There are a lot of things that are different about construction accounting, but retainage may be one of the most unique. These amounts withheld from project payments can be a challenge, since they often account for a contractor’s entire profit margin on a job. Not only does retainage make it harder for a construction business to manage cash flow — simply recording the transaction can be a feat. This is especially true if your accounting software isn’t tailor-made for construction companies (like QuickBooks). In this article, we’ll show you how to set up a QuickBooks account to record and track retainage receivable — and make sure that you collect it on time.

Read more on recording retainage: Accounting for Retainage Receivable & Payable: A Contractor’s Guide

Note: We are using QuickBooks Online for this article. If you are using a different version of the software, the steps and language may differ slightly, but the overall process should be largely similar.

Why you can’t record retainage in Accounts Receivable

At first glance, it may appear that retainage belongs in Accounts Receivable. After all, it is money that you are owed, and are waiting to receive. But the timing of retention payments is different from regular invoices. If retainage is withheld on any of your projects, you need to track it separately from Accounts Receivable.

This is because, under most construction contracts, you won’t be able to collect it yet. When you submit an invoice or pay application, you subtract retainage from the total currently due. At the end of the project, or whenever it becomes due under your contract, you will bill for retainage in its own invoice.

As a result, the deadline to file a mechanics lien for retainage also differs from regular payments, as does the deadline under Prompt Payment rules.

QuickBooks includes a standard Chart of Accounts that works for many small retail businesses, which includes an Accounts Receivable (A/R) account. Contractors need to take some additional steps to set up a QB account to record and track retainage payments.

How to record & track retainage in QuickBooks

By default, QuickBooks doesn’t include an account for retainage, making it impossible to record this type of transaction out of the box. However,

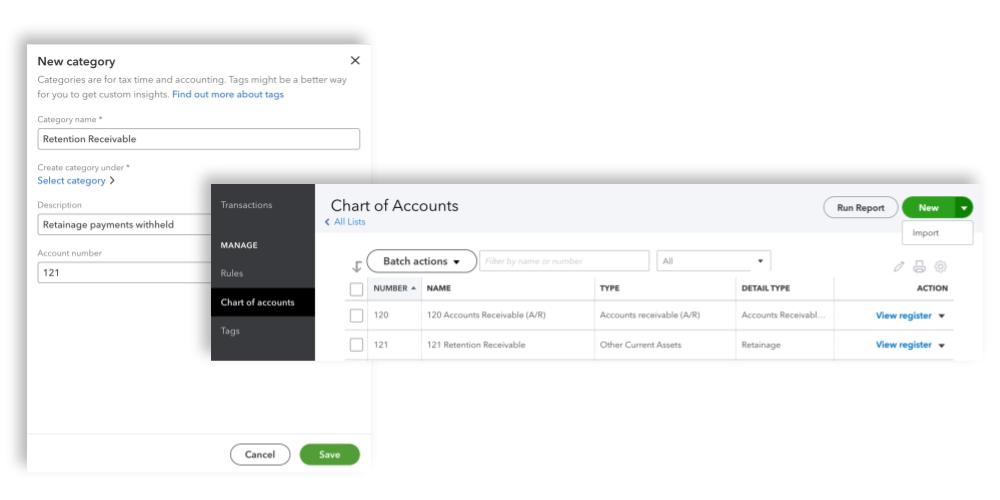

1. Add Retainage Receivable to the QuickBooks Chart of Accounts

The Chart of Accounts is the backbone of a contractor’s accounting system, and contains a list of all the accounts used to categorize transactions. These accounts are used to build the Balance Sheet (where Retainage Receivable will be reported) and the Profit and Loss Statement.

Contractors will need to customize their Chart of Accounts in QuickBooks to record construction-specific transactions, like retainage.

This account is commonly called Retainage Receivable, Retention Receivable, or Accounts Receivable — Retention.You can name your accounts however you like, but make sure it’s recognizable to everyone on the accounting team.

Steps to add retainage to the Chart of Accounts:

- Select Chart of Accounts from the Bookkeeping menu, or click on the Gear icon in the upper left and select Chart of Accounts from the menu under Your Company

- In the Chart of Accounts, click New to add a single account manually (You can also select Import from the drop-down icon to upload multiple accounts from Excel or Google Sheets)

- Set Category Type to Other Current Assets

- Set Detail Type to Retainage.

- Enter a Name for the account (e.g. Retainage Receivable)

- Click Save

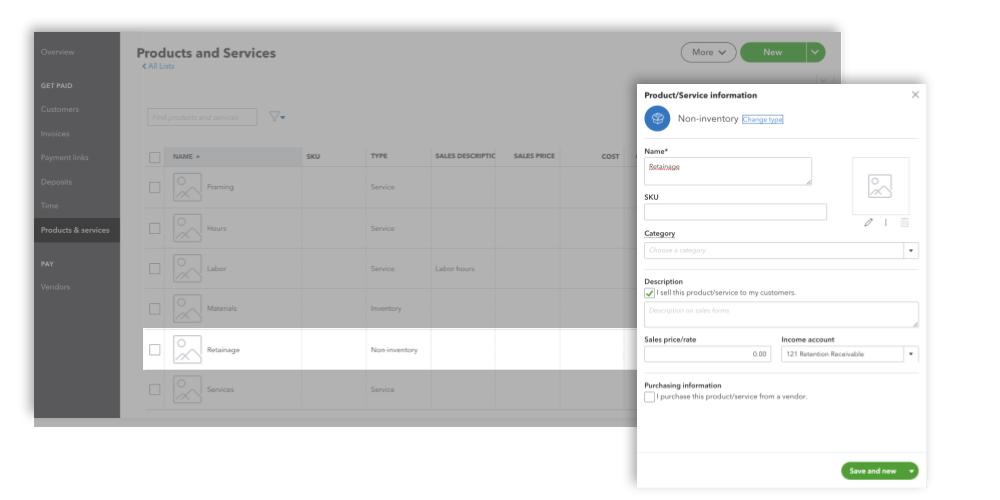

2. Create a Retainage product

Now that you have an account for recording the transaction in QuickBooks, you need to create a product. This will allow you to add a line item to an invoice for retainage.

Steps to add a Retainage product to QuickBooks:

- Navigate to Products and Services (in the Get paid & pay menu, or in Lists under the Gear icon)

- Click New

- Add a name for the item (e.g. Retainage)

- Check the box labeled I sell this product/service to my customers.

- Choose the Retainage Receivable account under Income Account

- Click Save

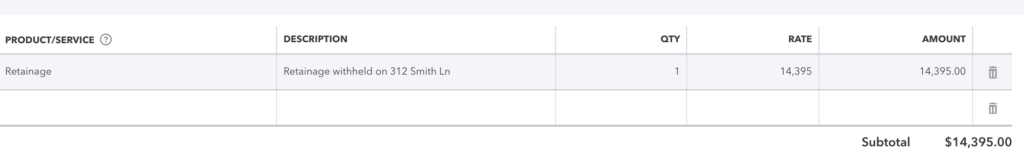

3. Add Retainage to an Invoice

Now, when you generate an invoice for a progress payment, you can add Retainage as a line item. QuickBooks doesn’t have an option to calculate a percentage, so you will need to calculate the retained amount manually.

Steps to add Retainage to an invoice:

- Create an invoice by clicking the + New item in the top left menu and select Invoice under the Customers list

- Fill out the available fields as you would with any invoice

- For the last item under Product/Service, select Retainage

- Enter the retained amount in the Rate column as a negative number (e.g. -2325)

- Save the invoice

QuickBooks will automatically save the amount in the Retainage Receivable account, and put the remainder in Accounts Receivable (A/R).

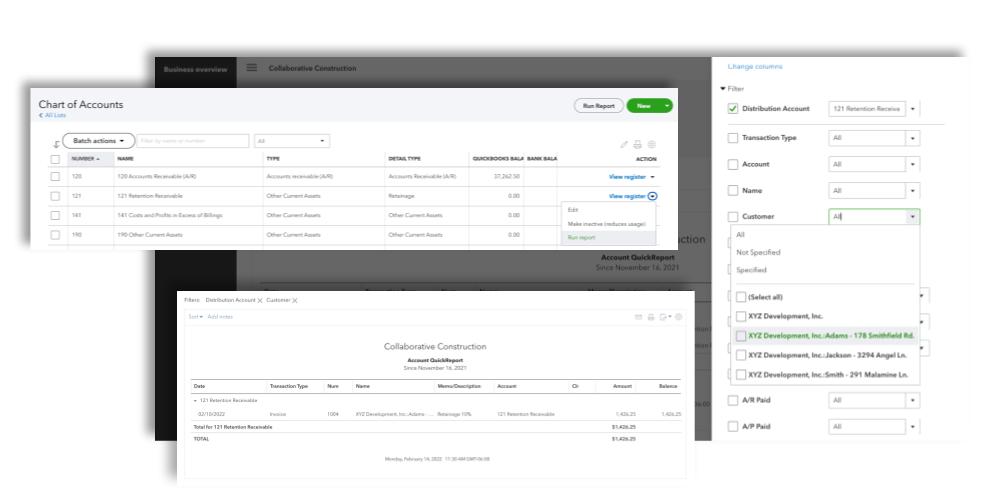

4. Track Retained Amounts

Throughout a project, you may want to track accumulated retainage on a specific project or withheld across all projects with a customer. When you are ready to bill for retention, you can use the Account QuickReport for the Retainage Receivable account.

If you have set up job costing in QuickBooks correctly, you will be able to generate a retainage report for specific projects using the steps below.

Steps to view retainage by customer or project:

- Navigate to the Chart of Accounts

- On the Retainage Receivable row, click the drop-down icon in the far right column next to View register

- Click on Run report

- Click on the Customize button

- Under Filter, select the Customer from the drop-down list (to view project-specific retention, choose the Job name under the customer name)

- Click Run report

4. Bill for Retainage

When the project is substantially complete or you are otherwise entitled to bill for retainage, you can create a separate invoice to bill your customer for retention on the project.

The process to create a retainage invoice is the same as creating any other, except that in this case you will enter the Rate as a positive number.

After you save the invoice, QuickBooks will automatically remove that amount from the Retainage Receivable account and move it to Accounts Receivable (A/R). Now it’s up to your collections process to make sure your customer actually submits the payment!

Using QuickBooks to track retainage deadlines

Figuring out how to record and track retainage is one thing. But actually collecting retention payments — and making sure they don’t tank your cash flow — is an entirely different ballgame. Depending on the phase of a construction project you typically work in, you may end up waiting for retainage to be collectible for a year or longer, well after your company’s work on the job was finished.

A mechanics lien is the most powerful tool in a contractor’s collection toolkit, but it has an expiration date. Every state has a specific deadline by which contractors must file a lien claim for retainage, often based on the day it was due.

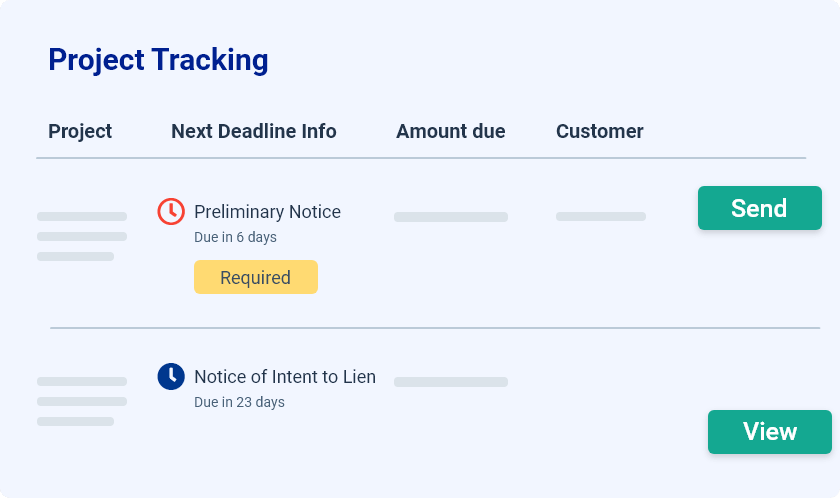

QuickBooks doesn’t track deadlines. Fortunately, Levelset makes it easy. Levelset software integrates with your existing QuickBooks account — anytime you submit an invoice, Levelset automatically starts the clock on the money you’re owed, making sure that you never miss a deadline again.