The North Carolina Prompt Pay Act establishes specific timelines in which payments must be released on public and private construction projects within the state. Failure to comply with these rules can result in interest accruing on the unpaid funds. This article will detail the deadlines to make payment, the release of retainage, and the interest penalties that will apply.

North Carolina Prompt Pay statutes

There are two sets of prompt payment laws in North Carolina, one that covers public projects and one that covers private projects. Any contractor or suppliers that don’t receive payment according to these rules can claim interest un the funds until they are paid.

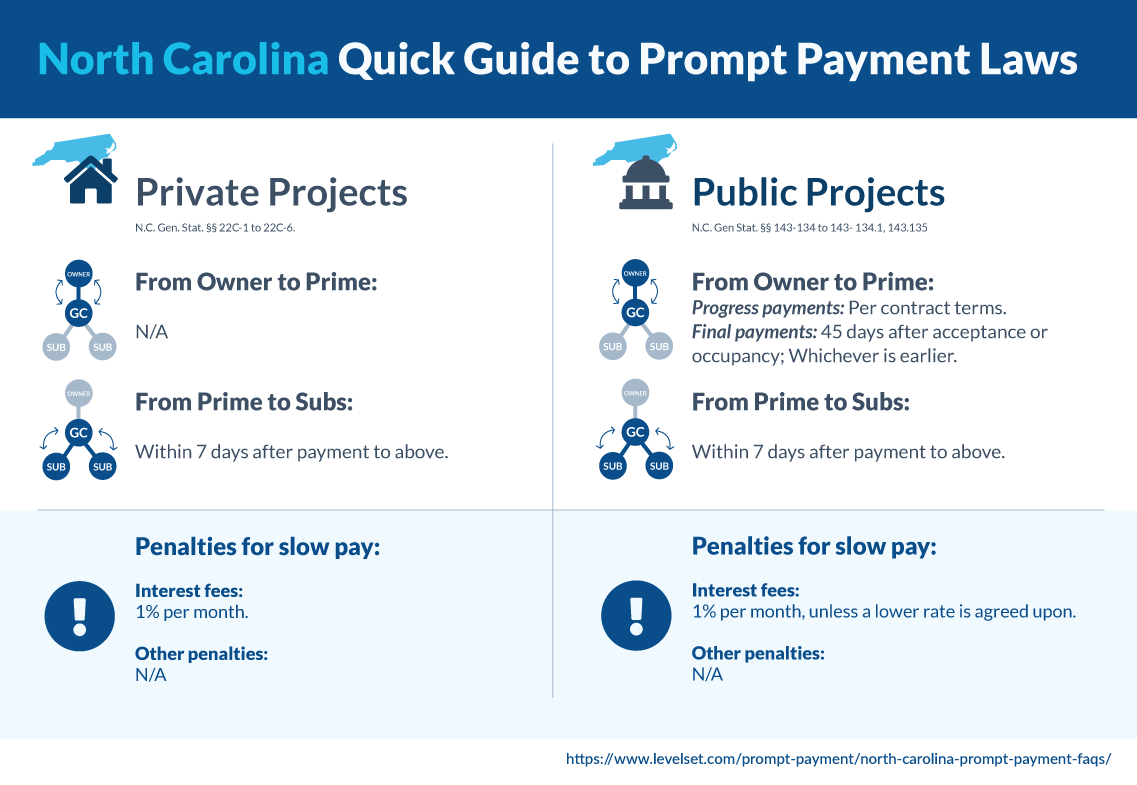

Public projects are governed under N.C. Gen. Stat. §143-134.1 and applies to all local and state government-funded projects except those commissioned by the Department of Transportation and the Department of Public Safety.

While prompt payment on private projects is governed under N.C. Gen. Stat. §22C. There is one notable exception to prompt payment regulations on private projects. These rules do not apply to residential contractors, nor does it apply to improvements to real property that is intended for residential purposes. These laws will only apply to commercial contracting work.

North Carolina Prompt Pay Act timelines

As long as a contractor or supplier performs in accordance with the provisions of their contract, they will be entitled to payment. This is regardless of whether or not there is a condition precedent to payment, such as a pay-if-paid and pay-when-paid clauses. Such clauses will not affect these regulations as they are unenforceable in the state of North Carolina.

Public projects

On public projects, the progress payments made to a prime contractor are governed by the contract terms themselves. As for final payments, a will be entitled to final payment once the project has been officially accepted, or the improvement becomes occupied by the owner and is used for the purpose for which the project was constructed. When either of these occurs, the public entity is required to pay the prime contractor within 45 days.

As for payments to subcontractors, both periodic and final payments are covered under the statute. North Carolina law states that once a prime contractor receives payment from the public entity, they are required to pay their subs and suppliers within 7 days of receipt.

Private projects

The North Carolina statutes do not specify a time period that owners on a private project need to release payment to the general contractor. However, all other payments down the chain are regulated. When a subcontractor has performed in accordance with their contract provisions the GC is required to pay the subcontractor within 7 days of receipt of payment. The same goes for any sub-subcontractors or suppliers down the payment chain.

Interest penalties

Any payments that aren’t made in accordance with these regulations will accrue interest. On either public or private jobs, the rate is set at 1% per month. There are, however, some circumstances that are set out in the statutes that allow for the good faith withholding of payments. If any of these reasons are present, there will be no penalties for late payment:

- Unsatisfactory progress;

- Defective work that is not remedied;

- Disputed work;

- Third-party claims;

- Failure to pay parties down the chain;

- Damage to a contractor or other subcontractors;

- Reasonable evidence that the contract can’t be completed for the outstanding balance thereof;

- Failure to make required payments to the parties below.

Retainage rules

Retainage on private projects is regulated by the contract. However, the statute does state that the retainage withheld from subcontractors on private projects can’t exceed the percentage retained on the contract between the owner and the prime contractor.

On the other hand, retainage is regulated on public projects. The percentage can’t be more than 5% of any periodic payments. If the retainage withheld from the public entity is less than that, the retainage withheld from the sub can’t exceed that number. Once the project reaches 50% completion, and the contractor has been performing satisfactorily, the owner should no longer be withholding retainage.

However, if the owner determines that the contractor is failing to meet their obligations, then they can decide to reinstate retainage for the remaining progress payments. All withheld retainage must be released by the owner within 60 days of completion. And, once received, the retainage withheld by the prime contractor must be released within 7 days of receipt. Late payment of retainage will accrue the same 1% interest rate.

Recovering under the North Carolina Prompt Pay laws

North Carolina offers some strong protection to ensure that contractors and subs get paid on time. The ultimate problem is, that these interest rates can’t be included in a bond claim. Which means that in order to recover such payments, a lawsuit to enforce your rights under the prompt pay statutes is required.

Another option, before filing a lawsuit, could be to send a final warning letter. This is referred to as a Notice of Intent to Make a Prompt Payment Claim. By sending one of these, you are informing the party that you are still awaiting payment, you understand your rights under the prompt payment laws, and are willing to enforce them if necessary. When filling out this form, you should cite the statute under which the claim is made. These are usually pretty effective at inducing payments.

Additional resources