The simple way to think about a deadline is that it is the process of counting a period of time from one point to another, and at its core, this is true. In the world of mechanics lien and bond claim deadlines, however, the time counting process is complicated by a variety of factors dictating the point at which counting actually begins.

States’ mechanics lien and bond claim deadlines can generally be separated into two categories: Those that count starting with a claimant’s last furnishing date, and those that count starting with the completion or substantial completion of the entire construction project. The distinction can make an enormous difference as to a party’s actual filing deadline.

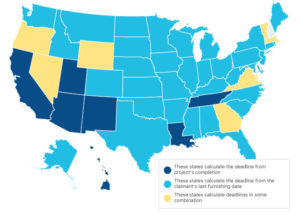

This article provides a state-by-state color coded chart breaking down the rules nationwide.

Map Demonstrating How Mechanics Lien Deadlines Are Calculated On Private Projects

When working on a privately owned construction project (i.e. commercial, residential, industrial), unpaid parties have the right to file a mechanics lien in the event of non-payment. Mechanics lien claims must be filed within a proscribed period of time in every state, with each state setting forth a different time requirement (see time requirements for state within Levelset mechanics lien resources).

The above map demonstrates how each state calculates these deadlines.

As evidenced by the map, most states calculate the mechanics lien deadline from the claimant’s last furnishing date. Accordingly, the lien filing period starts to countdown from the date that the lien claimant itself stops furnishing labor or materials to the construction project.

An example of this methodology can be found in Washington state, where the mechanics lien must be filed within 90 days of last furnishing any labor or materials to the project. Accordingly, if an electrical supply company last ships materials on January 1st, the deadline to file a lien will count 90 days from that date, regardless of whether the rest of the construction project continues to have work upon it.

Most states calculate the mechanics lien deadline from the claimant’s last furnishing date. A minority of states take an opposite approach. The above map highlights these states in blue, where the mechanics lien deadline is calculated from the completion of the entire project.

An example of this methodology can be found in Louisiana, where the mechanics lien must be filed within 1 year from the substantial completion of the project as a whole. Accordingly, if an electrical supply company last ships materials to a Louisiana project on January 1st, but the project continues to proceed until June 1st, the deadline to file a mechanics lien for the electrical company would be 1 year from the June 1st date.

While most states fit within these two deadline calculation methodologies, there are a few exceptions.

Get free mechanics lien form

We're the mechanics lien experts. We offer forms made by attorneys and trusted by thousands.

Download FreeIn Utah, for example, a lien deadline is calculated using the “last furnishing” methodology if the lien is for pre-construction services, but is more aligned with the “completion” methodology for other services and materials. Massachusetts is another exception example, where the mechanics lien deadline is calculated through a “last furnishing” and “completion” methodology mixture, providing that the lien must be filed at the earliest of the following three periods:

a) 90 days after the recording of the Notice of Substantial Completion; b) 120 days after the recording of the Notice of Termination; c) 120 days after the lien claimant last furnished labor or materials to the project.

Map Demonstrating How Mechanics Lien Deadlines Are Calculated On State Projects

When working on a state owned construction project (i.e. state, county, municipal, etc.), unpaid parties have the right to file a bond claim in the event of non-payment. Like mechanics lien claims, bond claims must be filed within a proscribed period of time in every state, and like mechanics lien claim deadlines, each state sets forth a different time requirement for filing a bond claim.

The above map demonstrates how each state calculates these bond claim deadlines.

A comparison of this map with the above map related to private projects will reveal that there is much more diversity in the deadline calculation rules when work is being performed on a state project. While private projects lien deadlines are mostly calculated from the claimant’s last furnishing date, it is much more likely that a deadline will be calculated using the “completion” methodology under laws regulating state projects. The result of this is that your bond claim period is likely longer on a state project than your lien claim period on private projects.

What is also interesting when comparing the two maps is that the methodology can be opposite within a single state depending on the project type. In New Mexico and Arizona, for example, the mechanics lien deadline is calculated from completion, but on state projects it is calculated from the claimant’s last furnishing date.

Free Payment Rights Advisor Tool

One of the most important questions about lien rights concerns whether a potential claimant even has the right to file a lien in the first place. What happens if filing a mechanics lien isn’t an option? What are some other actions to take when you’re having a payment issue? We have a free tool that will help you with these questions. It’s called the Payment Rights Advisor. It only takes a couple of minutes — just answer 5 quick questions about your job, and the Payment Rights Advisor will give you all of your best options, including whether or not you qualify for mechanics lien rights.

Be Mindful Of The Differences in Laws, And Exceptions

The above two maps are a great quick reference for companies to determine what actually makes a deadline’s claim period start to tick on a particular construction project. The obvious diversity in rules between states and project types, however, should be a reminder to pay close attention to the extreme differences in the lien and bond claim laws.

It’s critical to remember that the laws applicable to your lien or bond claim rights will change depending on your state, your project type, and the role you play in a project; and even further, may be subject to some bizarre or even hidden exception. Utilizing technology to handle all of these variables is critical to success at securing your debts.