The Ohio Prompt Pay laws regulate the timing of payments on both public and private projects. Late payment is a problem in the construction industry as a whole. In order to tip the scales of leverage in favor of lower-tier project participants, many states enact prompt payment laws to penalize late construction payments. Ohio is no exception. Let’s take a look at the specific rules and requirements under the Ohio prompt payment laws.

Prompt pay on public projects

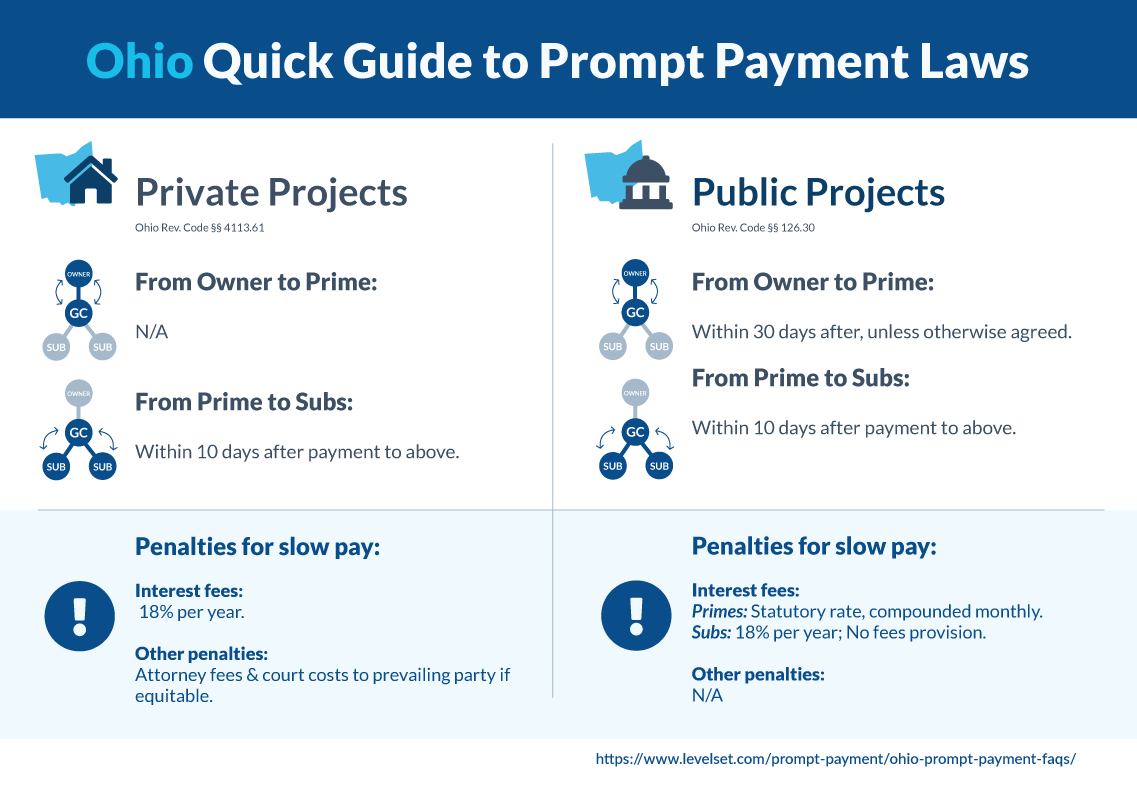

The Ohio prompt pay on public projects is regulated under Ohio Revised Code Ann. §§153.12 – 153.14, & §4113.62. Most of the requirements under these statutes allow the contract provisions to govern the payment terms between the parties.

However, when the contract is silent in certain situations, the statutes provide default time frames for payment and penalties for non-compliance.

Timing of payments

Public agency to prime contractor

When a contractor has performed in accordance with the terms of the contract and provides an accurate estimate of the labor or materials furnished, they are entitled to payment from the public entity.

The statutes allow for the payment terms set forth in the contract to govern the timing for payments. They do, however, provide some guidance on how to structure payments based on the type of contract they agree to. If there are no specific payment terms provided, then the default time for progress payments is 30 calendar days of receipt of a proper invoice.

If an improper invoice is received, the agency must notify the claimant by telephone or in writing within 15 days. This notice should inform that payment is not forthcoming, include a description of the defect, and provide information on how to correct the defective work.

Prime contractor to subcontractors and suppliers

Once a prime contractor has received project funds from the public entity they, in turn, have 10 days to pass payments down to their subs and material suppliers. They will also have 10 days from receipt of payment, to pay anyone they hired on the project.

Late payment penalties

Grounds to withhold

Unlike many state prompt payment laws, the statute governing Ohio public projects doesn’t explicitly state the reasons a public entity can withhold payments. Instead, the legitimate reasons for withholding payments will be governed by the construction contract terms themselves.

Interest rates

Late payments on public projects in Ohio are subject to interest rates accruing on the unpaid amounts.

For payment from the public entity to the prime contractor, the rate isn’t clear cut. The statute provides for interest at the average prime rate established by commercial banks in the city of over 100,000 population that is nearest to the construction project. So, for example, let’s say you’re working on a public project in Parma, the closest city with a population of over 100,000 would be Cleveland. The rate would be the average prime rate set by the largest banks in Cleveland.

As for all other types of down-chain payments, the statute is much clearer. These amounts will accrue interest at a rate of 18% a year, beginning on the 11th day following receipt of payment. This ends up being 1.5% interest per month on the improperly withheld amounts.

Attorney fees

If the dispute ends up going to court or arbitration, the Ohio prompt pay provisions do provide for the award of attorney fees. These will be awarded to the prevailing party, but this isn’t automatic. The court will consider a few factors to determine if the award would be equitable or not. The relevant factors being the presence of a good faith allegation or defense, the proportion of the amount of recovery as it compares to the amount of the demand, and nature and time expended in rendering the legal services.

Dealing with Slow Payment?

Send a Payment Demand. We're experts at prompting payment. It's fast, easy, and done right.

DEMAND PAYMENT NOWPrompt pay on private projects

The statute regulating Ohio prompt pay on private projects is in Ohio Rev. Code §4113.61. These regulations apply to mainly commercial projects, as single, double, and triple family “dwelling houses” are excluded. Furthermore, there are no provisions that regulate payment from the owner, only those from the general contractor down the payment chain.

Timing of payments

A subcontractor or other lower-tiered project participant must submit their pay application or invoice with enough time for the higher-tiered contractor to include that amount in their pay application. Once the higher-tiered contractor receives payment, they will have 10 days (same as public projects) to pass on payment to their subs and suppliers.

A contractor is permitted to withhold payment longer than 10 days, but only the amounts that may be necessary to resolve disputed liens or claims involving the work. The Ohio courts recently addressed this issue in Masiongale Elec-Mech, Inc. v. Constr. One, Inc. The amount that is allowed to be withheld must be direct, tangible amounts relating to disputes involving faulty labor, work, or materials furnished. No other unrelated, disputed amounts or offsets may be withheld.

Late payment

If the higher-tiered party fails to make payment within the 10 day period, interest will begin accruing on the 11th day at a rate of 18% a year, (again, 1.5% per month). Once the payment is outstanding for 30 days, the law grants the party awaiting payment a cause of action in court. If the dispute goes to court after this 30 day period, the prevailing party may be awarded attorney fees and court costs. This will be determined in the same fashion as attorney’s fees on public works project disputes.

Bottom line

The Ohio prompt pay laws are meant to protect all tiers of a construction project. It’s important to keep in mind that these provisions apply to both the receipt and disbursement of payments on any given construction projects. Interest can add up quickly, especially on larger projects. So understanding how these laws work can not only help ensure that you get paid what you’ve earned, but that you don’t have to pay more than what you contracted for.

Additional resources

- How to Make a Claim Under Prompt Pay Laws

- Ohio Prompt Payment Act Overview & FAQs

- Know Your State Prompt Payment Act to Speed Up Construction Payments