Note about the author: Jason Lambert is an attorney specializing in construction law at Dinsmore & Shohl LLP in Tampa, FL. If anyone knows about the importance of following Florida’s lien laws and requirements – and the consequences of failing to adhere to them – it’s Jason. In this article, he shares stories from his law practice about clients who didn’t realize the importance of the notice to owner (NTO) until it was too late.

If you are part of the construction industry in Florida, no doubt you have at least heard of a Notice to Owner. You probably also know that you have a time limit to serve them and that they impact your ability to record a lien. While this general knowledge is a start, it is no substitute for knowing the actual requirements for an NTO and the consequences for failing to follow them.

Good, Bad & Ugly: NTO is for all construction relationships

To help illustrate this, I want to share a common experience several clients of mine have encountered. They started work with a contractor. The business was great at first, they were getting a lot of jobs and were generally being paid on time for their work. But after a few projects together, the general contractor started paying slowly and all of a sudden my clients realize they have $50,000 – $100,000 in invoices outstanding across all their projects.

So they scramble to send out notices to owner on the projects they are owed money on. Generally, they have an idea of when they first started a project, but they may not check permitting records, inspection records, or payroll records to confirm. Another months goes by, and they still have not been paid. Now they file liens.

Sometimes they contact me to help with this, other times they do it on their own or through a third-party service like Levelset. But they record the liens.

Losing your lien when you need it most

Another month goes by, still with no payment, and then they contact me to talk about what they can do next to collect this money. At this stage, the most common option is to file a lawsuit to foreclose the lien and for breach of the contract due to non-payment.

Before doing that, we confirm with the client that the notice to owner was sent within 45 days of starting work on the project, and that the lien was recorded within 90 days finishing work.

This is where it is critical that people in the construction industry maintain good records, especially regarding start and completion deadlines.

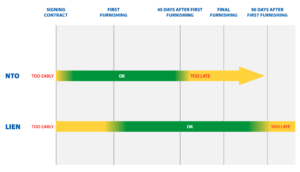

First, it impacts the validity of your lien. A notice to owner is required before filing a lien where your company is not in direct contractual privity with the property owner. It is required to be served no later than 45 days after you first begin providing labor, materials, or services to the property.

This means the notice to owner must be received by the property owner within that 45 day period – not just sent. If the NTO is late, any subsequent lien will be invalid.

If you are even a day late with your notice to owner, it can invalidate your Florida lien.

A bad lien lawsuit can cost more than the lien itself

This can quickly turn a case where you were expecting to collect money and recover your attorneys’ fees into one where you are paying the other side. That is because if you file a lawsuit to foreclose on a construction lien, it triggers a prevailing party attorneys’ fees right under Florida’s Construction Lien Laws.

For example, one of my clients recently had a circumstance where they had a $7,500 lien on property. After filing suit, it came out that there was an error in their records and the notice to owner was about a week late.

This not only invalidated the lien, but ultimately resulted in the client having to pay several thousand dollars in attorneys’ fees to the other side just to resolve the lawsuit and close it out.

In that example, the client was lucky, because the error was caught early. But if you take a case all the way through trial, only to have a timing issue disqualify your lien, you could face tens or hundreds of thousands of dollars in legal fees.

This is why understanding, tracking, and knowing the critical dates impacting your lien rights is so important.

So here is a refresher on Florida’s mechanics lien deadlines:

- Notice to Owner: You have up to 45 days from when you first furnish materials, labor, or services to the property to serve a notice to owner. If you are making specially fabricated materials, the date you start making them, if it is earlier than your first day at the property, is when this 45 day clock starts.

- Lien Claim: You have up to 90 days from when you last furnish materials, labor, or services to the property to file a construction lien. Last furnishing generally does not include punch out or warranty work.

- Foreclosure: You have 1 year from the date you record a lien to file a lawsuit to foreclose on that lien. In Florida, liens are not renewable.

Construction liens are a powerful thing

While a construction lien is not the only tool you can use to get paid on a project, it is one of the most powerful. So keep track of these deadlines and send notices to owner early and often—on every project where you are not in direct contractual privity with the property owner. This will help ensure that you always have lien rights in case you need them.