As the end of the year rapidly approaches, it’s time for companies to take stock of their receivables, reevaluate (or create) their credit policy, analyze their average DSO, grade their collection efforts, and vow to get paid more often and write-off less bad debt in the new year. While those goals all sound good on paper, actually accomplishing them is a much harder proposition. When used in the right way, however, this type of data can be used, along with readily available tools, charts, and other information, to significantly improve a company’s bottom line.

1. Analyze and Organize Outstanding Receivable Accounts

A. The first step to always getting paid in the future is to clean-up and organize outstanding accounts now. Many companies use specialized software programs to track payments on projects.

For all currently outstanding accounts, the date of first delivery, the date of last delivery, the amount owed, and the date payment was due should be entered into your spreadsheet.But, even if your company doesn’t use a program specifically created to track payments or monitor receivables accounts, they can still be organized and tracked. A regular spreadsheet can provide the information needed to make decisions about the required steps to take on specific projects, provided the right information is being entered into the spreadsheet. For all currently outstanding accounts, the date of first delivery, the date of last delivery, the amount owed, and the date payment was due should be entered into your spreadsheet.

Once the information is entered into the spreadsheet, it can be organized by days overdue (and then potentially sub-organized by amount due). That way, there is an easy way to see which projects have gone the longest without being paid, and of those, which projects have the largest amount outstanding. This is also useful in determining lien rights, or determining which projects, if any, could still benefit from sending a preliminary notice.

B. The next step to take with the spreadsheet is to expand it to include all projects, whether or not payment is overdue. Getting into this habit can be crucial to overhauling a credit policy, because it provides the information and organization necessary to strictly comply with a thorough notice and lien policy. And, as I have mentioned before, in my opinion, a thorough notice and lien policy is the best protection suppliers have to make sure they get paid on all of their projects.

2. Analyze Average DSO, Grade Collection Efforts, and Set Benchmarks to Measure Future Improvements

A. Many companies already know their average DSO; the time it takes to be paid is crucial to a business’s cash flow and strategic planning. And, most companies who supply on credit want to decrease their average DSO for the same reasons. If you don’t know your average DSO and have many unpaid accounts, that information can be truly eye-opening. It can mean a lot for a business if, instead of getting paid on average 90 days after they supplied material, they are routinely getting paid 45, or even 30, days after material has been supplied.

If the average DSO is unknown, the spreadsheet created in step 1, above, can provide the information needed to make that calculation. Once a calculation has been made, set goals marking where DSO should be at the end of next year, and at points along the way. For example, if your end goal is to move average DSO from 90 to 45 days, a third of the way through the year average DSO should be approaching 75, and two thirds of the way through the year they should be approaching 60.

B. Grading collection efforts overall can be a tricky proposition. There are really only three outcomes: 1. You get paid the amount due; 2. You get paid a portion of the amount due; and

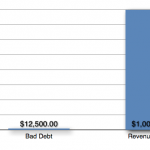

Setting a grade for collection can be accomplished in any way that makes sense for your individual business. One general way to grade overall collection efforts is to determine the percentage of uncollectable debt (total bad debt written off by the company) as compared to total sales figures. Since building material supply companies operate on an average profit margin of 1.25%, writing off a relatively small amount of bad debt ($12,500) results in the need of an extra $1,000,000 in revenue to make up the difference. Clearly, the more that can be collected the better.

3. Making Changes that Matter for the New Year

Now that you have the information about the current year ready, it’s time to implement some changes to make all that information look better next year.

A. Re-evaluate or create your credit policy

The success of any credit department is based on a strong foundation. Having a thorough, written, and strictly followed credit policy is the foundation on which a successful credit department can be built, and is a key to writing off less bad debt next year. Among other information, a good credit policy will include the following:

- Concrete methods to separate those who can and cannot get credit

- Concrete factors to guide the credit manager in determining who must give additional security (personal guaranty, joint checks, etc.)

- When and how lien rights will be used to secure accounts (see: Lien Policy and Notice Policy)

- How long are your credit terms?

- What is done when a payment is not made?

- What is done when an account goes into default?

Strict compliance with the credit policy, and especially with the notice policy and lien policy sub-parts is the number one factor in making next year more financially robust.

B. Apply notice and lien policy retroactively where possible

Deciding to revamp your credit policy and to strictly adhere to its requirements in the new year is a good start, but what about the debt still outstanding from this year?

notices should be sent on every project with time remaining before the notice deadlineFor those amounts still outstanding, you can use the chart created above to determine which of the projects may still be protected by mechanics lien rights (your strongest protection to get paid). Lien rights are complicated, and many states require preliminary notices to be sent in order to secure the benefit of later filing a mechanics lien. Further, suppliers may have other requirements (or, unfortunately no lien rights at all) depending on the party with whom they contracted. Suppliers to suppliers are sometimes not allowed to file a mechanics lien, whereas suppliers to subs, generals, or property owners are.

Since material suppliers are almost universally required to send preliminary notice prior to filing a mechanics lien (although, again, this may depend on the party with whom you contracted) the chart you created above can be used to determine which (old) projects could benefit from sending preliminary notice. Alternatively, a third-party platform that tracks lien and notice deadlines may be used for this step as well, to decrease the workload. Once the appropriate projects have been determined, preliminary notice should be sent on all of those projects. Further, after the preliminary notices are sent, liens should be filed when possible. This can be done in-house, or by a third-party notice and lien service. Either way, however, notices should be sent on every project with time remaining before the notice deadline.

C. Don’t forget the projects where retroactive noticing is not possible

Finally, there will likely be some projects that have passed the deadline to send preliminary notice and/or file a lien. These should not be forgotten and automatically written off, however. Sending a demand letter, or sending a Notice of Intent to Lien, can provide a huge benefit. These documents can be very effective in procuring payment, even on stale accounts.

By cleaning up your old accounts, setting goals, and strictly following a robust credit policy, this next year can be your best year ever.