After a slowdown at the onset of the pandemic, the construction industry is once again booming across the residential, commercial, and public sectors. However, despite strong projections for growth in residential (9%) and non-residential (4.6%) construction, many businesses are struggling with material costs, labor shortages, and slow payments.

Levelset surveyed 519 construction companies across the United States to create the 2022 Construction Cash Flow & Payment Report. This report examines the state of the industry in terms of payment speed, cash flow, mechanics lien usage, and more.

Here are some of our key findings:

- While nearly 2 out of 3 construction businesses enjoy profit margins greater than 10%, only around 1 in 10 businesses are always paid on time for their work.

- Nearly 9 out of 10 construction companies offer payment terms of 30 days or fewer, but fewer than 4 in 10 businesses report getting paid within 30 days on average.

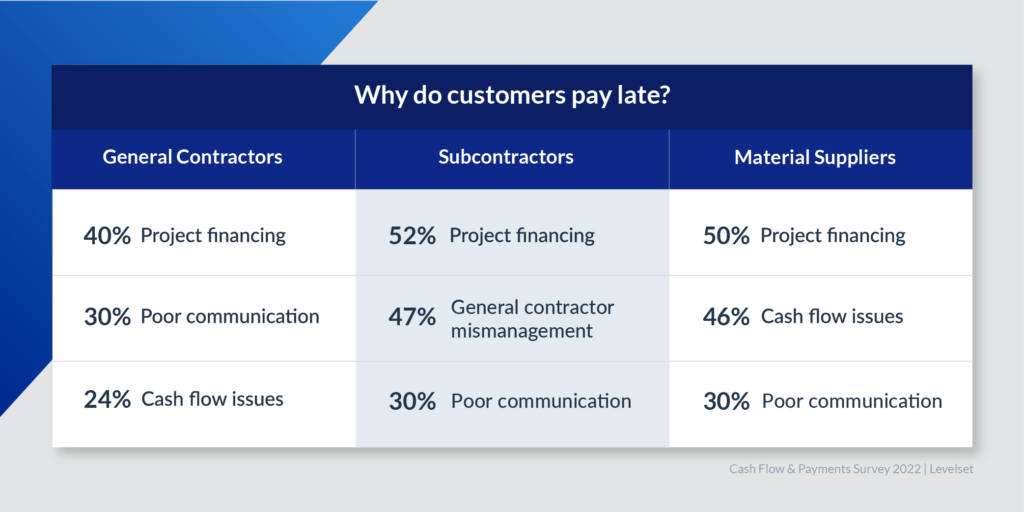

- Almost 50% of subcontractors blame general contractors for slow payments, while 40% of general contractors report that project financing is the cause of slow payments.

- Construction businesses report that slow payments contribute to wasted resources (45%), reduced profit (41%), and failure to meet payroll (18%).

Download the full report for a detailed view of our data, or keep reading for a summary of notable findings.

Payment issues are industry-wide, but some groups are hit harder

Payment speed has plagued the construction industry for many years. Research suggests the average Days Sales Outstanding (DSO) for US construction is around 90 days—among the worst of any industry. Even in the current construction boom, payment problems continue to affect companies across the industry.

According to survey respondents, just 12% of businesses report always getting paid on time, and only 15% of businesses note that they’re always paid in full. Fewer than half of construction companies are paid within 30 days on average, and 10% of companies say that the average customer takes more than 60 days to pay.

Payment problems affect different roles and sectors disproportionately: For example, general contractors reported that they are more than twice as likely as subcontractors to get paid within 30 days — and GCs are also six times more likely than material suppliers to get paid in that timeframe.

Private residential projects generally fare much better than private commercial or public projects. While nearly 1 in 2 businesses handling private residential projects are paid within 30 days, just 1 in 3 businesses dealing with private commercial projects and 1 in 5 companies working on public projects are paid in that same timeframe.

Learn more: 3 Simple Tips for Getting Paid Faster in Construction

Blame game rampant along the payment chain

The construction payment chain contributes to slow payments and uncertainty for many construction companies. Since money flows down the payment chain — from owner to GC and then subcontractors — many construction businesses are left waiting in the dark for payment.

This payment predicament is reflected clearly in the report, which highlights that different parties are likely to disagree about the causes of slow payments. For example, 52% of subcontractors and 40% of material suppliers cite general contractor mismanagement as the source of payment problems.

On the other hand, general contractors are much more likely to blame project financing (40%), poor communication (30%), or customer cash flow issues (24%) as the leading causes of slow payments.

Because many subcontractors and material suppliers do not have full visibility into project financing, it can be extraordinarily difficult for them to identify the reasons that payment has not reached them for completed work or delivered materials.

Learn more: How the Payment Chain Works in Construction (And Why It Matters)

Companies are hesitant to act on slow payments

Although 95% of construction companies note that they experience stress over slow payments, many do not take significant action to remedy payment problems.

For example, 1 in 2 survey respondents noted that working with financially secure customers was the most significant factor in getting paid more quickly. On the other hand, around 1 in 3 construction businesses say they rarely or never prequalify customers—and that figure jumps to 1 in 2 among subcontractors.

Meanwhile, 1 in 4 companies do not send invoice reminders or make follow-up calls when payment is late. And just 25% would consider filing a mechanics lien in response to a late payment.

Some companies report that their hesitancy to act on late payments results from fear of losing a customer. However, survey data suggests that just 13% of businesses say they will not work again with a subcontractor or supplier who files a lien on their project.

Learn more: How Mechanics Liens Can Help You Get Paid

Concerns loom about supply and staffing shortages in 2022

While the construction industry has seen a huge recovery since the onset of the pandemic, many businesses have economic concerns about the coming year. Significant economic changes and lingering effects of pandemic disruptions are likely to make 2022 a difficult year for many businesses.

Survey respondents noted that increasing costs (59%), supply chain constraints (48%), and staffing shortages (39%) are three of the most significant challenges facing the construction industry over the coming year.

Almost 1 in 2 construction companies expect some sort of growth throughout 2022, but around 1 in 3 businesses expect that economic challenges — like inflation — will lead to either stagnation or some decline in their revenues.

Industry remains optimistic despite challenges

Continuing economic challenges and issues with slow payment are causing unprecedented changes in the construction industry. Still, the majority of businesses remain optimistic about their prospects in the coming year.

Despite the difficult landscape, around half of businesses rate their optimism about their 2022 financial prospects as 8 or higher on a scale from 1–10.

We’ll continue to monitor the changing landscape of materials pricing, staffing shortages, and payment problems as the economic situation evolves over the course of 2022.