Texas mechanics liens provide valuable protection to contractors and suppliers working within the state. However, in order to benefit from these protections, there are specific rules and deadlines that must be followed. And Texas, in particular, has some of the more confusing mechanics lien requirements and notices in the country. Here are 5 essential things you should know about Texas mechanics liens.

1. Send a monthly notice for each month that you perform work

If you’re a subcontractor, a sub-subcontractor, material supplier, equipment lessor, or anyone else that didn’t contract directly with the property owner or general contractor, then you must send monthly recurring notices in order to preserve your right to file a mechanics lien. These notices don’t have a specific, designated name; but they are generally referred to as “Texas monthly notices.”

These monthly notices are a hybrid between preliminary notices and notices of intent to lien (NOI), which is found in other states. But, they’re not exactly a “final warning” like NOIs, nor are they sent at the beginning of the project like preliminary notices are.

For a deep dive on this topic:

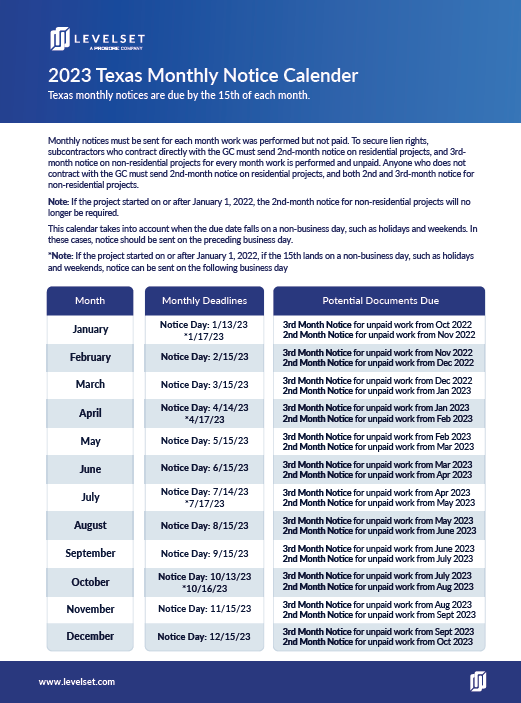

Depending on your role, and the type of project, you might be required to send a Two Month Notice, a Three Month Notice, or both. Most other states require that notices are due within a certain number of days after starting or finishing work. Texas, on the other hand, requires that notices are due on the 15th of the month, two or three months after each month in which you perform work. Here is the statutory language regarding Two Month Notices for subcontractors:

“The claimant must give the notice not later than the 15th day of the second month following each month in which all or part of the claimant’s labor was performed or materials delivered.”

Let’s take a look at some scenarios to help drive this point home.

You’re a sub-subcontractor on a residential project. You begin roofing work in September, and complete installation in October. As a sub-sub, you are required to send 2nd-month notices to the property owner and the general contractor. Since you have performed work in September and October, you must send two notices; one due on November 15th, and one due on December 15th, respectively.

Here’s a simplified example:

- Began work in April → 2-month notice is due June 15th

- Continued work in May → 2-month notice is due July 15th

- No work performed in June

- Completed work in July → 2-month notice is due September 15th

2. Don’t cut it too close to your monthly notice deadlines

Collectors like to avoid sending notices if they can, for several reasons; it’s more work, it costs money, and there’s a perception that it sends a bad message to customers.

In response to the first two reasons, it’s important to remember that sending a notice, even one day late, will destroy your ability to file a mechanics lien. In response to the third point, that simply is not the case. As mentioned above, monthly notices, like preliminary notices, are not a threat or warning; but rather a precautionary measure in case non-payment occurs.

Due to the unique nature of Texas notice deadlines, it’s more common for collectors and credit managers to wait until the last minute to decide on whether or not to send a notice. Invoices from 2-3 months prior begin to stack up as the collector waits; hoping and praying that payment will come through; thinking to themselves, “They told me the check is in the mail. It’s coming!” All the while, the 15th creeps up closer and closer.

Don’t wait! Preparing notices and getting them out the door takes time, and that time should be set aside for that process. It’s better to send a notice for a project that gets paid a few days later than not to send a notice at all, and realize there is no check in the mail.

Download the 2023 Texas Monthly Notice Calendar

This calendar takes the guesswork out of calculating the deadline for your Texas monthly notices. We update it annually.

Download the calendar3. There are special rules for Texas homesteads

Many residential properties in Texas are considered “homesteads.” This is important to note since the rules are requirements for homesteads and mechanics liens, are different than those for ordinary residential projects. You may be thinking, how do you know whether the property is a homestead or not?

Our Ask an Expert Center breaks this down a bit:

If you contracted directly with the homestead owner, the requirements are fairly straightforward. But, if you didn’t contract directly with the owner, then you are forced to rely on the GC fulfilling their lien right requirements in order for your lien rights to be protected. That’s right! If the person contracting with the homestead owner misses a Texas requirement for mechanics liens, all the subs, sub-subs, suppliers, etc. lose their ability to file a lien.

Best practice? Maintain open communication with the GC; or better yet, try to execute a direct contract with the owner instead.

For further reading on Texas homesteads:

4. There’s a specific notice for specially fabricated materials*

Specially fabricated materials are defined by Texas statutes. It defines them as materials that are not generally suited for or adaptable for use on other projects or job sites. Those who provide specially fabricated materials would have a right to file a lien claim, even if those materials were never actually delivered to the project.

The requirements for suppliers of specially fabricated materials are very similar to those for regular material suppliers. However, specially fabricated suppliers must use a specific notice form, called a Notice of Specially Fabricated Materials.

* Note: On projects started on or after 1/1/22, the Notice of Specially Fabricated Materials will no longer be required to secure lien rights.

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

5. There are a LOT of lien and notice requirements in Texas

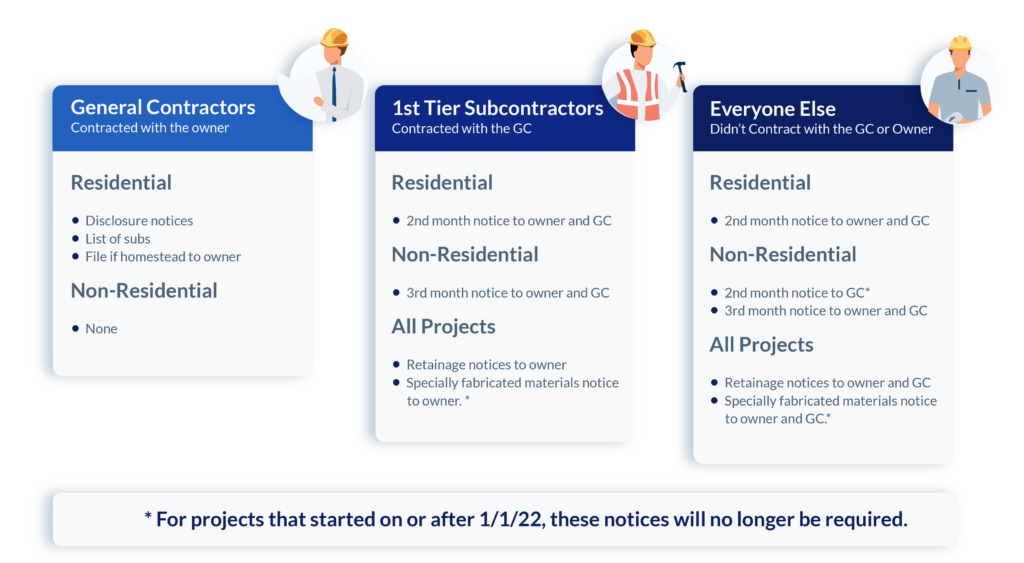

Texas has some of the most confusing and complicated lien and notices requirements in the entire country. This is everything you have to get right in order to be able to file a mechanics lien.

A. Send the right documents

You may be required to send one, or several, of the following documents. Also, don’t forget that you might have to send two or three-month notice more than once.

- Disclosure Notice

- List of Subcontractors & Suppliers

- Two Month Notice

- Three Month Notice

- Retainage Notice

- Notice of Specially Fabricated Materials*

B. Send at the right time

The following is a list of the different deadlines for people sending notices and filing line in Texas.

- Before beginning the work

- 15th day of the second month following each month in which the work was performed

- 15th day of the third month following each month in which the work was performed

- The earlier of the following:

- 30 days after the date the claimant’s agreement for providing retainage is completed, terminated, or abandoned; or

- 30th day after the original contract is terminated or abandoned

- 15th day of the third calendar month after the day on which the debt accrued

- 15th day of the fourth calendar month after the day on which debt accrued

C. Send to the right people

Texas notices must be sent to the property owner, the general contractor, or both. If you’re doing work on a homestead, you may be required to officially file your contract with the county clerk before beginning work. Lastly, mechanics lien claims must be filed with the county clerk’s office where the property is located.

D. Send the right way

Notices must be sent via certified mail, with a return receipt requested. While liens and homestead contracts must be filed with the county recorder’s office.

How to understand your Texas notice & lien requirements

All you need to do to know which requirements apply to you is answer three simple questions.

- In which state was the project located?

- You’ve already got this one. Texas!

- What was your role/who hired you?

- (1) GC hired by the property owner; (2) Subcontractor hired by the GC; (3) Sub-sub, material supplier, or equipment lessor hired by anyone other than the property owner or GC

- What is the project type?

- (1) Residential; (2) Non-residential; (3) Homestead

Once you know the answers to these three questions, you have all the information you need to figure out your requirements and protect your lien rights.

Additional Texas resources

- How to File Your Texas Mechanics Lien & Get Paid

- Texas Mechanics Lien Guide & FAQs

- Texas Preliminary Notice Guide & FAQs