Virtually every state has prompt payment laws that make it illegal for anyone on a construction project to delay payments to their contractors and suppliers. Does that mean the police are going to show up at the GC’s door if they don’t pay you fast enough? Well, no. It doesn’t work quite that way. But the law does give you protection, and actions you can take to speed up payment. Not only that, the laws even give you recourse to get paid more than the original payment due!

Why do construction payments take so long?

First, the owner pays the prime contractor. Next, the prime pays subcontractors. Then, subs pay their subs and suppliers. Next, sub-subs pay their subs. And, and so on…The long and short of it is: Getting paid in construction is slow.

Further, when you consider the amount of detailed information required in a pay application to get it approved, it can take a long time for a company down the payment chain to receive their money. Since payments from the owner to prime contractors often take 45-60 days, it’s no wonder why it takes an average of 83 days for subs and suppliers at the bottom to see any money.

Part of the reason that construction payments take so long is because many contractors don’t understand their right to timely payments. And if they do, they rarely enforce them.

Fortunately, you don’t have to accept slow payments as the status quo.

How contractors can use construction laws to get paid faster

Luckily both the federal and state governments feel your pain, and have enacted some laws to help with this issue.

Prompt payment laws exist at both the federal and state levels that mandate when payments should be made on construction projects. They attempt to shorten the time from invoice submission to payment to the first level contractor. Many laws also provide provisions for payments below the prime contractor level.

Even though there are prompt payment laws, no one is going to prison for making a late payment on a construction project. However, these laws do have some teeth by hurting companies where it counts – in their pocketbooks. Most have stipulated interest rates or specific sources for rate calculations, and the percentages can be quite steep. Some even provide for compounding interest once a payment delay passes a certain deadline.

Let’s look at some of the details of these prompt payment laws, so you can find out where you stand in your state.

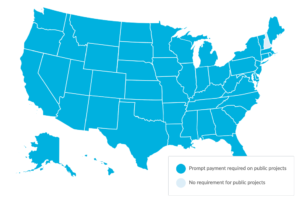

The only state in the US that doesn’t have prompt payment laws for either private or public projects is New Hampshire. However, federal projects in that state would still fall under the jurisdiction of the national law.

Slow payments are illegal on these construction projects

Federal construction projects

The US Prompt Payment Act sets payment deadlines on federal projects. The requirements apply to all federal projects, of any size, with any government agency. The agency must pay prime contractors 15 days after invoicing. GCs must pay subs 7 days after that. View the full text of the prompt payment law on the US House of Representatives website.

There are a few exceptions to the rule, and reasons why a hiring party can withhold funds. But generally, if a payment is late, the hiring party must pay interest on top of the payment. The interest penalty is set by the Department of the Treasury.

Private construction projects

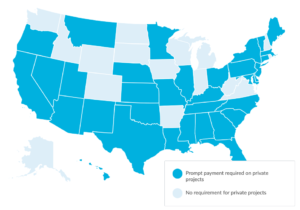

All of these states have deadlines for payment on a private construction project:

Alabama, Arizona, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Illinois, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, and Vermont.

Of course, every state has their own definition of “prompt.”

In Alabama, for example, payments on private jobs are due to the prime contractor within 30 days of invoice, and payments to subcontractors are due 7 days after that.

In Georgia, owners have 15 days to pay the prime contractor. The prime must pay subs within 10 days after that.

If you’re working in Hawaii, there is no timeframe for owners to pay prime contractors, but subs and suppliers have to be paid 10 days after they invoice.

Public construction projects

Every state except New Hampshire sets prompt payment deadlines on public projects. (What’s going on up there, New Hampshire?!)

Just like private projects, states define “prompt” differently. In Alaska, for example, payments to prime contractors are due 30 days of a payment request. After the owner pays them, GCs have 8 days to pay their subs.

In Arkansas, property owners must pay the prime contractor within 5 days for progress payments, and 90 days for final payment. However, they don’t set a deadline for primes to pay subcontractors.

And in several states, local municipalities are covered by the prompt payment legislation, too. In Virginia, they have to pay their contractors within 45 days.

Legal penalties for slow payment

The penalties for slow payment include the payment of interest, attorneys fees, and court costs. However, they vary from state to state and by type of project. Of course, a payment dispute must go to court for any attorney fees and court costs to be assessed. But in most cases interest is due, and in some places it keeps compounding as the payment gets later and later. On a big job, that interest can add up quickly.

Take California, for example, where the interest penalty is 2% per month. On a $100,000 payment, that’s a penalty of $2,000 per month. North Dakota charges 1.75% per month – and it compounds every 45 days. That means the hiring party has to pay interest on top of the interest. If a $100,000 payment is late by 6 months, the penalty adds over $7,000.

A late payment on a private job in Alabama garners 1% interest per month, while in California the rate is 2%. For public jobs, some states charge as much as 10% or 15% annual interest. Several base their rate on the rate published in the Wall Street Journal. Several states also allow the prevailing party to recoup court fees and attorney costs, including Arizona, Idaho, and Washington.

When you look at all of these fees, making a slow payment can be expensive!

Exceptions: When delaying payment is legal

Most states have language in their prompt payment laws that allows an owner or GC to delay payments for two primary reasons: Retention, and valid disputes.

Retention, also known as retainage, is a practice of withholding a percentage of the payment until the project is complete. Generally, retainage is exempt from prompt payment requirements. However, some laws do spell out how quickly it needs to be paid after the project is finished. A hiring party is typically still legally permitted to withhold retainage – as long as the retention terms are in the contract, and both parties agreed to it.

State laws also often allow a hiring party to delay payments if there is a valid dispute over the work. In Texas, for example, construction parties can withhold payment for a “good faith dispute.” While the law doesn’t spell out exactly what it means, it does say it’s “a dispute regarding whether the work was performed in a proper manner.” That gives the owner or GC some leeway. This is yet another reason why it’s important to document your work in detail. If you end up taking a prompt payment case to court, showing the judge visual proof or documented communication that refutes the other party’s version of events will strengthen your case.

How to enforce the law if payments are too slow

If you have a slow paying customer on a project that is subject to a prompt payment act, there are a few alternatives for collecting. The choices vary depending on whether the project is public or private. Your options on a public project are generally the same whether the project is funded by the federal government or a branch of state government.

Send a letter

The first option you have is to send a prompt payment demand letter. This letter informs your customer that you are requesting (or, ahem, demanding) payment under the federal or state prompt payment law. You should list the amount owed, including a breakdown by invoice or work completed, and include the appropriate interest rate and calculations. The letter should be sent by certified mail to your customer – so you have proof in case your claim goes to court. Levelset offers a free demand letter template that you can use. Often, a demand letter is effective in itself. Hopefully, the hiring party makes payment, and this is as far as you need to go.

File a lien or bond claim

If you still don’t get paid, you will need to either:

- file a mechanics lien (for private projects), or

- file a bond claim (for public projects).

A bond claim is also called a Miller Act claim on federal projects. Both of these documents are effective ways to get paid.

If you file a lien, you are attaching your debt to the deed for the property. If you aren’t paid, you can foreclose on that lien and force the sale of the property. With a bond claim, you are attaching your debt to the GC’s payment bond (a promise that they will pay all their bills). A valid bond claim will force the GC to pay you in order to release the bond at the end of the project.

File a lawsuit

Another option is to file a lawsuit for non-payment in court that has jurisdiction over the project’s location. This is generally a last resort, as it is expensive and time-consuming for all parties involved (except the attorneys, who love it). However, if the issue of non-payment isn’t straight-forward or there are other issues involved, like quality or completion of work, this may be the best way to get your conflict resolved.

Steps to avoid slow payments

How do you make sure your payments are received in a timely manner? While there is no foolproof way to insure prompt payments, you can increase your chances by sending a preliminary notice on each job you work or supply materials for. This ensures that the owner and GC know about you, and improves your chances of getting paid quickly. Everybody wants to avoid the possibility of a lien being filed.

Discover how a Florida contractor’s average DSO went from 60 days to 14 days after sending notices on every job.

Another idea is to send regular reminders about invoice due dates. Many software programs will do this for you automatically. If you don’t have one that does, set a reminder on your phone or email program to let you know when payments are due.

Always maintain open communication with your customers, and don’t be afraid to contact them and ask the status of your payment. They should be understanding, as they want their own payments to be made promptly. As contractors, we’re not just doing this for the fuzzy feelings. We need to make sure we get paid in a timely manner.

Construction law has your back

If you are dealing with late payments, there’s good news: The law has your back. To take advantage of your legal right to get paid in a timely manner, understand all of your options.

- Research your state’s prompt payment laws so you know where you stand.

- Protect your right to file a mechanics lien or bond claim.

- When a payment is late, use the tools available to exercise those rights.