As a subcontractor, aligning yourself with a large general contractor is one of the best ways to grow your business and ensure your success. Working with a large GC like Suffolk Construction Company can keep your pipeline full and take some of the pressure off of scrambling for jobs. But, moving up to the big leagues is a big commitment, and you need to make sure it’s the right move — and this guide to Suffolk for subcontractors can help.

Before you even apply or bid on a job with Suffolk Construction, you need to decide if your companies are a good fit. Keep reading to learn more about working with Suffolk so you can decide if it’s a smart move.

Suffolk Construction company overview

On the list of the largest general contracting firms in the world, Suffolk Construction is actually relatively new. This Boston-based company was founded in 1982 and quickly expanded into a coast-to-coast operation by 1998. Suffolk even operates several charitable organizations, one of which assists company employees during challenging times.

To get an idea of how large a construction company Suffolk is, ENR ranked the company as number 23 in 2019 and 2020’s Top 400 Contractors.

Suffolk’s projects include:

- Affordable housing

- Assisted living

- Aviation and transportation

- Distribution

- Entertainment

- Gaming

- Government

- Healthcare

- Higher education

- Hospitality

- K-12 education

- Mission critical

- Non-profit

- Office

- Residential

- Retail

- Science and technology

Before working with Suffolk Construction

Before contracting with a new general contractor, regardless of size, you need to do your homework — and lots of it. The idea is to prequalify the company and identify any potential issues ahead of time.

While GCs might’ve prequalified you plenty of times, you might be new to prequalifying a GC. The steps are largely the same, but Levelset suggests the following:

- Dig into the company’s payment history

- Review the company’s credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with the company’s payment process

Do remember that most companies have a few blemishes in their history, and it might not be too wise to write the company off at the first red flag. The construction industry can be a tough one to wrangle. Payment issues and disputes are bound to occur along the way.

Rather than shrugging off a red flag or writing off the company altogether, reach out to Suffolk Construction. If something you’ve uncovered during your research concerns you, ask questions. While a disgruntled sub can be a wealth of knowledge, a company being as upfront with you as possible can be even more telling about what they’re like on the job.

Suffolk Construction’s Payment Profile

You need the tools to prequalify a general contractor properly, and Levelset wants you to have them. That’s why we put together our Contractor Payment Profiles. These reports take a deep look into the company’s payment history, recent disputes, and complaints from subs and other contractors. These profiles bring a lot of value to a prospective subcontractor.

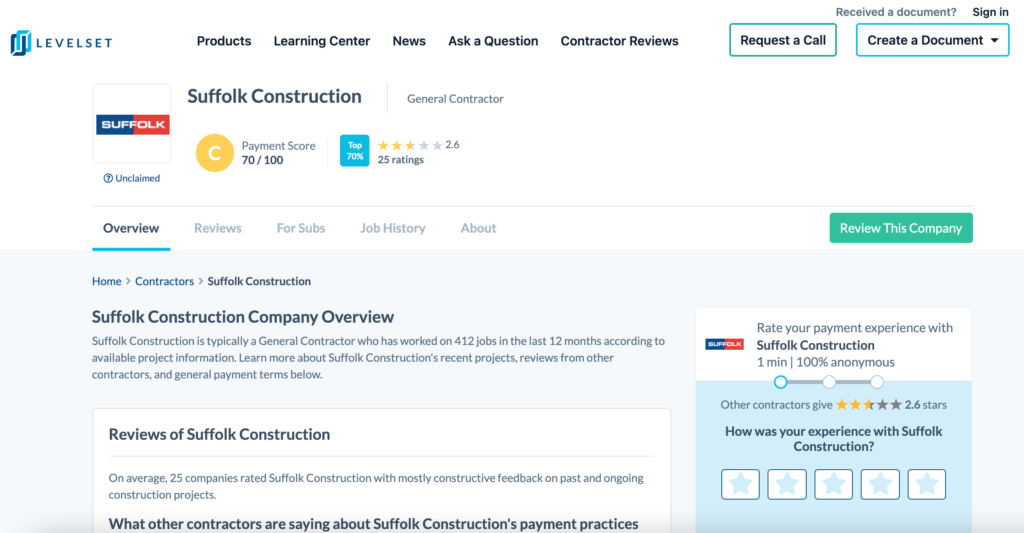

At the time of writing this article, Suffolk has a 70/100 payment score, giving it a C rating. That score puts it in the top 70 percent of contractors. These scores highlight a company’s payment practices, putting their payment speed and reliability on display for prospective subcontractors.

We take a look at on-time and late payments, as we compare that data with thousand of other contractors in order to offer a clear picture. If you’d like more information about how we calculate contractor payment scores, click here.

Recent payment disputes

At the time of this article, Suffolk is managing a handful of projects with mechanics liens filed against them, and several more with slow payments recorded.

100-112 Shawmut Ave, a 138-space condominium complex project run by Suffolk at that address in Boston, Massachusetts, is suffering from several mechanics liens. Some of those liens are pretty substantial (though any money owed to a subcontractor is substantial to them).

- February 2021: Lien filed by subcontractor for $221,311.25

- February 2021: Lien filed by subcontractor for $369,093.16

- February 2021: Lien filed by subcontractor for $686,590.58

Ritz Carlon in Sunny Isles, a project managed by Suffolk at 15701 Collins Ave, North Miami Beach, Florida, has a few liens filed against it as well. These liens are for lesser amounts than those on Shawmut Ave, but they’re no less significant to the subs filing them.

- February 2021: Lien filed by subcontractor for $109,251.67

- February 2021: Lien filed by subcontractor for $47,703.14

The Back Bay residential building in Boston is a massive skyscraper project managed by Suffolk Construction. And unfortunately, it’s not free from liens and payment issues.

- February 2021: Lien filed by subcontractor for $1,350,757.35

There are also other liens at projects in Dallas (Texas), Doral (Florida), Sebastian (Florida), Miami (Florida), and Boston (Massachusetts). There have also been 26 slow payment reports or liens threatened on Suffolk Construction projects in the last six months.

Recent subcontractor reviews of Suffolk

When it comes to deciding whether or not a contractor is worth working with, one of the best resources can be other subs that worked with them. Keep in mind that angry subs are more likely to give negative reviews than happy subs are to provide positive reviews, but they can still be helpful metrics.

Twenty-five subs and suppliers have reviewed their experience working with Suffolk Construction. The average score is 2.6 out of 5 stars, which isn’t outstanding. There are positive and negative reviews, however. When asked how these subs would describe Suffolk’s payment process, speed, and policy, two glaringly different reviews stand out:

“I don’t understand why some of these contractors are having such difficulties with payment. We’ve worked for Suffolk for over a decade and have never had any issues with payments. True, being that they are a larger, more formal contractor, there’s going to be more paperwork involved in getting paid, but that’s all understandable and comes with all contractors of their size.“

“I can verify previous reviews about their delays in payment. On several projects, Suffolk intentionally misled, delayed, and otherwise sought to get out of payment. This includes payment for signed labor tickets on work already performed. They had my team spend countless hours revising documents to get approved, only to reject all of them outright. They are dishonest and not worthy of their national status.”

Get paid with Suffolk

Before you decide to step up to the plate with Suffolk, you’ll want to know as much as you can about their payment processes. After all, getting paid is the name of the game.

Before work starts

Most large general contractors require certain pieces of information from you about your company. They typically include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

The job’s project manager will usually let you know which documents they need.

First payments

Large-scale GC’s like traditional payment documents, like AIA billing. The includes the G702 payment application and the G703 continuation sheet. Some might also require a schedule of values.

Be sure to find out when pay apps are due from your contact at Suffolk. Typically, they’re on the 1st, 5th, 15th, or 20th of each month. Ensure that your payment apps are complete and accurate to streamline the process.

Further learning: 5 Payment Application Mistakes That Subcontractors Make

Progress payments

Unless it’s a small job, a lump sum payment won’t do. Getting paid throughout the project might the only way to maintain healthy cash flow and avoid unnecessary interest payments. Progress payments are definitely the way to go with most larger projects.

To apply for progress payments with Suffolk, you should send a completed pay app as well as an updated schedule of values.

Project close-out

Every large GC has its own method for close-outs, but these are the most typical documents:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

You’ll want to be sure you’re careful and read every document and its implication before you sign any close-out paperwork. This is the point at which many lien waivers start popping up. You want to be sure you’re getting paid before you sign that waiver.

3 tips to get paid on every construction project

You know that there is always the potential for a payment issue on a construction project. But the following tips will help you avoid falling into a slow payment (or non-payment) trap.

There are a lot of moving parts to a construction project, and payment issues happen. The following three steps will improve your chances of getting paid on time.

1. Send preliminary notices

If you aren’t sending preliminary notices on all of your projects already, you need to start. In many states, they’re required to protect your lien rights. Without sending one at the proper time, you won’t be able to file a lien in the event of non-payment.

Even if the state you’re working in doesn’t require a preliminary notice, you should still be sending them. These documents serve as an introduction between your company and the folks running the job (and cutting the checks). You definitely want them to know you’re on the job and that you’re a professional. These documents go a long way toward timely payments.

2. Send other visibility documents

It’s not just a preliminary notice that you should be sending on your projects. Sending other visibility documents will keep your company in front of the managing firm. Documents like invoice reminders, notices of intent to lien, and demand letters are key. They’ll keep your company name fresh in the minds of the right people, and they can often be all it takes to spur a payment.

3. Maintain your right to file a mechanics lien

If you want to speed up payments and keep your competitive edge, preserving your lien rights should be number one. A mechanics lien attaches to the property, and it can hurt the owner’s chances at further financing and the property’s saleability. That’s a powerful tool, so most states have stringent requirements a contractor must meet to preserve those rights. Understand the rules in your project’s state to make sure you’re maintaining your lien rights.