If you’re a subcontractor and you’ve been waiting for payment from a prime contractor on a project, you might find yourself asking, exactly how long does a contractor have to pay a subcontractor on a project? How long do you have to wait before you can take action? And, if you act, what should you do?

These are questions every subcontractor has asked themselves when waiting, impatiently, for a general contractor to pay them. The best way to avoid late payments is to make sure the GC has a good reputation (and doesn’t show one of these seven signs). Meanwhile, you wonder if there are laws that govern how long a contractor can hold the payment on a subcontractor, and if there is something you can do to speed up payment. Or do you just have to wait?

The good news is, there are some things you can do to try to speed up payment — and we’ll tell you what those are shortly.

Deadlines for payment to subcontractors

Generally, there are two places to look for the payment deadline: prompt payment laws and the construction agreement you signed.

In order to use prompt payment laws, you must know the type of funding the project is using (federally funded, state-funded, or privately funded) and the state the project is located in. Why do these things matter? Because they determine which prompt payment laws apply to the project.

Once you’ve determined the prompt payment laws that may apply, you’ll also need to look at the construction contract between you and the general contractor for any specific payment terms.

If the prompt payment laws for the project do not match the terms of your contract, which one should you go by? The answer depends on what the prompt payment laws for that state say.

For example, Georgia’s prompt payment rules always trump any specified contract terms. In contrast, Alabama’s law states that payments are due within the time defined in the law, unless otherwise agreed.

Prompt payment laws

Prompt payment laws govern how fast payments need to be made on construction projects. There are two levels of law, one at the federal level, and one at the state level. The federal law applies to federally funded projects. The state laws generally cover both publicly funded and privately funded projects, but each state is different, so you’ll have to review the laws for each specific state.

Federal law states that progress payments must be made to prime contractors within 14 days of submission of a proper invoice. If the payment is the final one for a project, the payment must be made within 30 days of invoice submission. From there, the prime contractor has seven days to pay a subcontractor.

Generally, state laws state that general contractors must pay subs within 7 to 14 days from receipt of payment from the owner. This may vary depending on whether the project is funded by state monies or is privately funded. Most states have laws governing public projects, but not all of them govern private ones. Please check the laws in the state the project is located in.

Both federal and state prompt payment laws cover all tiers of payments, including owner to general contractor, general contractor to sub, and sub to suppliers or sub-subcontractors. Subcontractors should be aware of their own prompt payment requirements to make sure they pay their subs and suppliers promptly.

Construction contracts

Most construction contracts between general contractors and subcontractors have the payment terms spelled out. Two of the most widely used contract formats are AIA and ConsensusDocs.

The AIA contract between a general contractor and subcontractor (A401) states that progress payments will be made within seven working days of the GC receiving payment from the owner.

11.1.3: “The Contractor shall pay the Subcontractor each progress payment no later than seven working days after the Contractor receives payment from the Owner.”

If the payment is for final retention on the project, the GC has seven days from receipt of final payment from the owner to pay a subcontractor.

11.3.1 – “If, for any cause which is not the fault of the Subcontractor, a Certificate for Payment is not issued or the Contractor does not receive timely payment or does not pay the Subcontractor within seven days after receipt of payment from the Owner, final payment to the Subcontractor shall be made upon demand.”

The ConsensusDocs document 750, which is a contract between a general contractor and subcontractor, states that the GC has seven days after they get paid to pay a subcontractor for satisfactory work.

8.2.5 Time of Payment – “Progress payments to Subcontractor for satisfactory performance of the Subcontract Work shall be made no later than seven (7) Days after receipt by Constructor of payment from Owner for the Subcontract Work. If payment from Owner for such Subcontract Work is not received by Constructor, through no fault of Subcontractor, Constructor will make payment to Subcontractor within a reasonable time for the Subcontract Work satisfactorily performed.”

Final payment is also due seven days after receipt of payment from the owner.

8.3.3 Time of Payment – “Final payment of the balance due of the Subcontract Amount shall be made to Subcontractor within seven (7) Days after receipt by Constructor of final payment from Owner for such Subcontract Work.”

“Pay when paid” and “pay if paid” clauses

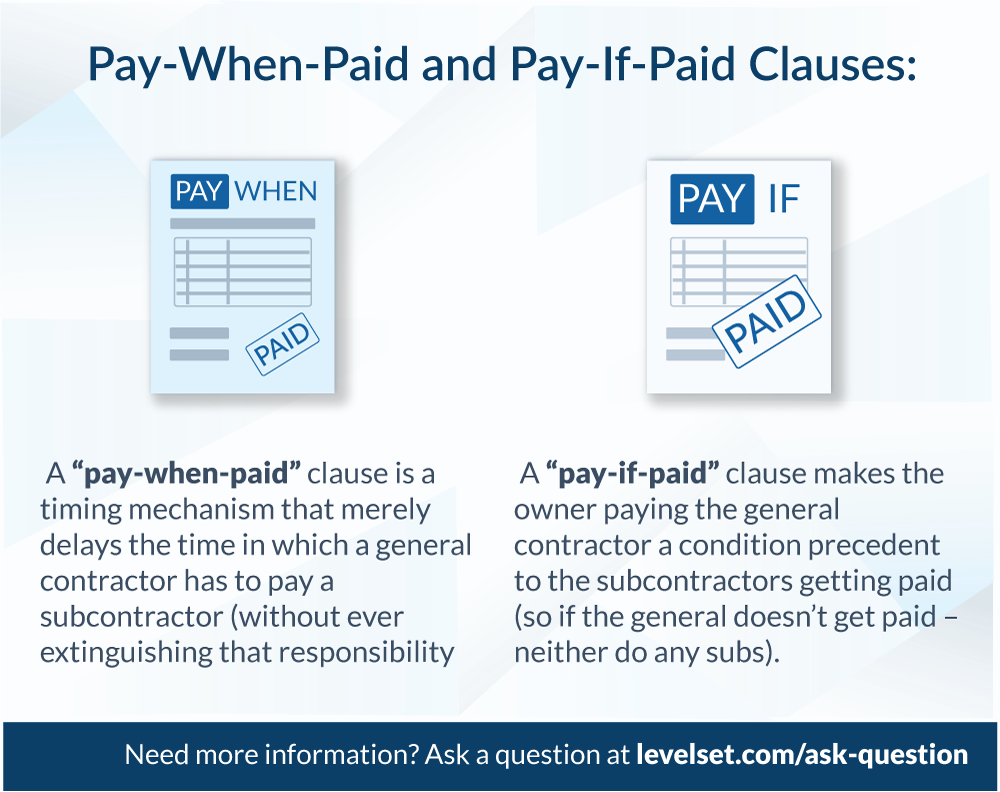

There are two other payment clauses that subs should be aware of – “pay when paid” and “pay if paid.” Even though there is only one word different in the two phrases, the effect is enormous.

“Pay when paid” clauses state that the GC will pay the sub after they get paid from the owner. There is usually some grace period, like seven days, for the payment to be made. This language defers the timing of the payment to the sub, but still ensures that the sub will be paid, even if the GC does not.

“Pay if paid” clauses state that the sub will be paid only if the GC gets paid. This shifts the financial vulnerability down to the subcontractor. If the GC doesn’t get paid by the owner, neither does the sub. Obviously, these terms are not beneficial to the sub, and should be negotiated out of any contract, if possible.

If your contract contains either of these payment clauses, ask the GC if they have been paid by the owner yet. If you don’t get a response, you can check the status of payment by contacting the owner directly. This will raise red flags with the GC, so use this technique sparingly.

What subcontractors can do if payment is late

What if you don’t receive a payment within the timeframe specified by law?

Subcontractors have three possible actions to try to collect payment: write a demand letter, file a lien, or file a lawsuit.

Send a demand letter

A demand letter simply lets the contractor know that their payment is beyond the terms of either the prompt payment laws or contract terms, and that you are demanding payment at this time to prevent a lien or lawsuit. Often this type of letter is successful in releasing payment, and further action is not required.

Send a notice of intent to lien

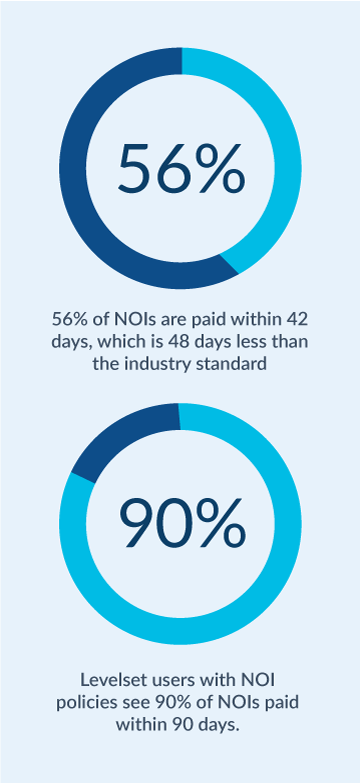

You can also send a notice of intent to lien (NOI) letter, which informs the owner and the GC that you haven’t received payment and will be filing a lien within a certain number of days if payment is not received.

Note that if these letters don’t work, filing a lien or a lawsuit may be the only way to collect payment.

File a mechanics lien

The laws regarding filing a lien differ in each state, so be sure you know your rights and responsibilities before you start work. You should be aware of the deadlines and notice requirements in each state you work in.

A lien is recorded at the county clerk’s office and forces the sale of the property if the amount isn’t paid. Once a lien is filed, you will have to file a lawsuit to foreclose on it and force the sale and payment. Luckily, the lien is usually all that’s needed to get payment flowing.

.

File a lawsuit

Filing a lawsuit to collect payment should be a last resort if a demand letter and/or lien aren’t working. With attorney expenses and court fees, lawsuits can be expensive and can drag out payments even longer, so make sure you’re prepared to pay the price before you start