Construction projects can be incredibly complex — especially when it comes to collecting payment. Money has to change hands many times before it’s finally received by the people who actually performed the work or provided materials. On a construction job, money flows through a payment chain — starting with the property owner or lender and trickling down to the contractors, subs, and suppliers at each level or tier of the project.

The construction payment chain can have dozens of tiers, and it’s important to understand how it works. The further down the chain you are, the more financial risk you carry. Here’s what subcontractors and suppliers need to know about the payment chain, and how to protect your company no matter who hires you.

What is the construction payment chain?

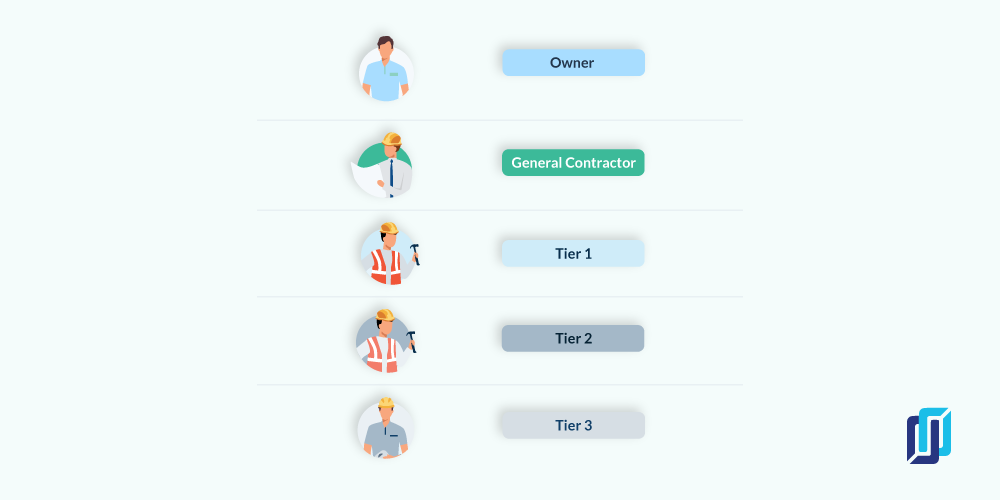

The payment chain refers to the hierarchy of contracts on a construction project, starting with the property owner and working down through all of the contractors, subs, and suppliers on the job.

On a typical construction job, all of the payments move down along this chain in order. The owner pays the general contractor, who then pays their subcontractors. Those subcontractors pass the payments along to their subcontractors and suppliers, and so on.

The Payment Chain Tiers

The property owner and any lenders sit at the top of the payment chain, where the project funds originate. The Prime Contractor — typically the general contractor — has an agreement directly with the property owner, so they’re often known as a “direct contractor.”

Underneath the general contractor, the payment chain is made up of tiers: Each time payment changes hands, you’re on a different tier. (Some state laws refer to “remote contractors” — this typically includes anyone who does not have a contract with the owner.)

- Tier 1 contractors include anyone that has a subcontract with or supplies materials to the Prime Contractor. This is where most subcontractors will be.

- Tier 2 contractors have an agreement with a Tier 1 contractor. Some subcontractors and most material suppliers will be in this tier.

- Tier 3 contractors have an agreement with a Tier 2 contractor.

- Tier 4 contractors…well, you get the idea.

Why the payment chain matters

Contractors and suppliers need to understand the payment chain because it has a direct impact on communication, payment speed, and financial risk. The lower tier your company is located in, the bigger the impacts will likely be.

Communication

While construction already has a transparency problem, the payment chain makes communication even more difficult. Many subs and suppliers only have a direct line of communication with the company that hired them onto the project. They may not know who the property owner is, or how to find out if there are financial problems on the project that could trickle down to them.

The general contractor, on the other hand, has the opposite problem. They have the difficult task of coordinating all of the remote contractors on the job, both in terms of scheduling and payment. But it can be hard to identify who all of those sub-subcontractors or suppliers are, or how to get in touch with them. Communication often flows through the payment chain in the same way that payments do — one level or tier at a time.

Payment speed

The complexity of the payment chain is one of the primary reasons why it takes so long to get paid in construction. Every time money changes hands, it is an opportunity for a delay in your payment (or worse, for it to disappear entirely). The further you are from the property owner, the longer delays you will experience.

A 2020 construction payment report found that general contractors were 2x more likely than subcontractors to be paid within 30 days. Of course, this doesn’t mean that GCs don’t have cash flow problems of their own — but because they’re close to the property owner, they are the first in line to get paid.

Financial risk

Unless you are the prime contractor, the company that hired you doesn’t have total control over your payments. Because you can’t prequalify every contractor between you and the property owner, you have no way of knowing how creditworthy everyone is, or how likely they are to keep the money flowing.

A mechanics lien is the most powerful tool that contractors and suppliers have to ensure their payment. Unfortunately, the payment chain can affect your ability to file a valid lien — a fact that can greatly increase your financial risk on a project.

In some states, mechanics lien rights are affected by a contractor’s position on the payment chain. In Pennsylvania, for example, contractors and suppliers below Tier 2 don’t have lien rights. In other words, only those hired by the property owner, the prime contractor, or a Tier 1 subcontractor are eligible to file a mechanics lien in Pennsylvania. Those below this level can’t use a lien as a means of securing their payment or reducing their financial risk.

In other states, like California, everyone working on or supplying to a project has lien rights, regardless of their tier. But they are often required to take steps to preserve those rights by sending preliminary notice to the property owner and GC. If they fail to take this step or miss a deadline along the way, they can end up back at square one without the protection of a mechanics lien behind them.

As a credit manager, I was responsible for sending all our intent to lien notices and confirm job information and if we had the protection of lien law. Unfortunately, there were many times we fell too far down in the payment chain to have any rights to file a lien if we were unpaid for any of our materials. The payment chain is one of the trickiest parts of mechanics lien law, and can be hard to verify. However, it is essential to understand your place in the chain to avoid the risk of extending credit that you can’t secure.

Material suppliers and distributors have an extra layer of risk to consider. In many states, suppliers to suppliers don’t have lien rights, regardless of which tier their customer is in. For example, if you are supplying lumber to another supplier on a Florida project, it doesn’t matter whether that supplier is in Tier 1 or Tier 10 — you’re “out of the money,” with no recourse to file a lien if you don’t receive payment.

How to prevent payment chain problems

Now that you know why the payment chain matters, how can you use this knowledge to prevent payment delays? The good news is that construction businesses have access to a number of tools that help secure or speed up your payment. But there are at least four that can directly reduce the likelihood that the payment chain will cause problems for you.

Prequalify your projects

In an ideal world, you would prequalify everyone on the project — not just your customer. In reality, this may be nearly impossible. But at the very least, you will want to assess the people who control the money. Who is the property owner? Is there a lender on the project? Do they have a track record of missed payments or lawsuits from subcontractors?

You will need to know who you are in business with because payment problems can arise at any time and point to the chain. If your customer has rock-solid credit, but the owner or the general contractor has a history of missed payments or liens on projects they manage, that can spell disaster for you.

Send preliminary notices

A preliminary notice is a stone that kills multiple birds at once. It improves communication between you and the people at the top of the payment chain, and, in many states, protects your right to file a lien. Regardless, send a preliminary notice to the owner and general contractor whether it’s required for lien rights or not.

Sometimes owners or contractors aren’t as educated to the requirements and will assume that your notice means you have lien rights. Sometimes just sending a notice will get their attention. The more people that know you are in line to get paid, the better.

Ask your customers to protect their lien rights

If your customer is having trouble getting paid, then you probably will, too. Encourage your customers to protect their lien rights on every project. Any steps that your customer can take to speed up their own payment will benefit you as well. This is especially important for subs and suppliers who are “out of the money,” or too far down the payment chain and without lien rights themselves.

Use joint check agreements

A joint check agreement is essentially a contract where one person (an owner, general contractor, subcontractor) gives permission to pay two or more parties at the same time. When done correctly, using a joint check agreement when your customer is a credit risk can increase your chances of getting paid.

Know where you stand on the payment chain

As with any contract, knowing who you are working with and what rights you have before you provide any labor and/or materials is extremely important. This information will drive the way you handle the account. While always remaining professional, I would flag “non-lienable” accounts and ones with lien rights differently.

Protecting the risk of your company can be a confusing and scary process, but the more you familiarize yourself with statute and options, the more confident and comfortable you will be.