This how-to guide provides a start-to-finish explanation on how to file a Texas mechanics lien and even includes free downloads of important forms. Keep reading to get all the details right, to get your claim filed, and to get your money fast.

Texas lien laws are wild

The Lone Star State is a loner in the mechanics lien world, as Texas easily wins the award for having the most confusing and tangled set of lien laws. How do you overcome this, and how do you file a Texas mechanics lien?

Don’t be intimidated! Texas mechanics lien laws get a bad reputation. This is mostly because they are written so poorly, and not because the underlying requirements are that complex.

If you’re unpaid on a construction project, don’t worry — you’re not alone! Slow payment is a major challenge for contractors in Texas (and everywhere). And nearly $1 billion per year goes unpaid to contractors and suppliers on construction jobs. And the mechanics lien filing may be just what you need to help with a payment problem.

Mechanics liens are an extremely powerful tool available to Texas contractors and suppliers to make sure they get paid!

Free mechanics lien forms

Texas rules for mechanics liens and notices are subject to major changes in 2022.

The information on this page has already been updated to reflect the new rules.

Lone Star Guide: How to file a mechanics lien

Time needed: 1 day

3 Steps to file a mechanics lien in Texas

- Fill out the Texas “Affidavit of Lien” form

Texas is very specific about the form required to file a mechanics lien. Make sure you’re using a form that meets the county recorder’s requirements. Fill out your lien form with complete, accurate details.

- Record your lien with the Texas county clerk

Bring your Affidavit of Lien to the county recorder’s office in the county where the property is located, and pay the lien recording fee.

- Send notice to the property owner (& GC)

After recording a Texas mechanics lien, claimants must provide notice to the property owner and GC within 5 days of filing.

Watch the video: How to file a mechanics lien in Texas

Before you file: Are you eligible to file a Texas mechanics lien?

Before you fill out a Texas mechanics lien form, you’ll want to figure out whether you can actually file one. This is an important step in Texas because the lien laws contain a lot of requirements and pre-requisites.

Before we get to the steps of preparing, serving, and filing the claim itself, you should spend a few moments examining whether you are in a position to file a lien.

In Texas, this involves 3 considerations.

- Is your work covered & protected by the lien laws?

- Did you meet all of the notice requirements?

- If on a Homestead property, does the GC have a properly executed contract?

- Are you within the lien filing deadline?

1. Is your work covered & protected by the lien laws?

The Texas Property Code outlines three broad categories of project participants who are entitled to file a mechanics lien claim:

- Parties who furnish labor or materials to an improvement of real property

- Parties who specially fabricate materials

- Design professionals (engineers, architects, surveyors)

Parties that contribute “construction of improvements” on a project, and fall into one of the three categories above, can file a Texas mechanics lien – as long as they follow the other required steps!

Related: What is a Design / Artisan Lien?

2. Did you send all the required Texas construction notices?

Figuring out how to file a Texas mechanics lien is not that difficult — as you’ll see below, the act of preparing and filing your lien in Texas is pretty straightforward.

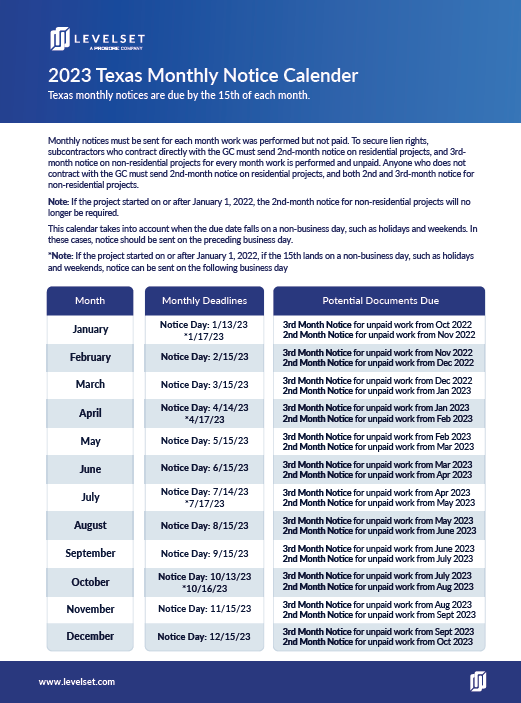

However, the Texas monthly notice scheme can be a nightmare. This is where the Texas lien process gets such a bad reputation. There are multiple notices and deadlines depending on the type of project and the claimant’s role. And language like “15th day of the second month following the month that work was performed” can be dizzying!

See the Ultimate Guide to Preparing & Sending Your Texas Monthly Notices

While this post is about the lien filing and not the notice scheme, it is mentioned here because the notice scheme is so important to lien rights, and because a lot of contractors make mistakes with Texas notices.

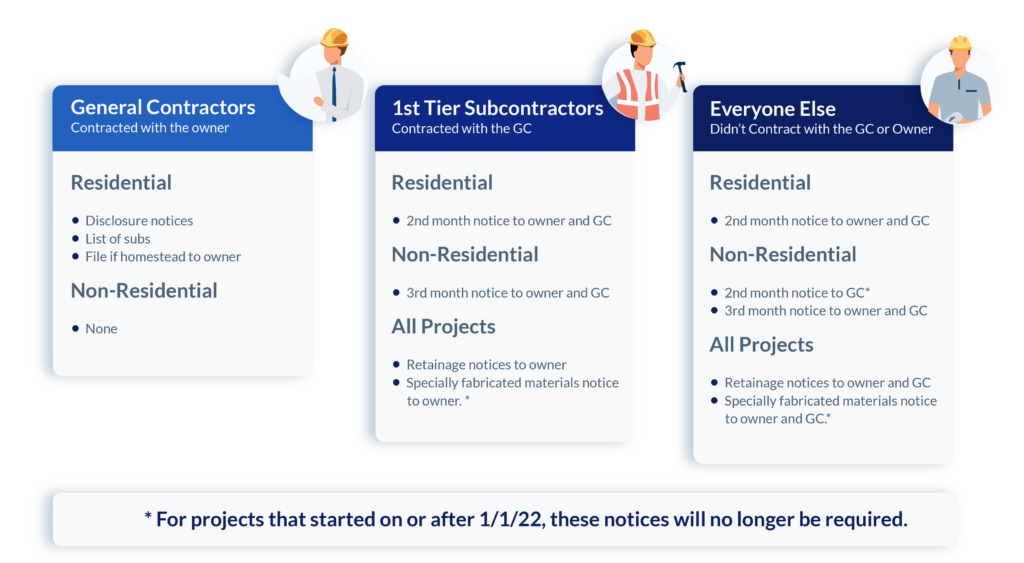

If you’re a subcontractor or supplier in Texas, you likely have some type of preliminary notice requirement! Those who contract directly with the property owner — such as general contractors — are the only participants who are exempt from most notices.

Don’t overlook your notice requirement. If you don’t send the proper notices, by the proper deadline, to the right people, you will lose your powerful Texas mechanics lien rights.

Texas notices go by a lot of different, unofficial, names: preliminary notices, pre-lien notices, monthly notices, three-month notices, two-month notices. Plus, there is a specialized required notice for those who provide a Notice of Specially Fabricated Materials Form*.

* Note: On all new projects entered into on or after 1/1/22, the Notice of Specially Fabricated Materials will no longer be required to secure lien rights.

3. If on a “homestead property,” is there a properly executed contract?

Because it is the property owner’s primary residence, a homestead is granted special protection under state law. Filing a lien on a homestead in Texas carries additional rules and requirements.

The property is a “homestead“ if the property owner lives in the property. Although, there may be some exceptions to this (i.e. people who split time). Refer to this question on our Expert Center for more detail: How do you identify a homestead project in Texas?

When a homestead is involved, there are additional steps required to qualify for a lien…and you must meet these additional requirements prior to performing work on the property.

Lien requirements for a Texas homestead project:

- There must be a written contract between the general contractor and the homeowner;

- The contract must be executed & signed before any work begins;

- If the owner is married, the contract must be signed by both spouses (even if the property is in the name of only one spouse!); and

- The written contract must be filed with the county clerk of the county in which the homestead is located.

4. Are you within the Texas lien filing deadline?

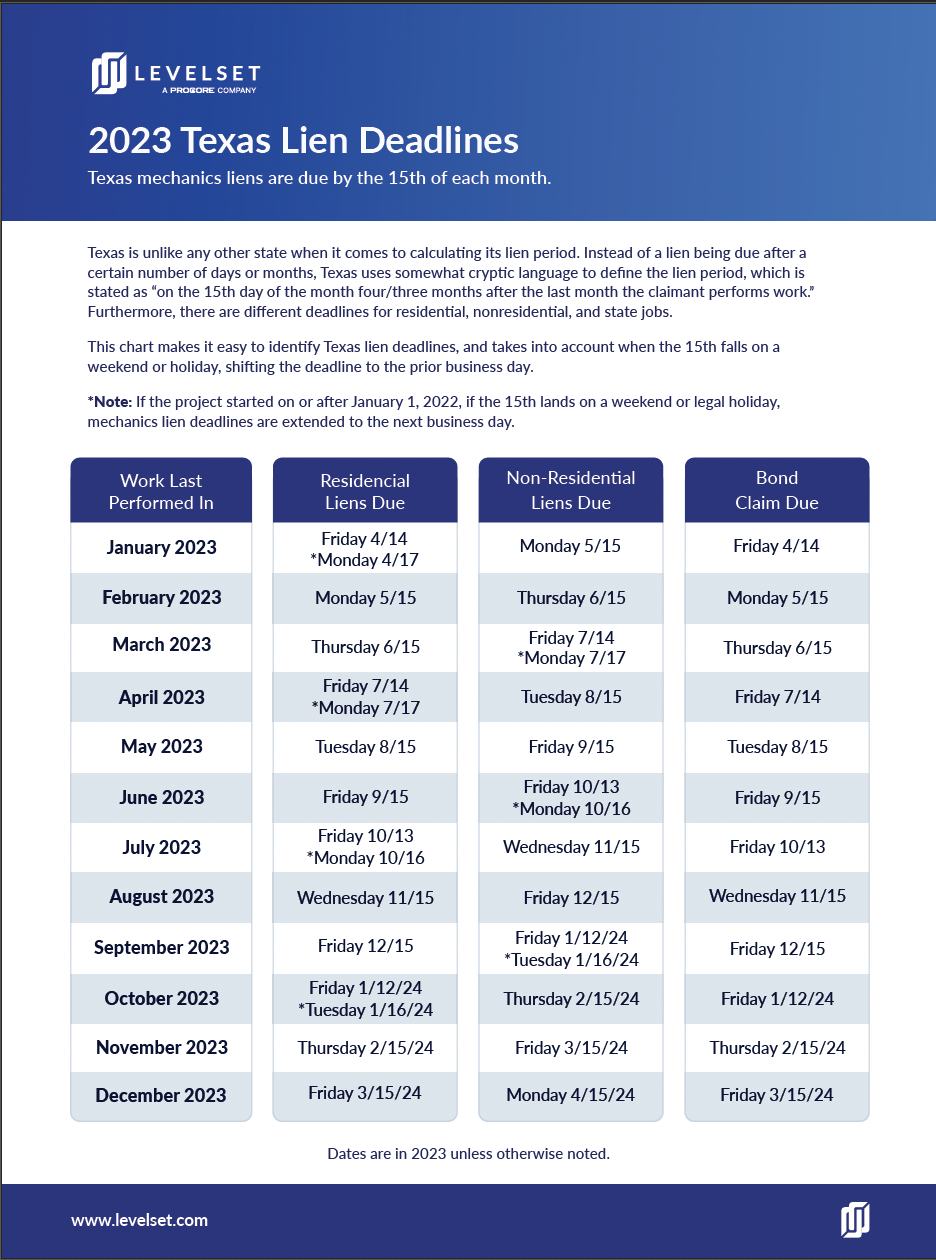

The final question to answer here is whether you still have time to file a mechanics lien in Texas. The time you have to file a Texas lien depends on whether the job was residential, or non-residential. Generally speaking, contractors and suppliers have a nice length of time to get their mechanics lien recorded. However, calculating the lien deadline is confusing because of the law’s wording.

Download the 2023 Texas Lien Deadline Calendar

This calendar takes the guesswork out of calculating the deadline for your Texas lien claims. We update it annually.

Download the calendarStep 1: Fill out your Texas mechanics lien form

Now it’s time for the big show: drafting and preparing your mechanics lien form for filing. On the one hand, this is a fairly simple task. On the other hand, there are many details you’ll need to get right and a few traps. This section will help you get the mechanics lien form you need, get it filled out, and get it ready for filing.

In looking for your lien form, note that a Texas mechanics lien is called an “Affidavit of Lien.” So, this is the form that you’re looking for. Additionally, the document is slightly different for original contractors (those who contract directly with the property owner) and others (i.e. subcontractors and suppliers). You want to choose the right one.

Free mechanics lien forms

Levelset provides free mechanics lien forms for every state, created and reviewed by construction lawyers to meet the state’s requirements.

Information you’ll need for your Texas lien form

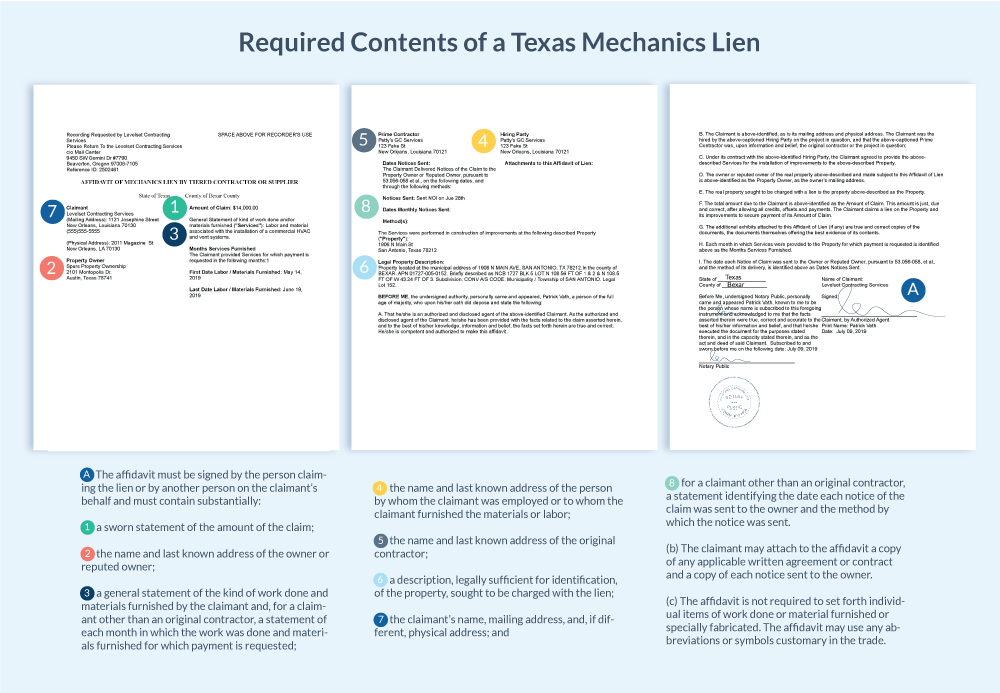

Now that you have the form in hand, it’s time to fill it out. The Texas mechanics lien statute is clear about what must be present within an affidavit of lien.

It contains a section called “Contents of Affidavit,” spelling out exactly what information must be contained within a lien claim to make it valid. However, as you’ll see from the discussion below, there are plenty of areas for a mistake, and getting the information correct can be difficult.

It’s an affidavit: Verify & sign

In filling out your Texas lien form let’s start with the last step because it’s instructive about all the other steps. The lien form in Texas is an “affidavit” that must be signed and “verified.” It’s extremely important that your Texas lien form has a signature block at the bottom! (You must sign it.) And, that the signature block contains language indicating that the information is somehow “verified.”

The statute has this to say about the requirement: “The lien affidavit must be signed by the person claiming the lien or by another person on the claimant’s behalf.”

Amount of the claim

On your Texas lien form, you must provide a sworn statement of the “amount of the claim.” This is commonly referred to as the “lien amount.”

At first glance, this is a straightforward requirement. You want to list the dollar amount that you are claiming to be due. However, this can be extremely tricky to get right, because there are some amounts you cannot include in your claim.

You want to make sure to include as much as you’re allowed, but no more. There are significant risks in “exaggerating” the amount due to you a mechanics lien claim.

What you can include in your lien amount:

- Amounts unpaid to you related to the value of the work and/or materials provided to the job

- Amounts that may be in “dispute” between you and others, so long as they are related to the work/materials put into the job

What you cannot include in your Texas lien:

- Costs of filing the lien

- Interest accrued under the contract

- Liquidated damages or other claims for “damages” caused by contractual breaches, or otherwise

- Attorney fees

While you cannot include these ancillary amounts in your lien claim, you may still be able to collect them through court action, if you decide to enforce the lien.

There is a difference between what is owed to you and what you can validly claim in a lien. Make sure you get this right and don’t over-reach, because over-reaching can cost you significantly and can negatively impact your lien rights as a whole.

Any amount unrelated to the value of the labor and/or materials furnished may not be included in the lien claim. However, the court may award legal fees and interest to a successful lien claimant during foreclosure.

Name & address of the owner

Your Texas lien must identify the name and “last known [mailing] address” of the property owner. This is usually quite easy but can have some complicating factors. For example, if the job is commissioned by a tenant instead of the owner; the property is sold or transferred during the job; the owner is misrepresented to you, or the property has multiple owners.

The law appears to offer some flexibility here by requiring you to identify the owner or the reputed owner. However, the term “reputed owner” is not defined, which leaves this open for debate.

Name & address of “original contractor” & person that hired you

In addition to identifying the owner of the property or reputed owner, a Texas lien must also identify two other parties:

- The name & last known address of the person who hired you to the job

- The name and last known address of the original contractor.

The “original contractor” refers to the general contractor — the person who the property owner hired. If you were hired by the “original contractor,” or you are the original contractor, this section will be really simple for you.

However, if you are a sub-subcontractor or a material supplier, you must identify two different companies here.

Description of your work and/or materials (by month)

You must describe the work and/or materials you provided to the job within your Texas lien. In addition, you must provide a list of months in which you furnished labor or materials for which you are claiming payment.

The bad news here is that you need to list each month in which labor or materials were furnished but unpaid. The good news is that the description of the labor or material can be “general.” It doesn’t need to be itemized and detailed.

Here is how the Texas statute explains the requirement:

[Must provide] a general statement of the kind of work done and materials furnished…[and] a statement of each month in which the work was done and materials furnished for which payment is requested…

…[However t]he affidavit is not required to set forth individual items of work done or material furnished or specially fabricated. The affidavit may use any abbreviations or symbols customary in the trade.

Property description

A mechanics lien is a claim against a specific piece of real property. It’s extremely important to identify the property correctly, and as completely as possible. This is how the lien gets indexed by the county recorder.

If you don’t get the property description right, your lien is potentially invalid. Furthermore, it could be impotent because no one sees it in the title records!

So, how detailed does the property description need to be?

The Texas statute requires “a description, legally sufficient for identification of the property sought to be charged with the lien.” Unfortunately, what constitutes such a description is not crystal clear.

The Texas Supreme Court has held that a description of the property is sufficient when the description would “enable a party familiar with the locality to identify the premises intended to be described with reasonable certainty, to the exclusion of others.” And other Texas Courts follow this rule generally.

But it’s not easy to apply this rule without a close, legal examination. Even those examinations threaten to be inconsistent. As such, the best practice is to include the property address and a lot, and block number. Even better, include a full legal or metes and bounds description of the property (in other words, a “legal property description”).

For some guidance on this, check out our article on Researching the Legal Property Description.

Your name & address

This is the “gimme” field, like getting points for putting your name neatly on the top of your elementary school test. The statute provides that you must provide your “name, mailing address, and, if different, physical address.” Don’t mess this up! Furthermore, if you are filing on behalf of a corporation or LLC, be sure to use the full company name, i.e., “ABC Contractors, LLC.”

You would be surprised at how much can go wrong with this field. Check out the 4 most common mechanics lien mistakes to see how you can easily misidentify yourself in a mechanics lien claim.

List the notices you sent on the job

We discussed the importance of sending Texas monthly notices earlier in this post, and now these notices are coming home to roost.

(If you are not the general contractor, you were required to send notices.)

Now, within the mechanics lien document itself, you’re required to confirm that these were sent, and identify specifically when you sent them!

The law specifically requires that your lien claim have a “statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent.”

Download the 2023 Texas Monthly Notice Calendar

This calendar takes the guesswork out of calculating the deadline for your Texas monthly notices. We update it annually.

Download the calendarLien claim attachments (exhibits)

If you’ve gotten through #1 – #8 above you are ready to file your Texas mechanics lien. You have completed everything that is required. However, you should consider taking another step.

The Texas lien statute says that you “may” include some attachments with your Texas mechanics lien. Specifically, it says that you “may attach to the affidavit a copy of any applicable written agreement or contract and a copy of each notice sent to the owner.”

You should strongly consider including additional exhibits. Attaching these documents to your mechanics lien makes the lien statement stronger, more clear, and protects you against “not having enough” details in your claim document. These problems may arise after your lien is filed, but can even cause your lien to get rejected by the recorder.

Relevant attachments might include any of the following:

- A copy of your written construction contract

- Any invoices or work orders relevant to your work on this project

- Copies of notices you sent to the owner or general contractor

By attaching this type of documentation to the lien claim, you are including pre-emptive proof of the validity of the debt with the lien filing. This should make it more difficult for the owner to dispute your lien claim.

A word of caution, however: while parties may want to include all sorts of documents with their lien claims, excessive pages may rack up the cost to record your lien.

Here is a tip: Many counties will accept exhibits that are displayed two to even four pages on one sheet of paper (see an example to the right). However, it is important to call and confirm that the county recording your mechanics lien will accept this type of submission.

To prevent confusion, be sure to clearly and correctly label your exhibits – i.e. Exhibit A, Exhibit B, etc.

Step 2: File your lien with the appropriate county recording office

Your Texas mechanics lien form is now prepared and ready to go. It’s time to file your document, known as recording your mechanics lien.

Obviously, this is an extremely important part of this process. Although a Texas constitutional lien is technically “self-perfecting,” recording the lien is required in most situations, and is a best practice in all situations.

Generally speaking, you need to file your Texas mechanics lien in the county “Recorder’s Office” in the county where the property being liened is located.

Counties record a lot of different documents in a lot of different offices. You need to be sure that you’re filing in the right county, and then that you’re filing in the right office! This can be confusing, so we’ve compiled a list of all the Texas county recording offices that file mechanics lien claims, and provide you with some information about how to file in the county here:

Texas County Recorder Offices – Where to File a Lien in Texas

Step 3: Provide written notice to the property owner & GC within 5 days

The mechanics lien document is now prepared and filed with the appropriate county recorder. It’s now officially recorded and filed, and this is great news. You should be sniffing the finish line of the filing process, but there is an additional and critical step. You must notify the property owner and general contractor that you filed the lien.

The next step is to send a copy of the mechanics lien to the property owner and the general contractor (if you aren’t the GC). You must send this notice of claim to these parties within 5 days from when you filed the lien. Send a copy of the lien to the property owner and the general contractor by certified mail with return receipt requested.

It is a good practice to send a service copy of your lien at the same time as filing since you are allowed to send an unrecorded copy. This ensures that your claim will get served in time.

If you don’t provide this notice, all of your hard work could be for nothing. Just see how complicated it got for a contractor who filed 47 liens — and forgot to send the notice.

According to construction attorney Matt Viator, “If a TX lien is filed, but not served, that lien very well may be invalid and unenforceable if later challenged or if enforcement of the lien is attempted.”

You didn’t file this mechanics lien claim for sport. You filed the lien to get paid. It isn’t helping you much if no one knows that you filed it!

Sending notice kills two birds with one stone: You start getting people’s attention, and you meet the state requirements.

After you file your Texas mechanics lien

You filed and served your mechanics lien, which is now ready to go to work. Filing a lien is usually enough to get the property owner to pay you. Our research shows that the majority of mechanic lien filings get paid quickly, without any further collection or legal efforts.

Sometimes, however, more work is required. You have one of two options: Enforce your lien, or release it.

Enforce your lien (foreclose)*

Mechanic lien claims will not be effective forever. In Texas, you have 2 years before you need to enforce it. That’s a nice, long period to let your mechanics lien go to work for you.

Unlike many states, liens filed in Texas have a pretty long life. In Texas, the deadline to foreclose on the lien claim is the later of:

- 2 years from the last day of the filing period

- 1 year from completion of the work

On residential construction projects, the period is a bit shorter: just 1 year from either date, whichever is later. In either case, though, this is a nice long period that gives you time to make demands, escalate the situation, and get your claim paid.

* Note: On all new projects started on or after 1/1/22, the foreclosure deadline for all lien claims will be 1 year from the last date the claimant could file a lien.

Foreclosing a lien claim is a full legal proceeding, and many times it may not be worth it.

One alternative route you can take is to send a Notice of Intent to Foreclose. These notices are incredibly effective at inducing payment, as they’re essentially a final warning that you either get paid or you will take legal action.

Extend the foreclosure deadline*

This is a new option available on all new projects entered into on or after 1/1/22. If the claimant and the property owner agree to extend the foreclosure deadline they may do so by signing an agreement and filing a notice containing the terms of the agreement before the foreclosure deadline passes. The parties cannot extend the foreclosure deadline past 2 years from the date the claim was filed.

Release the lien claim

If, however, your mechanics lien has effectively rendered payment, congratulations! But this may not be the end of the story.

Under Texas statute, if the property owner, general contractor, or any other party making payment sends a written request to remove (release) the lien, you are required to do so. In fact, the law states that the lien should be released within 10 days of receipt of the notice.

That pretty much wraps up all the essential things to know when filing a mechanics lien in the state of Texas. Good luck!

Texas Construction Lien Law & Payment Resources

- Lone Star State Lien laws: Texas Property Code §53.001 et seq.

- Texas Mechanics Lien Guide & FAQs

- Even more resources to get paid on Texas construction projects