Not the way to read and sign lien waivers

Lien waivers are important documents that, due to their ubiquitous nature, are occasionally overlooked. The critical importance of lien waivers is grounded in two related areas: the ability of lien waivers to be the cornerstone of fair payment – and the potentially devastating consequences when lien waivers are misunderstood or used unfairly as leveraging tools. One key to making sure lien waivers are used correctly and appropriately is to understand the lien waiver document, and realize how minor changes can have major effects. Becoming well-versed in lien waivers doesn’t need to be a momentous undertaking, though. This article will provide some hints and tips and provide insight on how to read a lien waiver.

First Things First – Have You Been Paid?

A prerequisite to even beginning to answer the question of how to read a lien waiver is understanding the background giving rise to the waiver: Have you been paid? And, what is the nature of the payment? Lien waivers are meant to function as a sort of receipt – if a party is paid a certain amount, that party waives his or her right to claim a lien for that amount. Or, a party is promised a payment of a certain amount and says they will waive the right to lien for that particular amount provided he or she actually gets paid. This is it. Those two sentences constitute the totality of the lien waiver’s purpose, as originally conceived. Everybody is protected, and the payment process is fair.

A prerequisite to even beginning to answer the question of how to read a lien waiver is understanding the background giving rise to the waiver: Have you been paid? And, what is the nature of the payment?

Knowing the answer to thess question is critical in being able to read and understand a lien waiver. And, reading and understanding the lien wiaver is important because what the lien waiver says happened may be more important than what actually occurred. If you sign a document that says you were paid – the law thinks you got paid.

With the knowledge of whether or not payment has been received, the first step in how to read a lien waiver can be undertaken and that’s determining what type of waiver you have in front of you.

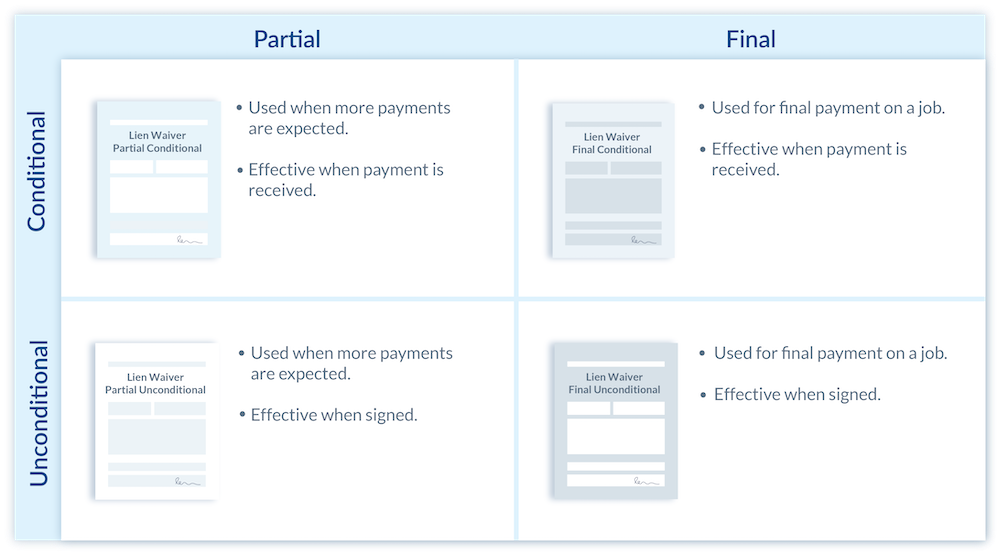

The Four Kinds of Waivers and How To Recognize Them

There are four general types of lien waivers, broken down by two main types each having two sub-types. The main types of waivers are Conditional Waivers and Unconditional Waivers, and each main type can either be pursuant to Final Payment or a Progress Payment. If your project is in one of the states in which lien waiver forms are set forth by statute, the type of lien waiver being provided will likely be included as a title of the document. However, the specific wording of the lien waiver is what determines the type, so waivers should always be read carefully to see which type of waiver they are.

This is where knowing whether you have been paid, and the nature of that payment, if any, is important. An important part in knowing how to read a lien waiver, and whether a specific lien waiver is appropriate in a specific situation, is determining whether the waiver type lines up with the waiver type. If you’re done with the project and have been paid everything you are owed, an Unconditional Waiver on Final Payment is likely appropriate, but if you’re still working on the project and haven’t been paid, any waiver Final Payment waiver, or any Unconditional waiver will not.

Determining the waiver type is crucial, but how do you do it? The language (and potentially the title) of the waiver give away its type. If the document contains phrases like:

This document waives and releases lien, stop payment notice, and payment bond rights the claimant has for labor and service provided, and equipment and material delivered, to the customer on this job.

or

Rights based upon labor or service provided, or equipment or material delivered, pursuant to [anything] prior to the date that this document is signed by the claimant, are waived and released by this document.

or

The Claimant has been paid in full

that are not qualified by limiting language represent Unconditional Waivers and Final Payment. A Conditional waiver document would contain language to the effect that the document is not effective until receipt of payment, and may caution third-parties not to rely on the waiver unless they are otherwise confident the claimant has been paid.

Unconditional and Conditional waivers pursuant to progress payment work in a similar manner, however, there will be a “Through Date” listed on the document that provides an endpoint the waiver is effective through, but not beyond.

How Long Is Your Waiver? Does It Include Waivers of More than Security Rights? Is It Clear?

Now that you are confident you have identified the waiver type, and that it corresponds with the nature of the payment received or promised, you can take a look at the document to check for other potential issues. The fact that lien waivers are provided to be signed in exchange for payment (an important part of a project, and one in which the paying party seems to hold all the leverage and may not be averse to using it) the documents can end up being much more than the receipt they are intended to be. Because the party signing the lien waiver may feel obligated to sign whatever document is presented in order to get paid, unscrupulous or oblivious parties may attempt to use the lien waiver as a legal positioning tool and cram all sorts of other language into the lien waiver that really has no real legitimate right or reason to be there.

One quick step in evaluating a lien waiver is to look at its length. Remember, a lien waiver is supposed to be a “receipt” for payment made or promised and the relinquishment of the associated security rights. There are few legitimate reasons why a waiver would be over a page long. If the waiver received is multiple pages, or full of really tiny print, or just appears long, it may be worth taking special precautions in looking through the waiver for unnecessary and/or unfair language.

Further, lien waivers should be clear. While lien waivers are a legal document, and some states actually set forth the specifically required text of the document by statute, the document should be clear and easily understandable. The document should clearly state what has been paid (or promised to be paid), whether the payment is a progress or final payment, whether there are any exceptions to the waiver, the through date (if applicable) and what, specifically, is being waived. Additional information, other than identifying the parties or the project, is extraneous and may be potentially harmful.

It’s important to read the waiver carefully in order to look for language not related to the simple act of waiving security rights for money that has been paid. Predatory companies may attempt to use the lien waiver document as a means to sneak in terminology that alters the contractual relationship between the parties. Understanding how to read a lien waiver means understanding that a waiver should be examined for language that modifies the underlying contract, or waives rights other than the mechanics lien security it was designed to do.

In one Texas case, a $20 million dollar judgment was overturned, and the previously victorious party was on the hook for $10 million in attorneys’ fees due to additional language contained within lien waivers it had signed. This was not a case in which the contractor signed a lien waiver saying it got paid when it hadn’t, it was merely attempting to defend itself against liquidated damages claims. Over $2 million in liquidated damages was withheld for contract delays, to which the contractor alleged it had defenses. Unfortunately for the contractor, however, the court of appeals determined the contractor waived all those defenses and claims when it signed the lien waiver that included extraneous language.

The language at issue in that case was that the contractor “has no further claims . . . for the portion of the Work completed and listed on the Schedule of Costs in Payment Number . . .”. The fact that this was not limited to mechanics lien rights, and stated that the claimant had “no further claims” for any of the amounts billed through the certain date, waived all rights associated to those amounts. It pays to be careful when reading a lien waiver so that you understand what is being waived. If you have questions about what a lien waiver actually says, whether you just don’t understand the implications of a certain clause, or it’s written in such a way as to cause confusion, it may be worthwhile to ask your lawyer.

Conclusion: How To Read A Lien Waiver – Actually Read It

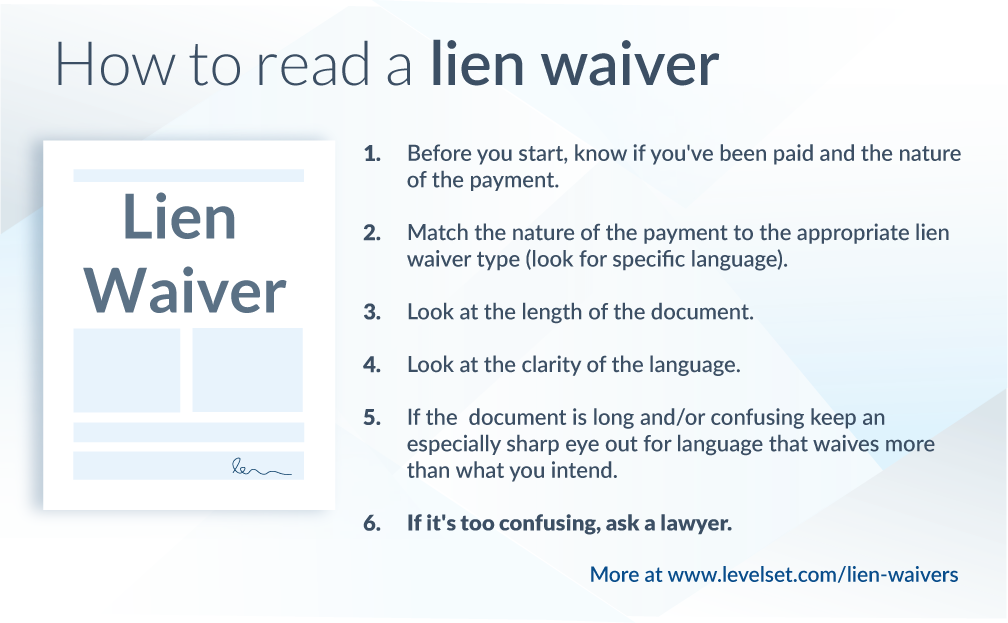

This article began with the mission to teach hints and tips, and to provide insight into, How To Read A Lien Waiver. In case your eyes glossed over a bit in the journey to this point, here are some quick take-aways into reading a lien waiver like a pro.

- Before you start, know if you’ve been paid and the nature of the payment

- Match the nature of the payment to the appropriate lien waiver type (look for specific language)

- Look at the length of the document

- Look at the clarity of the language

- If the document is long and/or confusing keep an especially sharp eye out for language that waives more than what you intend

- If it’s too confusing, ask a lawyer