Pennsylvania Prompt Pay Act

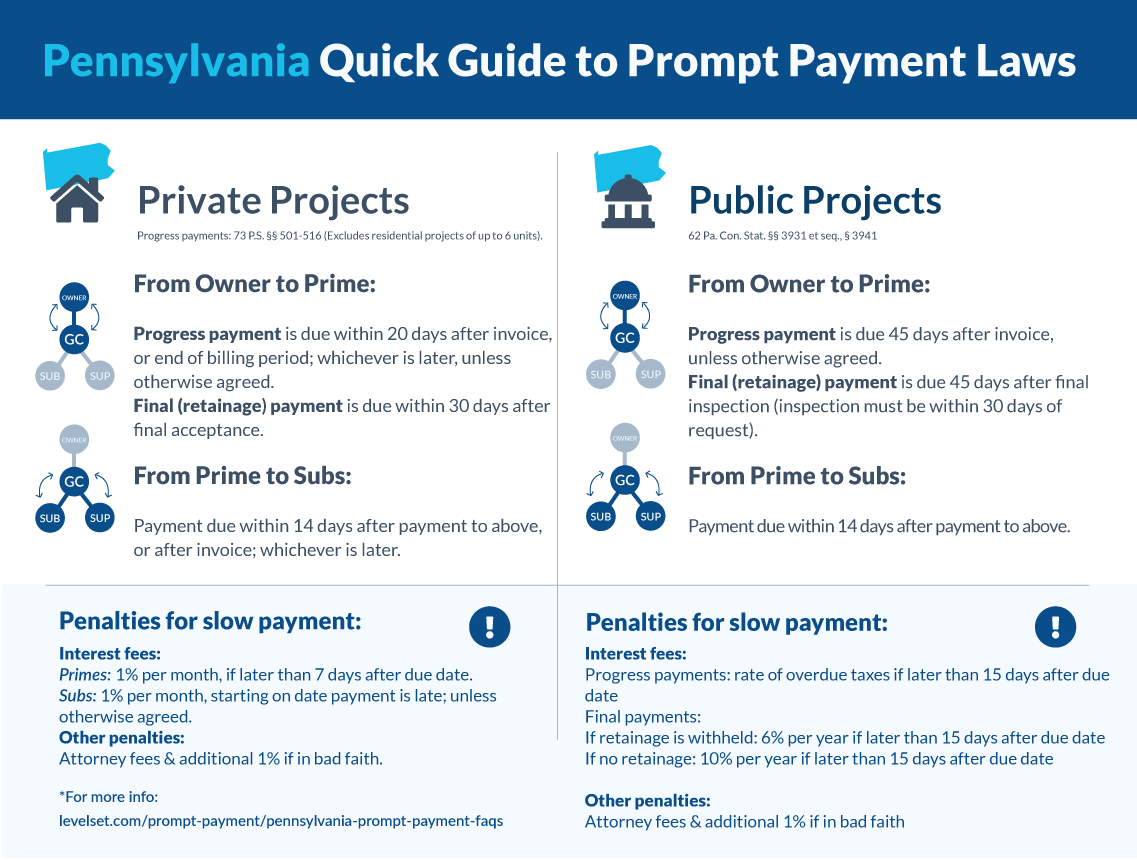

The Pennsylvania Prompt Payment Act sets default timeframes for payments on construction projects within the state. There are regulations for both private and public jobs. Failure to comply with these provisions can lead to penalties such as imposing interest on the late payments and the potential to recover attorney fees as well.

Prompt pay on public projects

The regulations covering prompt payment on public projects are found in 62 Pa. Con. Stat. §§3931-3935. These provisions allow for a fair amount of leeway to allow the contract to govern most of the payment timing and penalties. However, there are additional penalties imposed if there is any evidence of bad faith on behalf of the paying party.

Payments from public entities to prime contractors

Once a contractor has performed in accordance with the contract terms, they will be entitled to payment. The payment schedule will be determined by the contract itself. However, if the contract doesn’t specify the timeframes, then the statutory requirements will prevail.

Pennsylvania prompt pay laws require that the prime be paid within 45 days of receipt of a pay application. If the work requires approval by an architect or engineer, then the law requires payment to be released within 45 days of the approval.

Payments from primes to subs

Again, subcontractors will be entitled to payments if the perform their work in accordance with their contractual terms. Once the public entity has released funds to the prime contractor, it sets off a domino effect of payment deadlines.

The clock to make payments down the chain begins once funds are received. So once the prime receives payment, they have 14 days to pay their subs and suppliers. Once they receive payment, they also have 14 days to release payment to their subs and suppliers; and so on down the chain.

Grounds to withhold payment

The law in Pennsylvania states that payments may be withheld for any deficiency items, according to the contract terms. A deficient item is defined as work performed but the approving/certifying party will not approve the work or materials as in accordance with the contract.

If the paying party decides to withhold payments, they must notify the contractor requesting payment within 15 calendar days of receipt of the notice of deficient work. If the money is being withheld by the prime, they must also notify the public entity as well.

Penalties for late payment

If payment isn’t made within these timeframes, the amount that is due and owing will begin to accrue interest.

The rate of interest for late progress payments on public projects is the rate for overdue taxes set by the Secretary of Revenue, which is (as the date of this writing) set at 6% per year. As for final payments, the rate depends on if there is retainage or not provided in the contract. If there are retainage provisions, the unpaid amount will accrue interest at a rate of 6% per year. Contracts that don’t require retainage, interest will accrue at 10% per year.

One interesting aspect of the Pennsylvania prompt pay laws is that there is an established grace period for payment. If the contract doesn’t state one, then interest will not accrue if payment is made on or before 15 calendar days after payment was due.

Bad faith penalties

If it’s established, during either arbitration or litigation, that the paying party withheld payments in bad faith, an additional 1% per month of interest will be imposed. Bad faith has been defined by the Pennsylvania courts as and arbitrary or vexatious withholding. The court further defined vexatious as withholding without any grounding in law or fact with the purpose of causing annoyance. Additionally, if bad faith is found, the prevailing party may also be awarded attorneys fees.

Prompt pay on private projects

The prompt pay regulations on private projects in Pennsylvania, also known as the Contractor and Subcontractor Payment Act (CAPSA), are much more lenient. These types of projects are covered by 73 Pa. C.S. §§501-516. These requirements apply to all private projects, with two notable exceptions: (1) residential projects with 6 or fewer units, and (2) contracts for the purchase of materials by a person performing work on their own property.

Payments from owners to prime contractors

Once the contractor has performed in accordance with the contract terms they may submit a pay application. Unless otherwise established in the contract, here are the deadlines for payment. For progress payments, at the end of the billing cycle; and for final payments, at the completion of the work. The owner is required to pay within 20 days of either the end of the billing cycle (or completion) or from receipt of the invoice; whichever is later.

Payments from GCs to subs

For payments from GCs (direct contractors) to subcontractors and material suppliers, the deadline to pay is 14 days. This 14 day period is counted from either the day the GC received payment from the owner; or 14 days from when the payment invoice is received by the GC. This same timeframe applies to every other payment due down the chain on the project.

Incorrect invoices

If a submitted invoice is either incorrectly filled out or claims more than what is owed, the party receiving the improper invoice must give notice of the errors within 10 days of receipt of the invoice. However, the paying party is still obligated to pay what is appropriately due and owing within the statutory timeframes to avoid penalties.

Grounds for withholding

The legitimate grounds to withhold payments are the same as the grounds allowable on public projects. If there is a deficient item provided, according to the contract terms, the paying party may withhold the amount due for that particular work or materials furnished. If the owner or contractor does decide to withhold payment, they must provide written notice to the party within 7 calendar day of receipt of the notice.

Penalties for late payment

If any progress payments or final payments (at any tier) aren’t paid within 7 days of the due date required by the statutes, interest will be imposed on the amount. Interest will accrue at a rate of 1% per month beginning on the 8th day the payment is late, and continue until the balance is paid.

If there is evidence of bad faith (as was defined above for public projects), then the party requesting payment may be awarded an additional 1% interest a month, along with attorney fees if successful in arbitration or litigation.

Dealing with Slow Payment?

Send a Payment Demand. We're experts at prompting payment. It's fast, easy, and done right.

DEMAND PAYMENT NOWBottom line

Timely payments on construction projects are what keeps cash flowing and projects on schedule. It’s important to know your rights to payment, and your obligations to pay. Sending a payment demand under the prompt pay act is usually enough leverage to induce payment. On the other hand, knowing when payment needs to be released is also incredibly important, as interest can add up quickly.

Additional resources

- Pennsylvania Prompt Payment Overview & FAQs

- PA Right to Stop Work for Nonpayment

- How to File a Pennsylvania Mechanics Lien