As a subcontractor, you probably spend a lot of your time lining up jobs with general contractors, hoping to keep the job funnel as full as possible. But, aligning your company with a larger general contractor — like Primoris Services Corporation, for instance — might mean more jobs and better growth. That is if your company and the big GC are a good fit. This guide is written to help a subcontractor decide whether working with Primoris Services is right for them — and how to protect payments when on the job with this utility construction specialist.

Before you can park your truck on a Primoris project, you need to make sure your companies are compatible. Between company atmospheres and how they treat their subcontractors, it’s essential to do some digging.

Primoris Services: An Overview

Primoris Services’ beginnings date back to 1960 as ARB, Inc., of Bakersfield, California. The company began specializing in pipeline construction, meeting the demands of the mid-century oil boom. By the mid-80s, ARB was acquiring the assets of other oilfield specialists — something that really picked up steam in the 1990s. The 90s also saw ARB break into steel structure construction.

PSC President & CEO

In 2004, ARB became known as Primoris Services Corporation, and the company continued growing. From 2012 on, Primoris Services grew by at least one acquisition a year, most years acquiring two or three. Today, Primoris specializes in pipelines for natural gas, wastewater, and water.

Primoris Services operates 18 offices in the US and Canada, with most located in California and Texas. The company is currently led by its President and CEO Tom McCormick.

Visit their company website to learn more: https://www.primoriscorp.com/

Before working with Primoris Services

When you’re considering working with a new general contractor, you should be doing as much research as possible before signing a contract. Think of it as prequalifying the GC to ensure your companies will fit together. They’re prequalifying you, after all; you would do well to prequalify them.

Prequalifying a general contractor involves the following steps:

- Use their Payment Profile to dig into the company’s payment history

- Review the company’s credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with the company’s payment process

Do understand that anytime you’re digging, you’re bound to find something. Most companies have a red flag or two in their history. A company like Primoris Services, with its 60-plus year history, is bound to have a few negative reviews. Construction is a tricky business, and a slighted sub is more likely to spout off on the internet than a happy sub is to leave a positive review.

If there’s something about a contractor’s past that sends up a red flag, reach out to the company and ask about it before writing them off. If a general contractor is upfront and honest about the issue, it could say a lot about what it’s like to work with them.

Primoris Services Payment Profile

Before working any GC, visit their Payment Profile to review the contractor’s payment practices, past disputes, liens, and payment speeds in order to give an inside look into subcontracting for them.

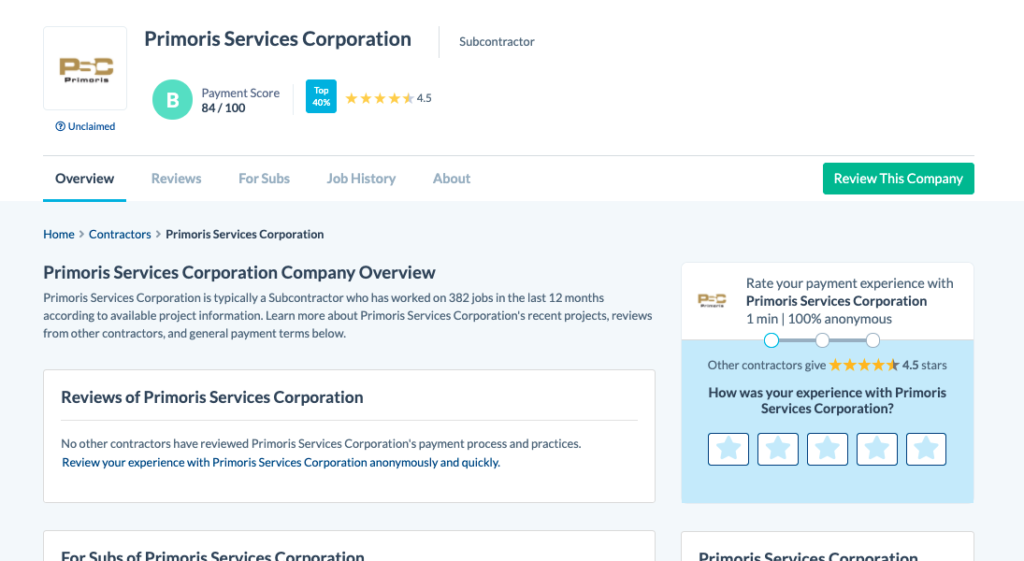

According to their Payment Profile, Primoris Services currently has a payment score of 84 out of 100, giving the contractor a B rating. That’s not a bad score for a company as large as Primoris Services.

These payment scores collect data about a company’s payment practices and compares them against the scores of thousands of other contractors. Subcontractors can use them as a benchmark to compare general contractors and shop around before partnering with one.

(Learn more about how a contractor’s scores are calculated here.)

Payment Disputes

One way to understand how a general contractor treats its subs is to take a look at its dispute history. Whether it be reports of slow payments, lien notices, or liens filed, this is telling data. Almost all general contractors have a few disputes to their name, for one reason or another.

In the past 12 months, Primoris Services has had over 35 complaints of slow payment on projects it’s managing. While that might seem like a lot, there have not been any threats of liens or liens filed against those projects.

To put things further into perspective, in the past 12 months, 96 percent of Primoris’s projects have gone off without a reported payment hitch. In 2021 alone, that number is 95 percent, with 2020 and 2019 also coming in at 95 percent.

Those percentages might be why surveyed subcontractors rate Primoris Services 4.5 stars out of 5 in Levelset’s Payment Profiles.

Getting Paid with Primoris Services

Even with an excellent payment score, things happen. Payments can be late for reasons outside of the general contractor’s control. For that reason, you want to know as much as possible about a contractor’s payment policies beforehand.

Before work starts

Before you’re able to start working with a large general contractor like Primoris Services, the company will have some required paperwork that you’ll have to provide. They usually include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

The project manager will typically contact you for this paperwork and any additional documents they might need from you before you’re able to get to work.

First Payments

Most large contractors like to standardized their paperwork process as much as possible. With 18 offices, using the same docs will help make things a bit more streamlined from shop to shop. For that reason, industry-standard documents like AIA billing, G702 payment applications, and G703 continuation sheets are usually the preferred methods for billing.

Also, be sure to ask your project manager when payment applications are due — typically the same day each month. It is usually the 1st, 5th, 15th, or 20th, but make sure to ask. Missing one of these windows can drag out the time it takes to get paid.

Progress Payments

Most of Primoris Services’ projects are long and involved, and depending on your role, you could be on site for a long time. Waiting until the project wraps up to get paid isn’t going to work. For that reason, you should be using progress payments to keep cash coming in each month.

While you’re sending in your payment application, be sure to include an updated schedule of values to streamline the process.

Project Close-Out

All general contractors have their own ways to handle project close-out, but there are some near-universal documents and processes you can expect to deal with:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

But here’s the thing about project close-out: It’s easy to let the process sweep you away. Between retainage and final payments, the promise of cash flow can have you signing documents without reading them. But you need to be careful about lien waivers. If you aren’t careful or don’t read every document thoroughly, you could sign a waiver for a payment you haven’t received and throw away your rights to a lien.

3 tips to getting paid on every construction project

Other than counting on things coming up, construction is unpredictable. Delays, disputes, and other issues pop up all the time. Following these three tips will help ensure they don’t blindside your cash flow.

Send preliminary notices

If you aren’t sending a preliminary notice on every one of your jobs, you need to start. Many states require contractors to send them in order to retain their rights to file a mechanics lien in the event of a payment dispute. You need to check your state’s laws to ensure you’re meeting the deadlines and other requirements.

Even if the state you’re working in doesn’t require a preliminary notice to protect lien rights, you should still be sending these documents. They serve as a professional introduction between you and the people writing the checks — those are the people you want to know your company’s name.

Visibility is everything

Sometimes, getting paid is a matter of visibility. When your invoice sits on the bottom of the pile, you might need to send a document or two to bring it to the top. For that reason, sending visibility documents like invoice reminders, notices of intent to lien, and demand letters is critical. These documents can refresh the memories of the GC and project owner, ensuring you receive a check.

Make your right to file a lien a priority

When you partner with a big general contractor, the goal is usually growth and making more money. It’s critical to protect that money on every project, regardless of its size. If you protect your mechanics lien rights, your money will be safe because you’ll have recourse if a payment dispute arises.

Filing a mechanics lien is the fastest way to get paid when a dispute happens. These tools are incredibly powerful, and they can compel a contractor to pay you. But, because they’re so powerful, states have strict requirements contractors must meet to use them. Be sure to meet those requirements so you can make protecting your lien rights a priority on every job.