Webinar Hub

Become the payment expert for your construction company

Learn how to get paid faster by watching webinars led by construction

attorneys, financial experts, and industry thought leaders.

Ferguson’s Mission-Driven Leadership: How Purpose Powers Success

Want to get notified about upcoming webinars?

Never miss your opportunity to attend a webinar or live

event hosted by Levelset.

event hosted by Levelset.

All webinars

Ferguson’s Mission-Driven Leadership: How Purpose Powers Success

MariaJenniferLisaCatherine

Register

Getting Paid in California: Why Preliminary Notices Matter

LeslieAlice

Watch now

Learn From SRS Distribution: How to Attract and Develop Construction Credit Managers

CharlesChris

Watch now

How the ERC Tax Credit Can be Used by Construction Businesses

DavidPhilip

Watch now

Credit, Year End Clean-Up & Secret Santa

LoriD'Ann

Register

Credit Applications, Thanksgiving Traditions & FUN!

TheaLoriLisa

Register

Integrating Your Systems: The Shortcut to Protecting Your Payments and Saving Time

Danny

Watch now

Materials Financing 101 (and why it’s the perfect partner to your lien rights software)

RaneWhitley

Watch now

Credit Applications, Costume Contest & Prizes

Thea

Register

Why Contracts Aren’t Enough to Get You Paid

Michael

Watch now

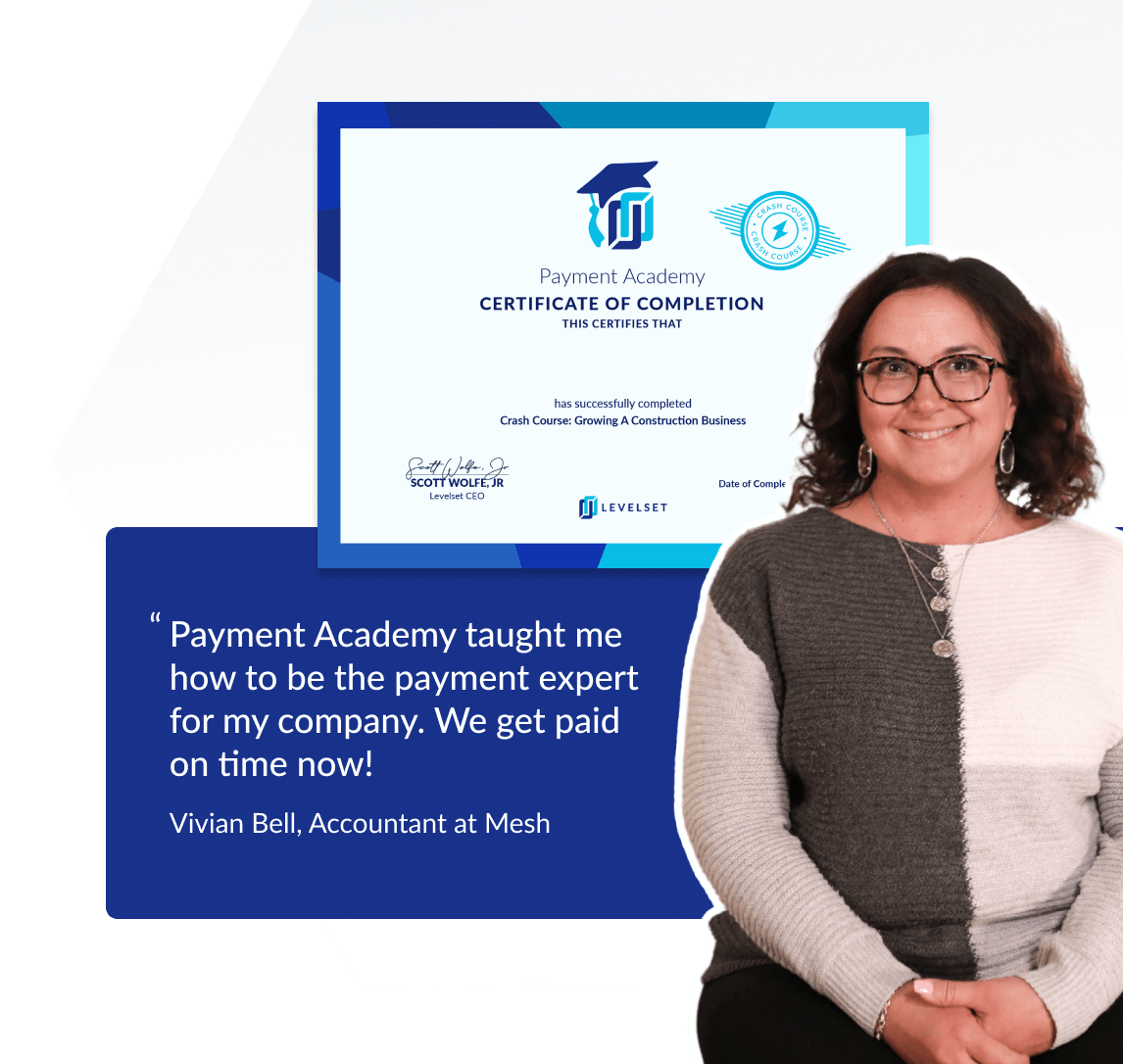

GET CERTIFIED

Levelset Payment Academy

Learn the knowledge, skills, and tools you need to get paid faster, improve cash flow, and build successful relationships in the construction industry.

Explore free courses

150 Expert Webinars

205 Total webinars

36 Payment Experts