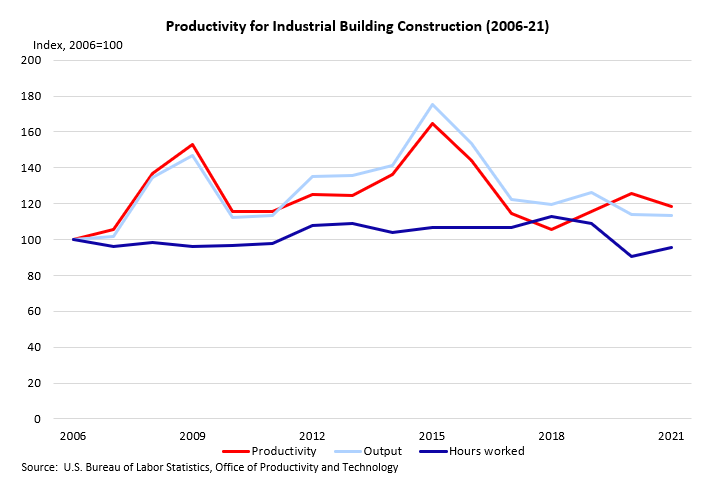

Industrial building construction

The one outlier of the group is industrial building construction productivity, though it isn’t exempt from its ups and downs. After 2008, industrial construction productivity and output spiked for a year or two while hours worked remained largely unchanged.

From 2010 to 2013, productivity remained relatively flat while output started to increase. Both output and productivity peaked around 2015 and steadily dropped off before flattening around 2017, where it has enjoyed relatively uneventful slight growth ever since.

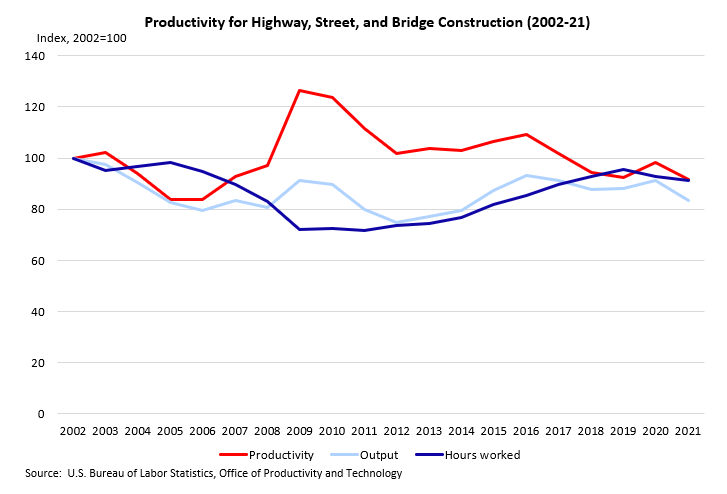

Highway, street, and bridge construction

Public works projects aren’t exempt from productivity issues (surprise, surprise). The industry’s output and productivity spiked between 2008 and 2009 and has since been on a relatively steady incline. Output followed a similar, albeit less extreme curve as well. Hours worked? Well, they had been on a slow rise since 2008, but productivity, output, and hours worked all began to slip between 2019 and 2021.

The challenge of measuring construction productivity

The act of successfully measuring productivity in the construction industry has always been a difficult one. The industry’s unique characteristics make it difficult for researchers to determine where productivity comes from, where it’s lacking, and how to improve it. The following key areas make up the majority of the challenge.

Measuring output

Measuring the construction industry’s output is a challenge all of its own. Unlike widget manufacturing or determining trucking routes, the variables affecting construction change from project to project.

According to the BLS, “Productivity is difficult to measure for construction industries because of the challenges in measuring both output and hours worked.”

For instance, 2,000-square-foot homes come in an endless number of styles and contain a wide variety of materials — and the challenges of building one on the east coast will differ from the midwest, south, or west coast. Even building these homes in different areas of the same county can have drastically different results. Most industries don’t experience the same degree of variability.

Deflating construction prices

To really quantify an industry’s productivity, you need reliable data to base current, past, and future costs off. Finding those deflators within construction is difficult because it’s a unique industry. The Bureau of Labor Statistics agrees, saying “it is difficult to develop reliable output price deflators to convert observed revenues into constant dollar measures of output growth.”

Also, the act of painting with a broad brush simply muddies the water. According to the Building Futures Council, “The use of proxy indices in construction also contributes to the problem (e.g. using the Census Housing Index to deflate commercial and military construction).”

Other industries don’t have these same issues, as accurate deflators are much easier to determine and can be reliable for longer periods of time.

Subcontracting

How a typical construction project comes to fruition also makes it difficult to determine the actual cost of labor. Typically, the general contractor subs out work to specialty contractors. Rather than accounting for those labor hours directly, they’re accounted for in materials inputs.

The Bureau of Labor Statistics states, “The services of subcontractors would normally be included as purchases of materials inputs, much as any other firm purchases necessary inputs from its suppliers. Since the present analysis considers only labor productivity growth, it does not account for materials inputs.” For that reason, the BLS can’t quantify them.

Undocumented labor

Skilled undocumented labor makes up a large portion of the construction industry workforce. According to some estimates, 13 percent of construction labor is performed by undocumented labor, though the actual number is obviously hard to nail down. This creates a significant (if not impossible) challenge for determining construction productivity.

According to the BLS, “It is likely that at least some undocumented laborers are included in official measures of employment,” through one means or another.

However, if those workers are entirely off the books, they may not be included in labor hours, therefore significantly skewing the level of productivity.

9 ways to improve construction productivity

With that understanding of the productivity struggles and why it’s hard to put a finger on it, it’s worth exploring how to improve it.

The following tips could provide the answers necessary to not only boost productivity but also kick the nation’s economy into high gear.

1. Streamline the regulatory process

Construction is one of the most highly regulated industries in the country, and it’s for a good reason. Building safety, life safety, and environmental impacts shouldn’t be taken lightly, so regulatory agencies must exist to oversee projects. But regulation often slows productivity, affecting output while extending hours worked.

Streamlining permitting and approval processes (possibly through web-based portals and apps) can allow the regulatory agencies to help keep the project on schedule.

2. Simplify contractual processes

It should come as no surprise that when two entities work together toward any common goal, the work goes faster and typically smoother. So why do we approach contracting with such an antagonistic, me-vs-them attitude?

The industry needs to consider moving toward a more synergistic, collaborative system focused on solving problems rather than undercutting the next bid. This attitude shift can lead to open communication—the harbinger of better-quality projects, fulfilled and valued contractors, and happy project owners.

Crash Course: Everything You Should Know about Construction Contracts

3. Supply chain management

One of the most significant issues that the construction industry deals with is the ever-changing supply chain landscape. Fluctuations in materials pricing, availability, and shipping costs chew construction company profits to the bone. Yet it remains an issue, year after year.

Obviously, companies need to diversify their supply chain and leverage their efforts to protect their profits. But, the supply chain moving toward digitalization will allow for better logistics management, allowing the chain to fill orders and deliver materials faster, decreasing hours worked while increasing productivity and output.

And not letting cash flow bog down the supply chain is another area worth considering. Financing designed for the supply chain in the construction industry allows contractors to keep moving forward and secure their place in line with an order before they receive a single check.

4. Improve payment transparency

If there’s one thing that can bring a thriving project to a halt, it’s payment problems. And it’s not always a lack of money or dishonesty that causes them. Often, a project owner or GC doesn’t know who needs to get paid, and a check might go unwritten. This missing check can turn into a project delay when the unpaid contractor files a mechanics lien and pursues legal action.

That’s not good for productivity.

To improve transparency, some projects moved to a publicly available database of contractors working on a project. This means that the project owner, GCs, subs, and suppliers all know who is working on a project, keeping everyone on a level playing field.

Also, general contractors or project owners requiring all participants on a project to send preliminary notice will solve a large part of the issue. As the preliminary notices roll in, the GC can develop its own database of involved parties, ensuring everyone gets paid for their efforts.

5. Prequalify contractors

Ever notice that some contractors seem to have a black cloud following all of their projects? Every project is late, over-budget, and riddled with productivity-sapping issues. What if there was a way to identify these contractors before doing business with them? There is, and it’s called a contractor payment profile.

The data that makes up these profiles will help vet contractors and subs for their past performances and technical proficiency. These factors allow the hiring party to estimate how the contractor might handle their project. Also, these profiles include the information necessary to determine whether or not a contractor values transparent payment practices—a must-have for well-oiled productivity.

6. Invest in technology

It shouldn’t come as a shock that one way to improve productivity is to lean on technology. The right technology can limit the number of hours spent working on simple tasks, allowing employees to stretch their problem-solving muscles and improve output. This leads to happier employees and better productivity.

Technology has a place in several areas in construction management:

- Smart contracts automate payments, approvals, orders, and other critical processes to speed up payments, scheduling, and more

- New design technologies like BIM and VDC provide better accuracy for office staff and help reduce errors in the field

- Software that links the field and back-office can improve communication and streamline contract changes

- Real-time management software can improve accounting, subcontractor scheduling, and other regular tasks

- Payment software can reduce the stress on administrative and financial staff while keeping vendors, suppliers, and subcontractors happy

With so many areas typically realizing the benefit of automation, staff can do the more important tasks that a computer program cannot.

7. Prioritize safety

Prioritizing safety is key when it comes to construction productivity. According to the National Safety Council, 99 million days of productivity were lost from work injuries in 2020, with an additional 50 million days of lost productivity projected for future years tied to those same injuries.

Job delays due to injuries can decrease productivity exponentially. It’s important to know what to look for and implement policies that may help prevent loss on projects.

Read more: OSHA’s top construction violations and how to prevent them

Investing in a safety program, training employees to follow safety procedures, and making safety a key component in company operations can help prevent project delays and additional costs that may be incurred due to worker injuries. Implementing safety protocols can also mitigate accidents from occuring on job sites and increase productivity levels.

8. Take advantage of prefabrication

Prefabrication can boost productivity on construction projects as it saves time and doesn’t rely on unforeseen hiccups like inclement weather or scheduling conflicts that are likely to occur during onsite work. Spending less time tangled up in project delays means companies can take on more projects and streamline their process.

It is important to consider some of the drawbacks that accompany prefabrication, however. Since the majority of labor and materials aren’t incorporated into the property until they are installed onsite, modular build methods may run into payment problems. Mechanics lien laws, for example, come into play for improvement on real property. Prefabrication projects are considered an improvement until after the majority of the structure is built.

Read more: Prefab construction: Getting paid for offsite work

This can further muddy the water with efforts to quantify labor, as mentioned above with subcontractor work. Prefabrication is a favorable route to consider to increase productivity on construction projects, but contractors should keep in mind that it is difficult to track data that reflects how productivity is affected by this method of construction.

9. Improve access to project financing

Construction is a cash-hungry business, and it’s impossible to keep productivity up while scraping the bottom of the barrel. In fact, a lack of cash flow is the main reason why construction companies fail. Without the money to spend on project labor, materials, and technology, productivity plummets and takes output with it.

Luckily, contractors have an increasing number of financial options to choose from, and they’re specifically tailored to the industry. Resources such as 120-day materials financing can remove the financial limitation that reduces productivity while also giving a contractor the boost, confidence, and opportunity they need to grow their business.