What is a stop notice?

- Stop Notice Resources

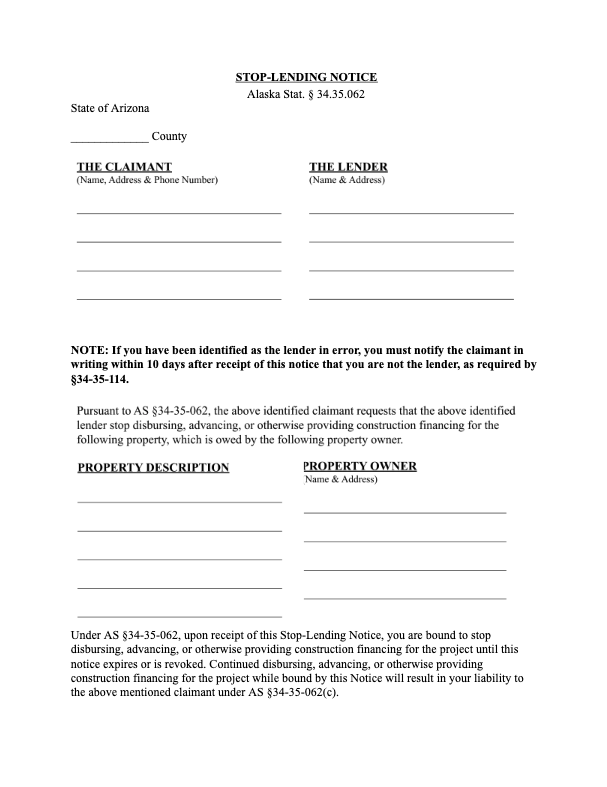

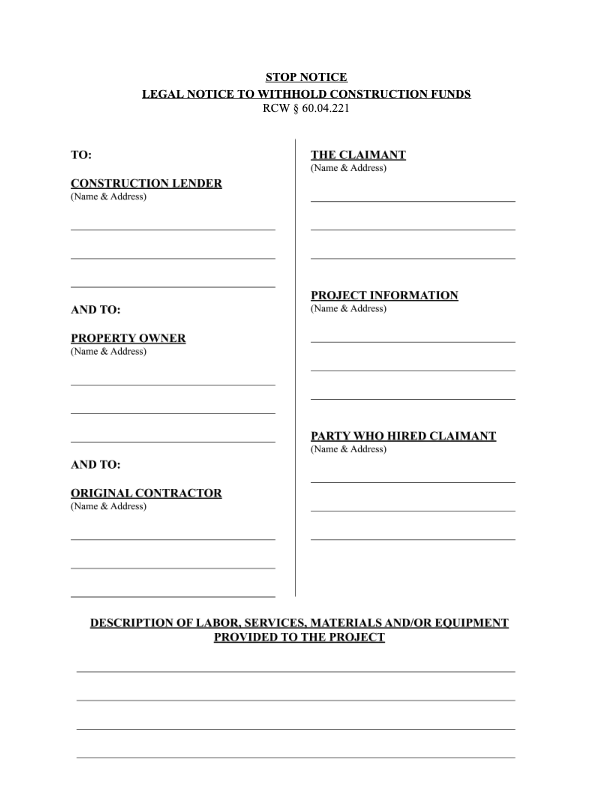

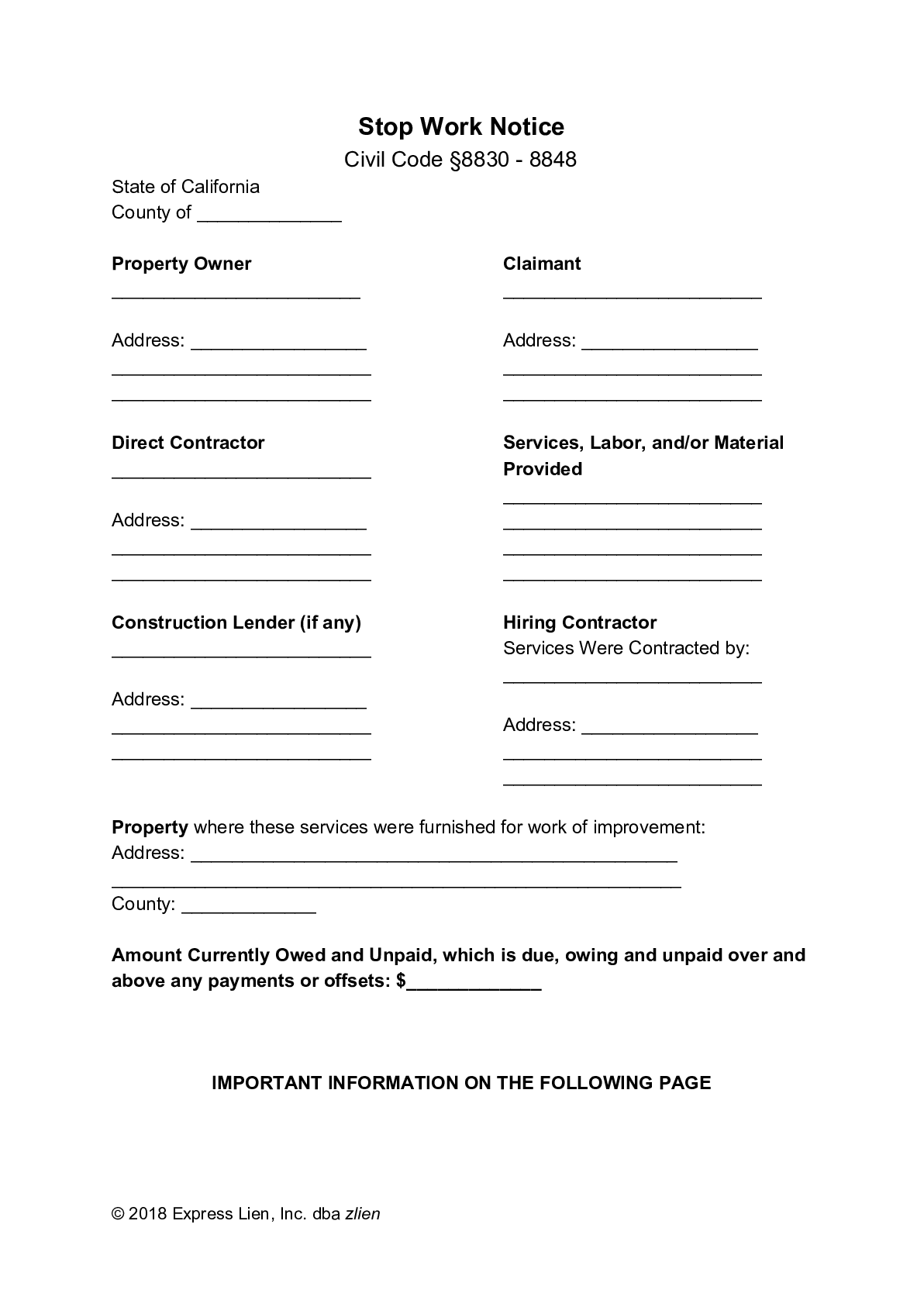

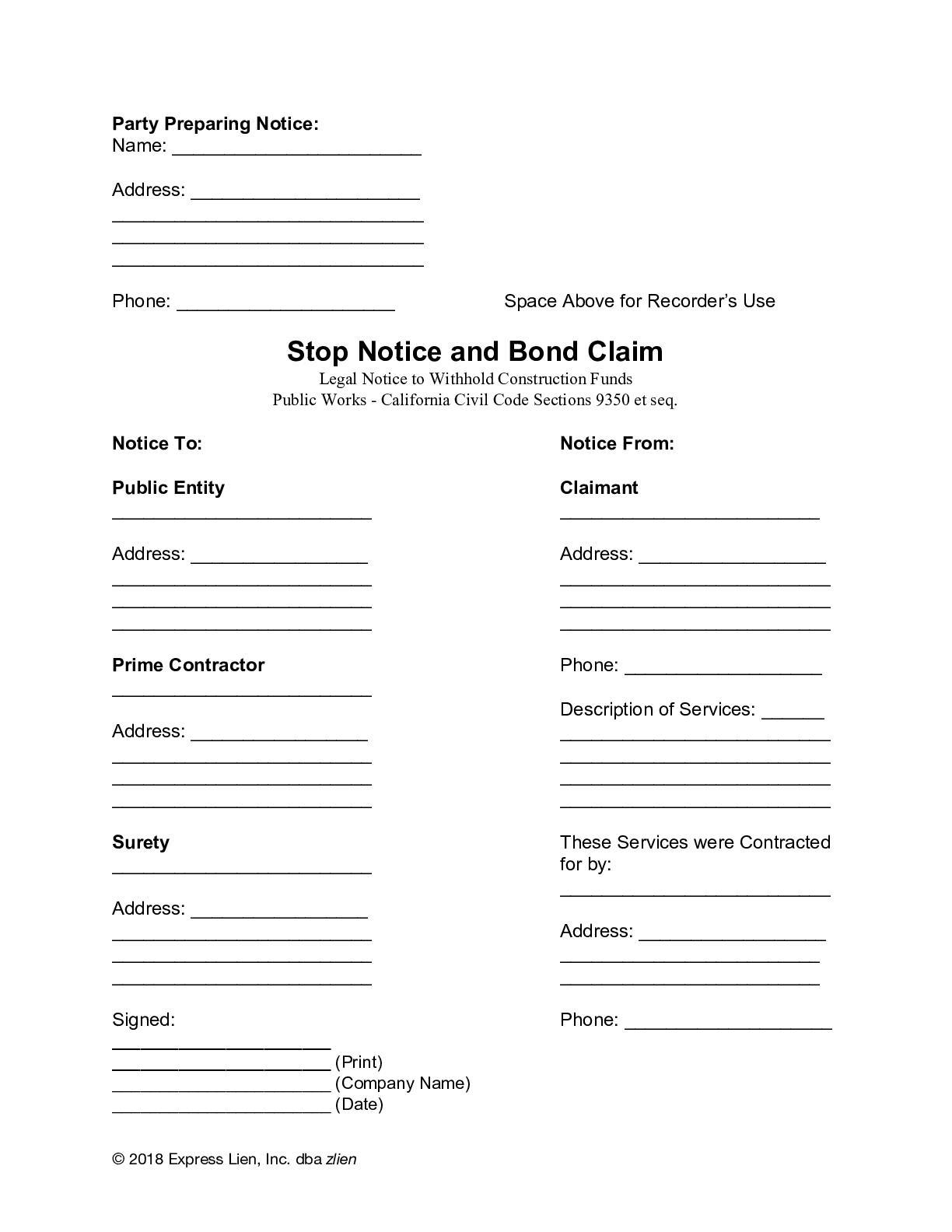

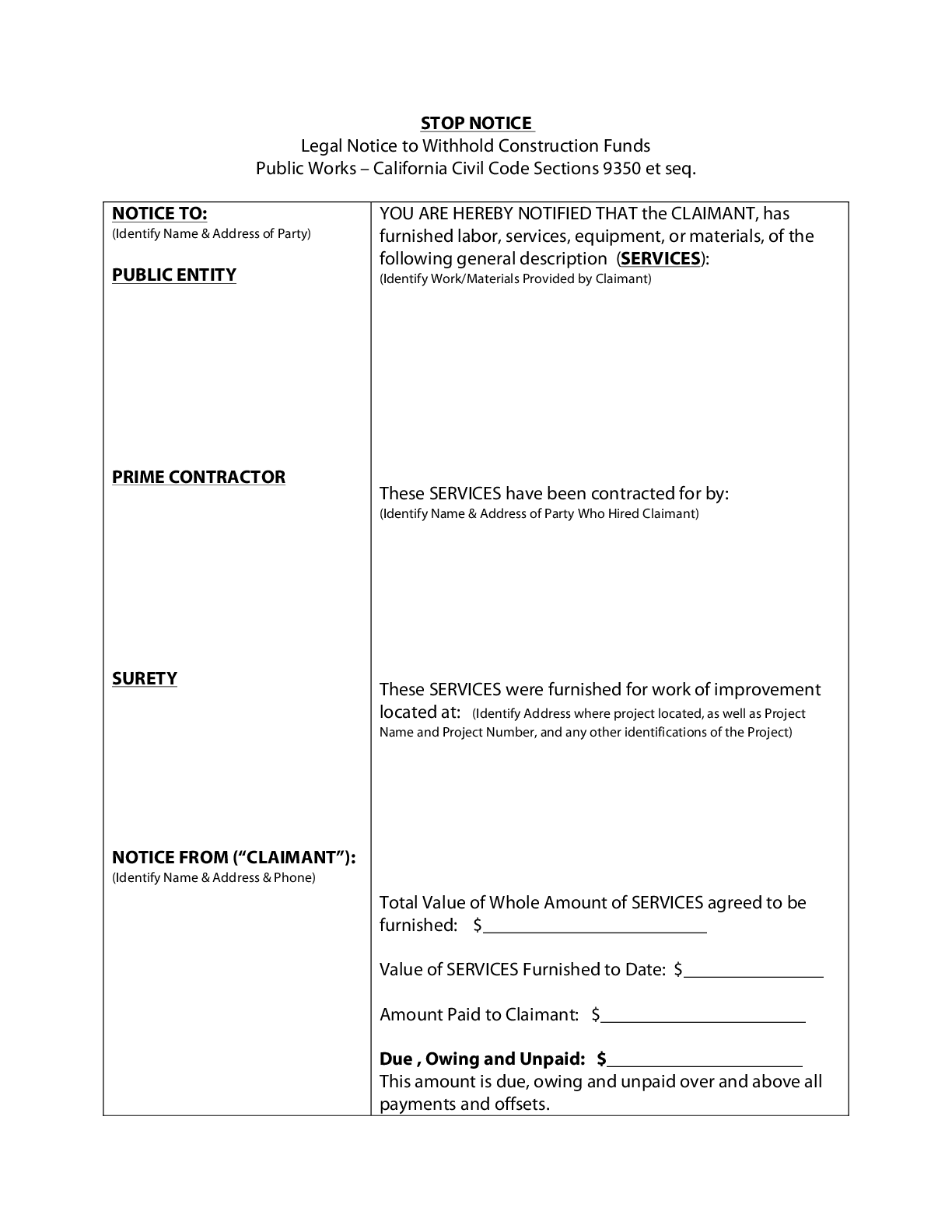

A Stop Notice is a document sent to the construction lender, property owner, or public entity for the purpose of stopping, freezing, or intercepting unpaid construction funds. A stop notice is another statutory protection, in addition to mechanics liens and payment bond claims, to ensure that contractors and suppliers on construction projects get paid what they’ve earned.

It is also referred to as a “stop payment notice,” or “stop lending notice.”

- Read more: What is a Stop Notice & How Do They Work?

How are stop notices different from mechanics liens?

A stop notice can be used as a substitute, or in addition to, a mechanics lien claim when faced with non-payment. Although they operate in the same general manner, there are some important differences. The most notable being that a stop notice only attaches to project funds, not the property itself. In this way, it is more similar to a payment bond claim.

Another important difference is that a stop notice only applies to project funds that have yet to be paid out or disbursed to the project. This essentially makes recovery similar to an “unpaid balance” mechanics lien.

In which states are they available?

Stop notices are only available in a small handful of states. These states include:

- Alaska

- Arizona

- California

- Washington

Each state has its own specific requirements and deadlines for a stop notice to be effective.

Note: Mississippi used to be included on this list. However, in 2012 the MS courts declared that the stop payment statute was unconstitutional.

What are the remedies for failing to withhold funds?

When the construction lender or property owner fails to withhold funds pursuant to a stop notice, the remedies available to the party who sent the stop notice vary by state to state. Typically, the party who sent notice will be entitled, at the very least, to attorney’s fees and court costs for enforcing their rights. Other states, such as Washington, will also grant the mechanics lien priority over the lender’s trust, deed, or mortgage.