On a construction project, exchanging lien waivers is super important for everyone involved. In California, it’s particularly important to get a lien waiver and release right, since it’s regulated by state laws. In this article, we’ll explain everything you need to know about the California lien waiver and release forms. We’ll review which forms to use for progress payments or final payments, when to use them, and things to watch out for.

In addition to this guide, you can find a lot of the forms, statutes, and frequently asked questions about lien waivers on the California Lien Waiver Guide & FAQs page.

Who uses lien waivers in California?

This one’s pretty easy. Everyone on a California construction project uses lien waivers.

- Project lenders frequently require lien waivers to approve loan disbursements.

- Developers or homeowners require lien waivers to limit the possibility that they pay for the same work twice.

- General contractors must collect lien waivers on behalf of the owners and lenders, and also to protect themselves.

- Subcontractors and suppliers should submit a waiver and release for each payment. They must deal with everyone’s lien waiver needs to get their payment processed.

If you’re reading this, you’re likely in charge of getting the lien waivers right on a California project. And getting it right is important. In fact, in many cases, getting one tiny thing wrong could invalidate the entire waiver, leaving you in a pretty tight spot.

There’s a lot that goes into getting the lien waiver exchange right.

This California Lien Waivers Overview will provide you with the resources, information, and forms you need.

Overview of California’s Lien Waiver Rules

Although every state has different rules, lien waivers are generally the same everywhere, including in California. That is to say that at its core, a lien waiver – also known as a lien release – is simply a document signed by a potential lien claimant (such as a contractor or supplier) stating that they waive future lien rights against the property, usually in exchange for payment. Signing a lien waiver that meets the state’s requirements releases the right to file a mechanics lien.

According to California’s mechanics lien rules, the lien waiver and release doesn’t just waive lien rights. It waives and releases mechanics lien, stop payment notice, and payment bond rights. A valid lien waiver releases all rights to make a claim for the amount paid.

The devil is in the details.

You can’t just waive lien rights in your contract

You can’t just waive lien rights in your contract

The lien waiver exchange process can be a pain in the neck…so why not just skip it entirely and have all lien rights waived within the construction contract? Well, because you can’t.

California does not allow parties to contractually prohibit mechanics liens. The law specifically provides that parties “may not, by contract or otherwise, waive” lien rights, and “any term of a contract that purports to do so is void and unenforceable.”

In fact, the law states that the only way to waive those lien rights is through the lien waiver exchange process.

But, lien right can be waived in some cases even without payment

California’s lien waiver rules generally work to avoid the circumstance when a contractor or supplier waives their lien rights before payment. However, if it is explicitly done, it’s possible to do so. This is done when the parties exchange an “unconditional” lien waiver. These lien waivers can be very powerful and are likely effective even if a check or ACH payment bounces or is reversed after the waiver is signed.

There’s very little wiggle room on California lien waiver forms

The last major thing you need to know about California’s lien waiver laws is that there’s very little wiggle room with the waiver forms. It’s common that lenders, developers, and general contractors want to use their own custom lien waiver forms. In California, that’s a mistake.

The state laws provide the specific form to be used right within the law itself, word for word.

It’s super clear that a particular type of lien waiver form be used, and it’s also clear that a waiver is not effective if it’s not using the correct form. So, in a sense, lien waiver exchanges in California are quite simple: just use the provided form.

Choosing the Right California Lien Waiver Form

On the one hand, California makes it easy to “choose the right lien waiver form” because the laws provide the actual forms and require those forms be used. This does make things more simple. In other states, the parties will fight a great deal about what provisions are included in the lien waiver form. That’s not a consideration in California.

On the other hand, there are still 4 different types of lien waiver forms, and the parties must choose the correct type of form with every payment. Here is a short guide to help you determine which form to use.

1. Progress payment or final payment?

Every payment on a construction project is either a progress payment (i.e. a partial payment) or a final payment. To select the correct lien waiver form, you must figure out which type of payment you’re dealing with.

If a contractor or supplier is getting paid on a project and will never be paid again for that project, the payment is a final payment. California has specific forms for these payments, known as a waiver and release on final payment.

If the contractor or supplier will likely be paid again in the future, and the payment in question is just one of many future payments, then the payment is a progress payment. In California, the form used is for a waiver and release on progress payment.

2. Have you received payment yet?

The second key question in selecting the appropriate lien waiver form is whether the actual payment has exchanged hands or not.

And it’s important that not only has the payment been made, but that the payment is permanent and not subject to a credit card dispute, an ACH reversal, or a bounced check.

If payment has already been made, has cleared, and is available to draw from, you may use an unconditional waiver and release. An unconditional waiver can be dangerous, so tread carefully.

If you are still waiting on payment, you should be using the conditional release form.

Selecting The Right Waiver and Release Form

Now that you have answers to these 2 simple questions, you’re ready to select the correct California lien waiver form.

Progress Payment Waiver Forms

- When payment isn’t made yet: Conditional Waiver and Release on Progress Payment

- When payment is already made: Unconditional Waiver and Release on Progress Payment

Final Payment Waiver Forms

- When payment isn’t made yet: Conditional Waiver and Release on Final Payment

- When payment is already made: Unconditional Waiver and Release on Final Payment

One size does not fit all. When push comes to shove, a tiny mistake can create a big, expensive headache. If you’re juggling multiple contractors and suppliers and/or multiple invoices and payment applications, this becomes a pretty convoluted calculation.

And further, the names of the forms are brain twisters.

Nevertheless, as you’ll see in the next section, it’s important to take your time and get these things right.

Lien Waiver and Release Form Requirements

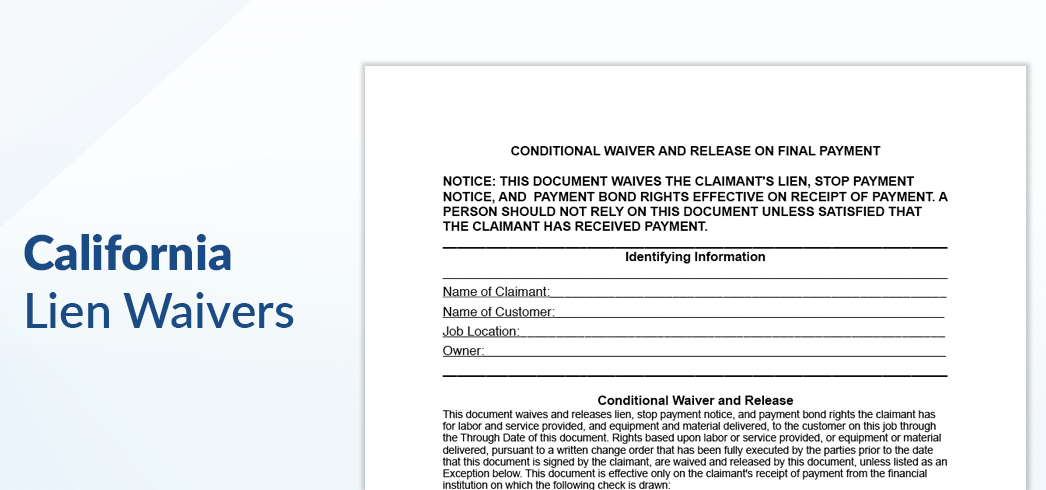

California law defines exactly what a lien waiver form should contain in order to meet the legal requirements. Every waiver form should contain some basic identifying and payment information:

- Name of Claimant

- Name of Customer

- Job Location

- Owner

- Through Date

- Date(s) of waiver and release

- Amount(s) of the payment (made or pending)

- Claimant’s Signature

- Claimant’s Title

- Date of Signature

However, the statute gives some additional language that must be included for the waiver and release to be valid.

Warning on Conditional Waivers

A conditional waiver and release in California must contain the following statement:

NOTICE: THIS DOCUMENT WAIVES THE CLAIMANT’S LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS EFFECTIVE ON RECEIPT OF PAYMENT. A PERSON SHOULD NOT RELY ON THIS DOCUMENT UNLESS SATISFIED THAT THE CLAIMANT HAS RECEIVED PAYMENT.

Warning on Unconditional Waivers

To be valid in California, an unconditional waiver and release form must contain the following statement:

NOTICE TO CLAIMANT: THIS DOCUMENT WAIVES AND RELEASES LIEN, STOP PAYMENT NOTICE, AND PAYMENT BOND RIGHTS UNCONDITIONALLY AND STATES THAT YOU HAVE BEEN PAID FOR GIVING UP THOSE RIGHTS. THIS DOCUMENT IS ENFORCEABLE AGAINST YOU IF YOU SIGN IT, EVEN IF YOU HAVE NOT BEEN PAID. IF YOU HAVE NOT BEEN PAID, USE A CONDITIONAL WAIVER AND RELEASE FORM.

In addition to these statements, California’s statutes spell out other required information, statements, and warnings that must be included in a lien waiver.

Exceptions

Every lien waiver form in California must include a section for exceptions. In this area, you can list any payments that you are not waiving the right to claim. California law creates some exceptions by default, including retainage, contract rights, and “extras for which the claimant has not received payment.” Even if you sign a waiver, you still have the right to make a claim for any of these amounts.

However, a final unconditional waiver is just that: final and unconditional. In fact, the final unconditional waiver and release form must state: The claimant has been paid in full. The only exception provided for in the statutory form is for “disputed claims for extras.” The form should contain a field to include disputed amounts for “extras” beyond the work outlined in the contract.

Other Considerations for California Lien Waivers

Now you should have a good handle on the general way that California lien waivers work, but some things can pop up to cause you to scratch your head. Below are some frequently encountered situations and questions, and some general answers.

You only really need a conditional waiver and release

Conditional lien waivers are exchanged when payments haven’t yet been made, so the natural question is: Do the parties will need to exchange another waiver after the payment (i.e. the unconditional)?

The answer is No.

The “conditional” waiver is all you need, and the California statutes are explicitly clear about this. According to §8124, a conditional lien waiver is fully effective and lien rights are completely released once there is “evidence of payment,” which is either:

- The claimant’s endorsement on a single or joint payee check that has been paid by the financial institution on which it was drawn.

- Written acknowledgment of payment by the claimant.

It’s unfortunate that the California legislature was a little short-sighted when drafting this law because they don’t contemplate credit card payments, ACH payments, and other electronic payments. Regardless, I don’t think it’s worth getting tripped up here. No sensible judge is going to be confused about this. All you need is evidence of payment and a conditional lien release.

Notarizing California lien waivers

Do you need to notarize a waiver in CA? Absolutely not!

In fact, it’s much more likely that notarizing a California lien waiver would invalidate the lien waiver.

If you’re someone responsible for payments in construction you’ll encounter suggestions that lien waivers be notarized. Heck, you may even hear from an attorney to get it notarized as a “best practice.” This is really common but misguided.

Don’t waste time and effort notarizing a waiver. California’s lien waiver and release process is already convoluted enough.

Can unconditional waivers be used even if payment isn’t made?

Yes. Some states will restrict the parties from exchanging unconditional lien waivers unless payment is actually made, and will invalidate any such waivers. California does not take this approach, but instead requires the language on all unconditional waivers to be very, very clear that it is unconditional.

Unconditional lien waivers in California must contain very specific language warning any signors that it’s unconditional. The language includes the following statement: THIS DOCUMENT IS ENFORCEABLE AGAINST YOU IF YOU SIGN IT, EVEN IF YOU HAVE NOT BEEN PAID.

If you’re signing an unconditional waiver…beware! You may find it better to exchange conditional lien waivers.

How strict are California’s lien waiver rules?

The California lien waiver rules are pretty strict, and you can assume that they will be strictly enforced. Many states have pithy and general lien waiver rules, and many states specifically give the parties a lot of leeway in determining how they want to exchange lien waivers and deal with lien rights. That is absolutely not the case in California.

The rules in California are specific and fairly lengthy. They must be strictly followed.