Rising costs during a construction project affect not only the project’s profitability — they affect a contractor’s ability to survive. Economic growth already strains a construction company’s cash flow, and increasing costs only make it worse. Contractors must manage costs while staying competitive with other contractors bidding for the same work. How contractors deal with rising material and labor costs determines their continuing success in the industry. In this article, we’ll explore why construction costs are rising — and what contractors can do to protect their bottom line.

Construction costs are higher than ever

Construction costs vary widely depending on the project location, building materials, the type of project being built, and many other factors.

For example, the cost to build a commercial project is among the highest of any job type. But it can range from about $300 per square foot for a single-story office building to almost $800 for a performing arts center.

An increase in any of the construction inputs can eat into a contractor’s profit. When multiple costs are rising simultaneously, construction companies can quickly find themselves underwater. Recent increases in labor and material costs, coupled with a spike in fuel prices, are a serious concern for the industry.

Learn more: How to Avoid Running Out of Cash on a Construction Project

Building costs

The costs of constructing a building went up 4.5% in the year ending in August 2021, according to JLLs H2 2021 Construction Outlook. This overall increase mirrored the jump in construction labor costs, which were up 4.5% over the same time period.

Material prices

Lumber prices have skyrocketed, jumping 17.5% from 2020 to 2021. That’s the largest increase in 40 years. (It got to the point that contractors actually accused lumber suppliers of fixing prices — though the lawsuit was later thrown out.)

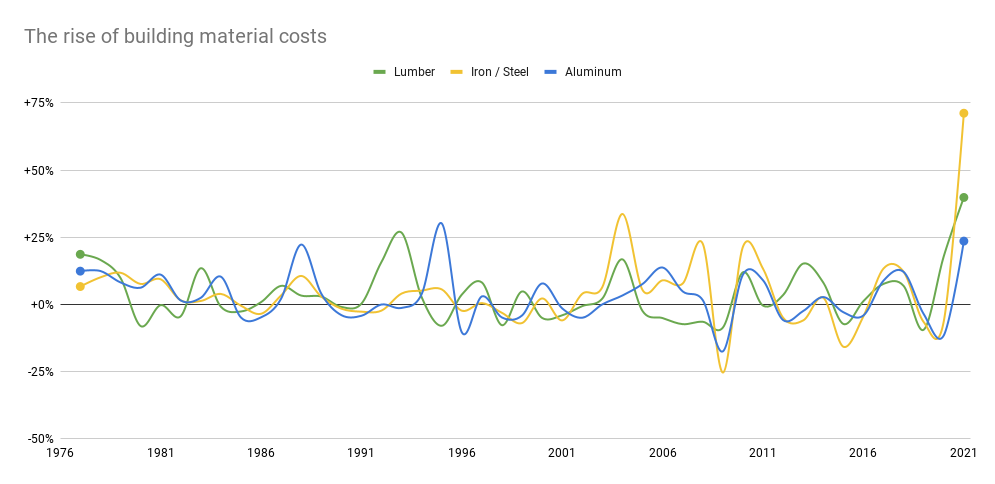

But lumber isn’t the only construction input that has seen supply and pricing volatility. Steel and aluminum have been getting more expensive and harder to get. , which hit its highest point since 1976. has been making headlines for the last couple of years. In 2021, lumber prices hit an all-time high since records started in 1949. Plastic also hit an all-time high since 1976.

Overall, material costs rose 23.1% in the year ending August 2021, according to the JLL report. The chart below shows the volatility of materials pricing, as well as the sharp increase in 2020-2021.

In 2021, higher material prices — particularly lumber — added $14,000 to the cost of an average single-family home. And, according to Ed Zarenski, nonresidential construction experienced inflation of 9% in the past year.

Learn more: Construction Costs Experienced the Largest Spike Since 1970

Why are construction costs going up?

The COVID-19 pandemic had an undeniable effect on every input that fuels construction.

Although in many states construction was seen as an essential industry and allowed to continue work, many manufacturers had to deal with shutdowns due to virus outbreaks in their facilities. These shutdowns created a shortage of many building materials. And workers were either laid off en masse or chose to pivot to a new role, often in a brand new industry.

Trade policy & economics

Throughout 2020 and 2021, pandemic shutdowns affected not only materials manufacturers, but also truck drivers, longshoremen, and other forms of material transportation. The already looming shortage of trucks and drivers was exacerbated by the rush to get delayed materials to job sites.

Many materials were stuck on barges waiting to offload in understaffed ports of entry. These delays increased shipping costs, affecting the cost of many goods.

Check the latest pricing trends for common building materials

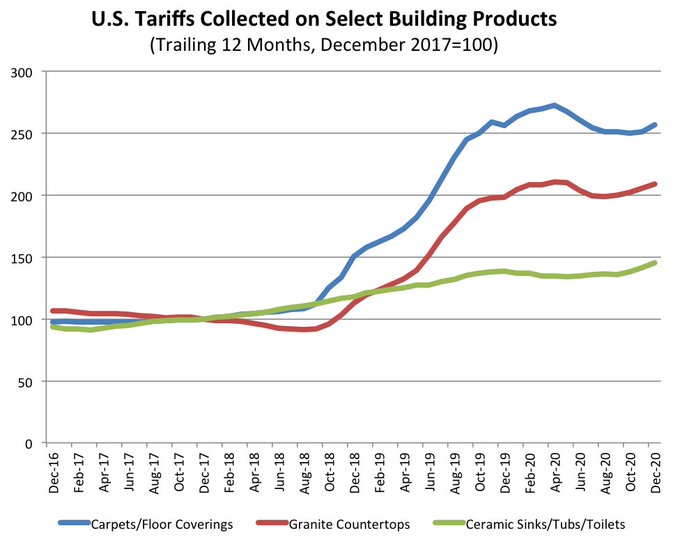

Protectionist trade policies led to a tariff increase on a variety of imported building materials, including steel, carpet, and plywood. Of course, higher tariffs on a single input may not have an enormous impact on costs overall. According to one estimate, a 25% steel tariff only increases the cost of a large commercial project by less than 1%.

Of course, steel isn’t the only construction input subject to import tariffs, and the building industry relies heavily on foreign markets for a wide variety of materials. Import fees on materials like carpets, granite, and ceramic fixtures have also risen by more than 250% in recent years.

Labor shortage

Construction has been dealing with a skilled labor shortage for several years. According to Statista, the construction industry lost 975,000 jobs in April 2020 at the onset of the pandemic — over 13% of the total workforce.

Uncertainty and instability forced worker priorities to shift towards employment opportunities with greater flexibility, especially jobs that allowed for remote work.

A 2021 survey of residential construction tradespeople found that 1 in 3 respondents was looking for a new job — and 30% of those are considering leaving the building industry entirely. A reduction in labor supply means more competition for open jobs — and more competition means higher wages.

Related: 5 ways contractors can tackle a construction labor shortage

3 ways to deal with rising construction costs

Contractors operate with low profit margins as it is, so absorbing the increased cost of materials and labor is usually not an option.

There are three main ways contractors can effectively deal with construction cost increases: financing building material purchases, adding a margin to their estimates, or including an escalation clause in the contract.

1. Finance job costs and material purchases

Contractors may choose to purchase all the material for a project as soon as the contract is signed. It takes an average of nearly three months for contractors to get paid — but most suppliers only offer 30 days credit, or maybe 60 if you’re lucky. This cash flow gap can make it difficult for contractors to make payroll or pay other bills when they’re working on tight margins.

Financing material purchases has a number of benefits for contractors:

- Relieves cash flow stress, giving you up to 120 days to make payment in full

- Allows you to exceed credit limits from a supplier and take on more projects

- Lets you lock in pricing early to avoid the risk of pricing surges

2. Increase your margins

Contractors can raise their prices to their customers in order to offset potential cost increases. How much to raise prices depends on the length of the project and the materials you are using.

One problem with raising margins: There’s no guarantee that prices won’t increase more during the duration of the project. You may be limited in your ability to recapture that lost income.

And with intense competition for projects, contractors who attempt to cover potential cost increases in their price may find themselves losing bids. Other contractors may not be keeping pace with pricing changes.

That’s not necessarily a bad thing. Competing on price is almost always a lose-lose proposition. Taking a low or no-margin job may be an effective way to get your foot in the door with a GC or developer — but it’s not an effective long-term strategy. Instead, focus on the value that your company brings to the job.

3. Include an escalation clause

An escalation clause in the contract allows contractors to recoup costs caused by price increases. The clause usually stipulates a percentage increase that costs must exceed before the clause kicks in.

For example, an escalation clause may say that, if material or labor costs increase more than 3% during the project, the contractor has the right to request additional funds from the owner for the increase.

These clauses protect contractors and owners alike. Without an escalation clause, contractors will raise their bids to cover potential price increases. With an escalation clause, contractors can provide a more competitive estimate without additional margin for risk.

Watch the webinar: How to use contract clauses to defend against material price swings

The rise in construction costs is expected to continue

All contractors operate on credit, effectively financing their customer’s projects with their own money. An increase in construction costs means higher credit risk. Don’t forget that problems with payment add costs to the job as well.

Even if you double your margins, a missed payment can erase any potential gains you might have earned. Make sure you are also taking steps to protect your payment and get paid faster on every project.

Prices on labor and materials are expected to continue through 2022. Contractors must take steps to address these increases, or their businesses will struggle to survive.