After a period of relative calm in the prices of building materials during late 2021, materials prices are once again spiking — and it’s having a serious impact on the state of construction.

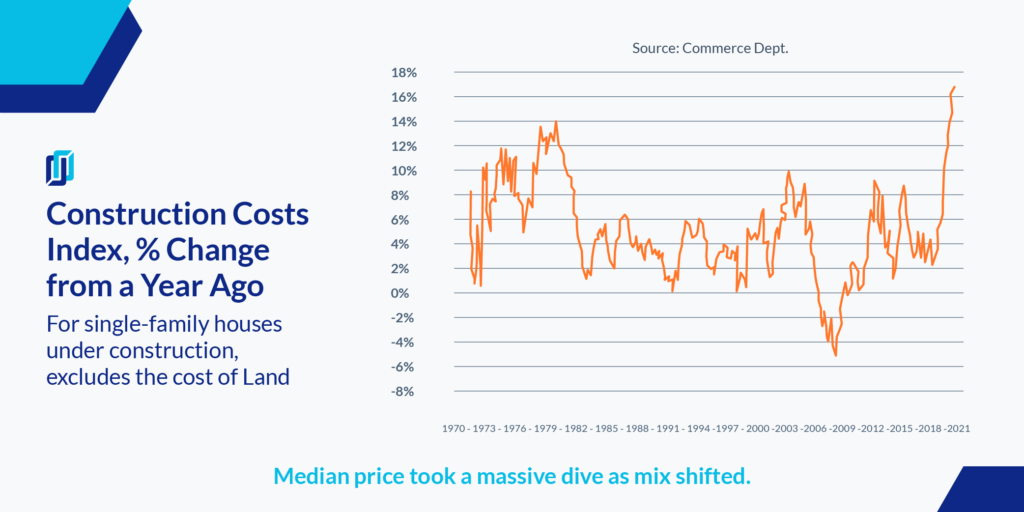

Recent data from the US Census Bureau showed that construction costs went up by 17.5% year-over-year from 2020 to 2021 — the largest spike in this data from year to year since 1970.

2021’s costs were also 23.5% higher than 2019’s pre-pandemic, showing just how large the rise in costs has been as the effects of the pandemic played out on multiple material supply chains.

Single-family houses for sale at all stages of construction have also been on a steep rise, surging throughout 2021 to hit 403,000 (seasonally adjusted) by December, up 58% from a year before. But with the supply chain unreliable and material prices climbing, homes are being sold while still missing elements.

“Homebuilders in particular have found themselves caught between a red hot buyers market and a substantial materials shortage,” Levelset’s Iain Smith reported in mid-January. “Some have even resorted to intentionally limiting sales in order to reduce pressure on precious supplies.”

Though companies have been working hard to maintain profitability, it hasn’t been easy with the unpredictable nature of the materials market.

Even though his company has worked to order its supplies six months in advance of potentially needing them, Jim Mundy, COO of Missouri contractor Contegra Construction, noted that “[rising materials costs are] going to drive a significant rise in overall project costs.”

The company, whose main focus is working on industrial warehouses, has seen the cost of roofing materials rise by as much as 300% during the past years, and has taken to stockpiling its materials to help protect it from future price increases.

Though shifts in materials costs didn’t directly impact as many contractors at the end of 2021 due to price points fixed before cost spikes construction research manager for Jones Lang Lasalle (JLL) Henry D’Esposito says that that may change significantly in 2022.

“New starts in 2022 will probably have (construction-related) cost increases in projects,” said D’Esposito. “That’s where we might see some hesitation.”

Similar to the Census Bureau’s data, JLL’s Q4 2021 Construction Price Report noted that the cost of existing greenfield and interior fit-out projects increased by 8–9% from 2020 to 2021.

Planning around the cost of materials can be especially difficult in this context, because prices have not only been high, but volatile and unpredictable.

“Pricing, if you go back a couple years ago, OSB board was $8-9 a sheet. Over the last few months it has gone as high as $50 to $55 a sheet,” said Sheldon Yellen, CEO of disaster response company Belfor.

As problems with the supply chain and impact of the pandemic — unlikely to be mitigated substantially any time soon — continue to have huge impacts, there will likely be just as much instability with materials prices for the foreseeable future.

“I think the supply chain issues and the COVID work stoppages in some of the manufacturing facilities and plants that are producing materials are probably more significant than the actual demand itself,” Yellen added.

Deep dive – Construction Costs: 3 Ways Contractors Can Deal with Rising Prices

However, some contractors have been able to overcome these materials issues with the help of good planning.

Mike Eveler, president of Kadean Construction, noted that demand for projects has mostly overtaken cost impacts for his company up to this point, with only a small number of developers choosing to pause projects.

“At first I would think we’re going to get to a point where the numbers don’t pencil out anymore for our clients: ‘Hey, I can’t afford to build the same thing now that I built a year ago for significantly less money, it doesn’t work anymore,'” Eveler said. “But clearly it’s still working, because the construction has not slowed down.”

It’s important for contractors to keep an eye out on trends in order to aid their planning. Levelset’s Material Price Tracker — a tool that aggregates the price of building materials and tracks industry trends — displays the unpredictable nature of individual materials in order to help inform contractors of what the state of materials prices is.

The volatile nature of products has been on display in recent months. For example, cement is up by more than 6% since December 2021, with prices for untreated and treated lumber up by over 4% and 3% respectively, while steel studs have fallen by almost 5% in the same period.

However, it’s these same changes in trends that make the utility useful. The Material Price Tracker includes necessary data for contractors looking to find the best supply prices, and includes information about short-and-long term trends nationwide alongside region-specific data.