In general, the mechanics lien laws in the US empower the contractors, subcontractors, and suppliers on construction projects. These tools allow contractors to place lien claims against properties in order to get paid for their work.

While these lien claims are incredibly powerful, they aren’t infallible. In fact, some states give property owners a tool to minimize a contractor’s ability to file a lien.

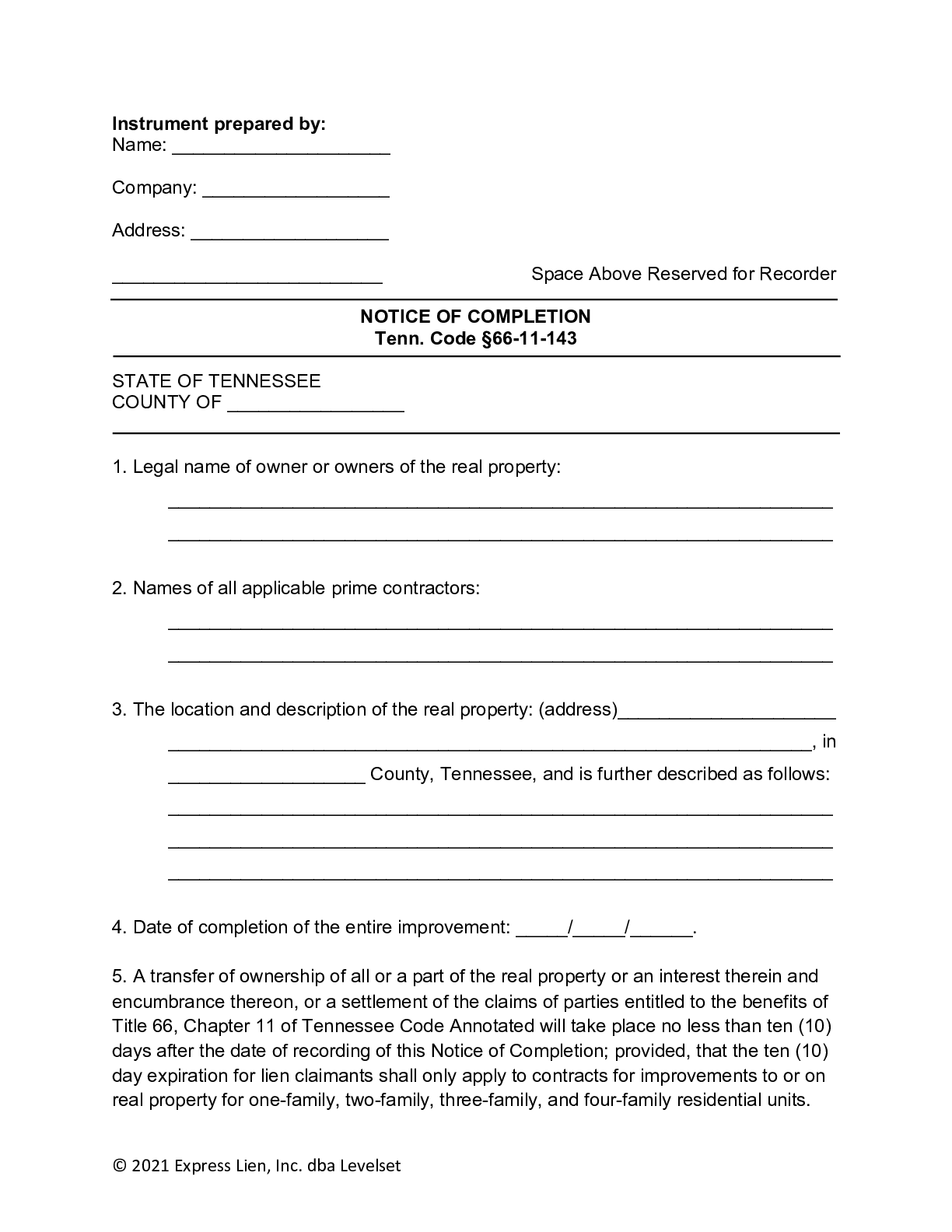

In this Notice of Completion: Tennessee guide, we’ll take a look at such a tool provided to property owners in The Volunteer State.

What is a notice of completion in Tennessee?

You wouldn’t be alone in thinking that completing a construction project is a good thing. In fact, as contractors, project completion is generally when the project owner releases retainage and the final checks. It’s often these final checks that contain all the profit. A notice of completion, on the other hand, isn’t quite as contractor-friendly.

In Tennessee, a notice of completion is a tool afforded to a project owner to help reduce the risk of lien claims on a property. Upon the completion of a project, the owner (or an agent of the owner authorized to do so) may file a notice of completion with the register of deeds.

Once filed, a notice of completion reduces the amount of time a contractor, sub, or supplier has to file a lien for unpaid goods and services. In typical circumstances, the deadline is 90 days from last furnishing. Under the notice of completion statute, this deadline could be as short as 10 days, though the circumstances do affect the deadline.

First, note that Tennessee general contractors aren’t required to file a mechanics lien to preserve their lien rights (though they probably should). Instead, they must simply file a suit to enforce the liened amount within one year from last furnishing.

Parties other than the GC have within 90 days to file their liens. In some circumstances, this excludes subcontractors on residential projects — on owner-occupied residential property of between 1–4 units, only the prime contractor (and/or those contracting directly with the owner) has lien rights. If the owner is acting as his own prime contractor on a project on a single-family residential property, laborers and suppliers contracting with the prime contractor and “first-tier subs” have lien rights.

Also, understand that a project owner (or their agent) must simultaneously record and serve the notice of completion on the contractor on the project. This is not an “and/or” scenario. Should the project owner do one without the other, the notice of completion has no weight, and the deadline remains at 90 days.

However, should the project owner properly record and serve the notice of completion, general contractors on residential projects have just 10 days from the date the notice of completion was filed to file their liens or suits. General contractors on commercial projects will have 30 days to take action. Residential subcontractors generally do not have lien rights in Tennessee, but commercial subs have 30 days when the notice of completion is recorded and served.

How to protect yourself from a notice of completion in Tennessee

Notices of completion are big, scary tools, and it makes sense that you’d want to insulate your business from their effects. The truth is, however, that Tennessee makes it pretty challenging to protect yourself. The good news is that the state does some of the work for you.

By requiring contractors to simultaneously record and serve their notice of completion on a contractor, you should at least be in the know. You can then take action, though you may have as few as 10 days to do so.

Overall, the best way to protect yourself from a notice of completion is to expect one at the end of every job. This means filing your mechanics liens or starting lawsuits sooner rather than later. Also, general contractors should prepare for their lawsuits early, as they may have as few as 10 days to do something about them