When it comes to paying for building materials, contractors often have to lay out their own funds before they can get paid by their customers. This creates a cash flow issue when they don’t have enough money coming in to pay for the materials. Building material loans offer contractors a way to get cash to pay for their materials, so they don’t have to front money on a project.

The problem with construction’s supply chain

In the construction industry, contractors have to order materials long before they start work on a project. The lead time for some building supplies can be up to 12 weeks.

Suppliers’ payment terms vary, with some charging contractors when the material is delivered to the jobsite, and others expecting payment at the time the order is placed. The number of days contractors have to pay their invoices also depends on their credit history and the credit policy of the supplier.

To provide cash to fund the purchasing of materials, contractors usually bill their customer or the general contractor and wait for payment from them to pay for their supplies. However, contract terms often state that a contractor can’t bill for materials until they arrive on site. By then they already owe the supplier for the materials or may have even paid for them already. Since customer payments can take up to 83 days or longer, this can lead to potential cash flow problems.

Contractors often scramble to find ways to fund their material purchases, knowing that they won’t get paid for those materials for a considerable amount of time. This makes it hard for contractors to scale up, since they often don’t have enough credit to cover larger material purchases. They have to rely on building material loans to cover these expenses and protect their cash flow position.

Building material loan options for contractors

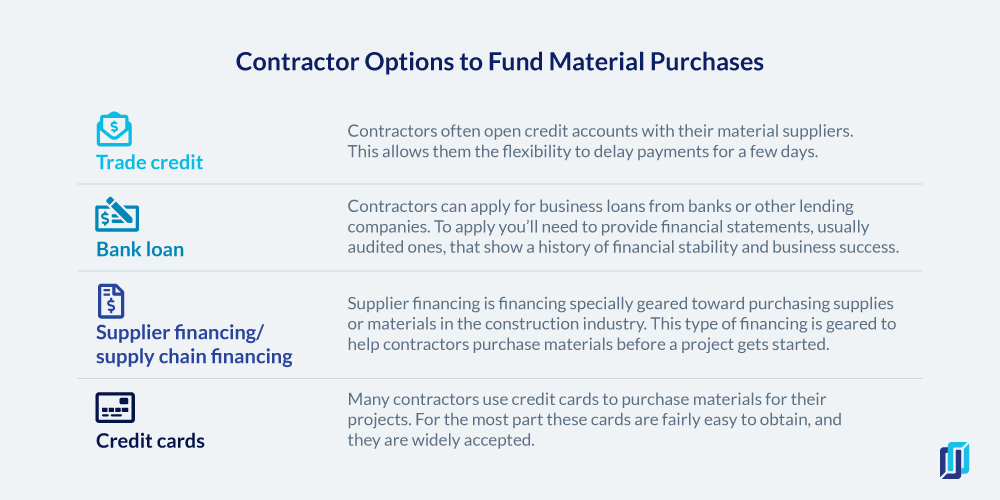

There are many ways that contractors can fund their material purchases without having to pay cash up front or pay their vendors before they get paid. These options include trade credit, bank loans, supplier financing, and credit cards.

Trade credit

Contractors often open trade credit accounts with their material suppliers. This allows them the flexibility to delay payments for a few days. Contractors establish an account by applying for credit from the supplier, who then checks their credit history before deciding if they are a good risk or not. Interest charges and late payment fees are usually assessed when payments aren’t made according to the terms of the credit agreement.

Deep dive: Creating a Concrete Credit Application

Opening a trade credit account is an option that most contractors have the ability to take advantage of. However, if the contractor is a new business or has poor credit history, a trade account may be difficult to get. And these accounts aren’t ideal for the supplier because they have to wait for payment from the contractor instead of being paid right away. Suppliers choose to offer credit as a way to help increase their sales.

Bank loan

Contractors can apply for business loans from banks or other lending companies. To apply you’ll need to provide financial statements — usually audited ones — that show a history of financial stability and business success. The bank will check the contractor’s credit history and will offer an interest rate based on the contractor’s perceived credit risk.

Learn more: How to Negotiate a Higher Credit Limit With Your Building Material Supplier

Banks don’t generally favor construfction building materials loans due to the high risk and potential delay in payment. Contractors should keep in mind that it can take a long time for a loan to be approved and funded, so you need to plan ahead. If you can’t get a loan from a traditional lender, you may be able to get an SBA-backed loan, but you’ll have to exhaust all your other financing options first.

Supplier financing/supply chain financing

Supplier financing is financing specially geared toward purchasing supplies or materials in the construction industry. A special financing company pays the supplier at the time of the material purchase, and the contractor receives the materials as they usually do. The contractor then pays the financing company back within the agreed-upon terms. Payment is usually due in 30 to 60 days, but terms may be extended to up to 120 days. The contractor pays the financing company a fee, which is usually a percentage of the purchase price.

Learn more: Negotiating Supplier Pricing: 3 Tactics to Get the Best Terms

This type of financing is geared to help contractors purchase materials before a project gets started. It recognizes the need for longer payment terms, which helps contractors meet their financial obligations without paying exorbitant interest or finance charges. Contractors are still subject to a credit check, and the financer’s fee will reflect the level of perceived risk.

Credit cards

Many contractors use credit cards to purchase materials for their projects. For the most part, these cards are fairly easy to obtain, and they are widely accepted. Materials are purchased using the card, and the contractor pays the credit card company back according to the terms of the agreement. Interest charges and late fees are assessed as they are incurred.

Some contractors may struggle with using credit cards for material purchases, especially if they’re buying a lot of materials for a large project. They have to ensure that their credit limit is high enough to cover all their projects and material needs. Credit cards are easy to get if you’ve got a great credit history, but those that struggle with their finances may have difficulty getting enough credit to cover their needs.

Contractors have options

Contractors have options to fund their material purchases. They don’t have to deplete their cash reserves to take on bigger and better projects. All contractors should look into building material loan options that best fit their needs, so they are ready when the next opportunity comes along.