According to the Census Bureau’s Business Dynamics Statistics, nearly 2 out of 3 construction businesses fail within 5 years! That’s worse than retail, mining, agriculture, manufacturing, and wholesale.

There’s really only one reason a business fails: it runs out of cash. So, why do construction businesses run out of cash? The simple answer is when working capital is mismanaged and accounts receivable stacks up due to slow payment, short term debt can become long term debt putting your construction company in a poor capital position to grow. Let’s take a closer look.

The construction industry has some unique challenges when it comes to managing cash flow and working capital. Despite dealing in huge dollar amounts, the margins in construction are incredibly thin. Typical small business and medium-sized contractors have margins of 5% or less. A $100K project may sound like a lot, but if the margin is 5%, that represents just $5,000 in short-term profit to the construction business. And that doesn’t take into account when the construction companies get paid.

Even established construction firms with a balance sheet of well managed current assets and current liabilities can easily end up needing an increased line of credit, working capital loans or some type of business loan to keep their team working through periods of slow payment that affect working capital.

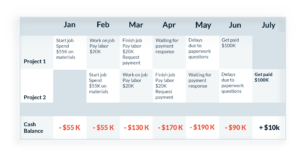

In the graphic at the top of the blog post, a subcontractor took on two new $100K jobs both requiring them to pay for materials upfront in January and February. In addition, the contractor needs to pay their crew $20K per month for labor before getting paid from their general contractor! Despite ‘winning’ two construction projects for $100K each, the contractor is out $190K in cash (working capital) in April and May and only starts to get back into the positive in July!

If the contractor can’t afford to be out $190K in cash, they will need to take on some type of debt and it’s associated interest rates, or simply go out of business. This is the primary reason two out of three construction contractors and businesses fail. The contractor has a working capital challenge: the more projects they take on, the more financial stress the business will take on. Growth is actually hurting their cash balance rather than helping it because they require so much cash to fund the materials purchases and future labor expenses before getting paid!

The contractor only has two options to consider:

- Slow down growth by spreading out when they take on new jobs so they can collect cash from their current projects first.

- Speed up the time it takes to get paid on their projects so they can grow their business.

No construction company wants to slow down to grow, so your best bet is to shorten the payment cycle for your projects. Speeding up the time it takes to collect your accounts receivable allows your current construction projects to more quickly fund your future projects.

Check out our free guide: Three Steps to Get Paid on Every Construction Project to speed up your construction payments and prevent working capital issues for your business!

Learn more: Types of Capital for Construction Businesses