If you’re stepping up to the plate with Fluor, one of the largest construction companies in the world, it’s helpful to have a little background on the company first. This article is your guide to Fluor for subcontractors: It will outline the company history, payment history, prequalification process, and more.

The more you know about Fluor, the better prepared you’ll be for working on its projects, getting paid on time, and meeting company culture standards.

Fluor company overview

The Fluor Corporation’s history dates back to 1912, when John Simon Fluor founded the Fluor Construction Company in Santa Ana, California.

The company grew quickly, focusing much of its efforts on public projects and then the oil industry. Fluor built refineries, pipelines, and other facilities in California and then expanded its operations to Texas and the Middle East. By the 1960s, the company expanded into oil drilling and coal mining.

After suffering losses from its mining operations and the gas crisis, Fluor pulled out of the oil industry and focused its attention on construction and other services. By the 1990s, the company began offering equipment rentals, staffing, nuclear waste cleanup, and more.

As of 2019, the Fluor Corporation made over $15.7 billion in revenue, making it one of the largest construction companies in the world. Fluor is currently #2 on ENR’s list of Top 400 Contractors of 2020.

The Fluor Corporation offers services in the following industries:

- Engineering and design

- Procurement

- Fabrication

- Construction

- Maintenance

Recent notable projects include:

- Aladdin Hotel & Casino – Las Vegas, Nevada

- Rebuilding power, water, and infrastructure after the Iraq War

- Gordie Howe International Bridge – Detroit River, Michigan and Windsor, Ontario, Canada

- Governor Mario M. Cuomo Bridge – Hudson River, New York

The Fluor Corporation’s headquarters are in Irving, Texas, but it has 54 offices in 29 countries altogether. Those offices include:

- Washington, DC

- Richmond, Virginia

- Calgary, Alberta, Canada

- San Francisco, California

- Buenos Aires, Argentina

- Tokyo, Japan

- Bangkok, Thailand

- Abu Dhabi, UAE

- Tarragona, Spain

- London, England

Before working with Fluor

Before you take any steps toward working with Fluor, you should make sure that it seems like a good fit for your company. It’s always good practice to prequalify any prospective general contractor before you work with them. Prequalifying Fluor will allow you to get an idea of how the company works with subcontractors.

If you don’t know how to prequalify a contractor, Levelset suggests the following five steps:

- Dig into the company’s payment history

- Review their credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with their payment process

Understand that through the prequalifying process, you’re likely to uncover at least one or two less-than-flattering reviews or disputes. With a company as large and old as Fluor, it’s unrealistic to think it will have a blemish-free history.

If you do find something particularly concerning, reach out to Fluor for some clarification before you write them off completely. If the company is entirely upfront with you, it says something about the type of General Contractor you might be working under.

Fluor’s payment profile

If you really want to get an idea of what it’s like to sub for Fluor, one of the best resources you can turn to is the company’s payment profile. Payment profiles compile useful information about contractors so subs have a better idea of the company’s practices.

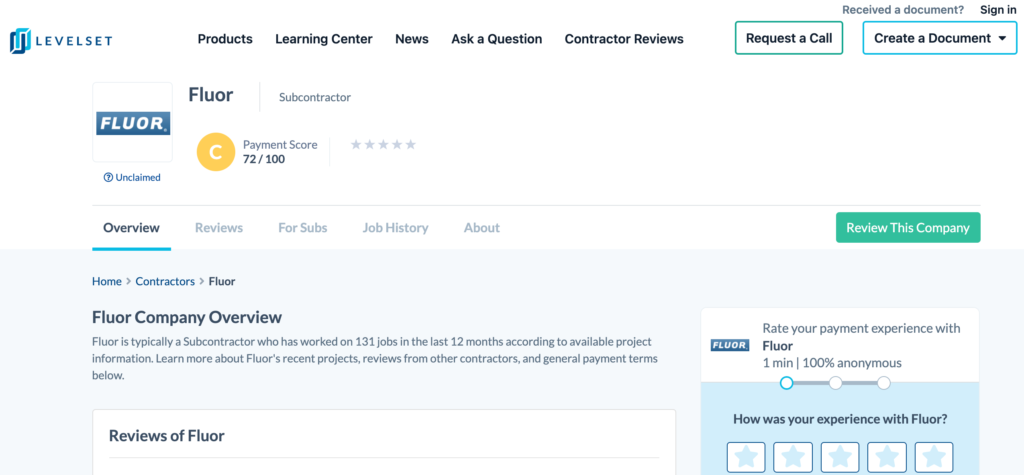

As of writing this article, Fluor has a payment score of 72/100, giving them a C-rating. We use payment scores as a measuring stick for a company’s payment practices, including on-time and late payments. Levelset compared Fluor’s history with thousands of other GCs to calculate this score. To learn more about how contractor payment scores are calculated, click here.

To get a better idea of how quickly or slowly Fluor might pay you, check out the company’s recent payment history.

Recent payment disputes

In order to bring as much value to subcontractors as possible, Levelset compiled data on many of Fluor’s most recent projects. In the past 11 months, at least 20 mechanics liens have been filed against Fluor for slow or non-payment.

While that might sound like a lot, 90 percent of Fluor’s projects go off without a payment hitch. With that said, one of a GC’s most important responsibilities is to make sure that payment goes smoothly. If the company’s payment history concerns you, reach out to Fluor directly for more information about their payment disputes and issues.

Fluor’s prequalification process

Before you can start bidding on projects with Fluor, you have to submit your company information to Fluor’s Supplier and Contractor Registry. Luckily, the process is straightforward.

Step 1: Go to Fluor’s Supplier and Contractor Registry page

You can find the registry in several ways, but the most direct is to head to the Fluor homepage, click on “Login Areas,” and then click “Supplier/Contractor.”

Step 2: Create a registration

By clicking on “creating a company profile,” you’ll be prompted to fill out your company’s information. You’ll need the company’s legal name, address, phone number, and email address. Be sure to click the checkbox to accept the terms of use before clicking submit.

Step 3: Check your email

Within minutes you’ll receive a username, password, and login link in your email address. You’ll use this information to log into the system.

Step 4: Provide a list of services

Once you’re logged in, you’ll be prompted to fill out a questionnaire of sorts about your company. You’ll be able to input the types of work you do, the services you offer, and how you can bring value to Fluor. Choose your words wisely, though, as you’ll only get 1,000 words to do so.

Step 5: Submit

Once you fill out every applicable field, go ahead and submit the registration. You should receive an email notification stating your registration is complete.

Get paid with Fluor

In construction, profits and cash flow are everything. When you’re working with a big contractor like Fluor, it’s wise to know what they expect ahead of time. You’ll cut down on mistakes which should ultimately reduce the amount of time it takes to get paid.

Before work starts

The bidding process is just the first step, and there are many more you’ll have to navigate before the job starts. A large general contractor like Fluor will want certain pieces of information about you and your business. They might include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

In most cases, the project manager on the job will go through all of the required docs.

Progress payments

If you want to avoid late fees on loans, unnecessary interest, and other bottom-line destroyers, get to know the progress payment schedule. You’ll need it to maintain positive cash flow.

When you’re applying for a progress payment with Fluor, you should send a completed pay app as well as an updated schedule of values.

The contract you signed with Fluor will outline any other important terms or items that you need to include with your progress payments. If you have questions, check with the project manager before you miss a progress payment window.

Project close-out

Every general contractor handle project close-out a little bit differently, but there are some relatively standard requirements for they’ll issue final payment. Those requirements include:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

Close-out paperwork can be tricky though, so be careful. If you sign certain documents, like lien waivers, you could be forfeiting your lien rights before you’ve received final payment.

3 tips to get paid on every construction project

There are times on construction projects where payment issues are tough to avoid. But, if you want to minimize a payment issue’s effect on your bottom line, the following three steps will improve your chances of getting paid on time.

1. Send preliminary notices

Even when they’re not required, sending a preliminary notice on all your projects is an excellent habit to get into. They serve as an introduction between your company and the owner and GC. A preliminary notice tells them who you are, what you’re doing on the project, and that you intend to be treated fairly.

Some states require preliminary notices by law in order to preserve lien rights. Not sending a preliminary notice within the required timeframe could cost a contractor their most effective line of recourse. If the customer doesn’t pay, you won’t have a mechanics lien to fall back on.

2. Send other visibility documents

Beyond preliminary notices, sending visibility documents can speed up the payment process. Sending invoice reminders, notices of intent to lien, and demand letters keep your company’s name fresh in the GC, admin staff, and owners’ minds. Many times they can spur a payment on their own.

3. Maintain your right to file a mechanics lien

Preserving your mechanics lien rights should be a priority on any project, regardless of the GC managing the job. When payments slow down, a mechanics lien is one of the most effective ways to speed them up again.

A mechanics lien can affect the owner’s financing, the property’s saleability, and cause issues up the chain. For that reason, there are certain requirements and deadlines you’ll have to meet in order to preserve your rights. Get to know the rules in whatever state you’re working in to make sure you’re preserving your lien rights.