Have you ever come across the words “Pay When Paid” or “Pay If Paid” in your construction contracts? Pay-when-paid and pay-if-paid provisions are ultimately about determining who will bear the financial risk of a construction project. In other words, if the property owner doesn’t pay, who’s left holding the bag?

Why Pay-When-Paid and Pay-If-Paid Clauses Exist

Pay-when-paid and pay-if-paid clauses are both often found in construction contracts. They’re also known as contingent payment clauses — stating that a payment is contingent on another event (like payment from the owner to the GC). But why do contracts use them?

Well, imagine that you’re a general contractor on a huge new housing development. In order for you to complete the job, you have to hire a variety of subcontracts, such as plumbers, carpenters, painters, carpet installers, and framers.

All of those subcontractors, obviously, expect you to pay them. But where is all that money going to come from? In all likelihood, you’re first going to need to get the money from the developer and/or property owner. Without it, you’ll be unable to pay your subcontractors.

This puts a GC in a difficult position. If you don’t pay the subcontractors, you’ll likely be liable for a breach of contract. Go ahead and pay the subcontractors and you may be paying with money you don’t have (and may never get).

What’s an innocent general contractor to do? Somewhere along the way, one general contractor’s attorney created a work-around: a “pay when paid” or “pay if paid” clause. Both clauses have the same goal: No subcontractor gets paid until the property owners pays the general contractor first.

How Are Pay-When-Paid and Pay-If-Paid Clauses Different?

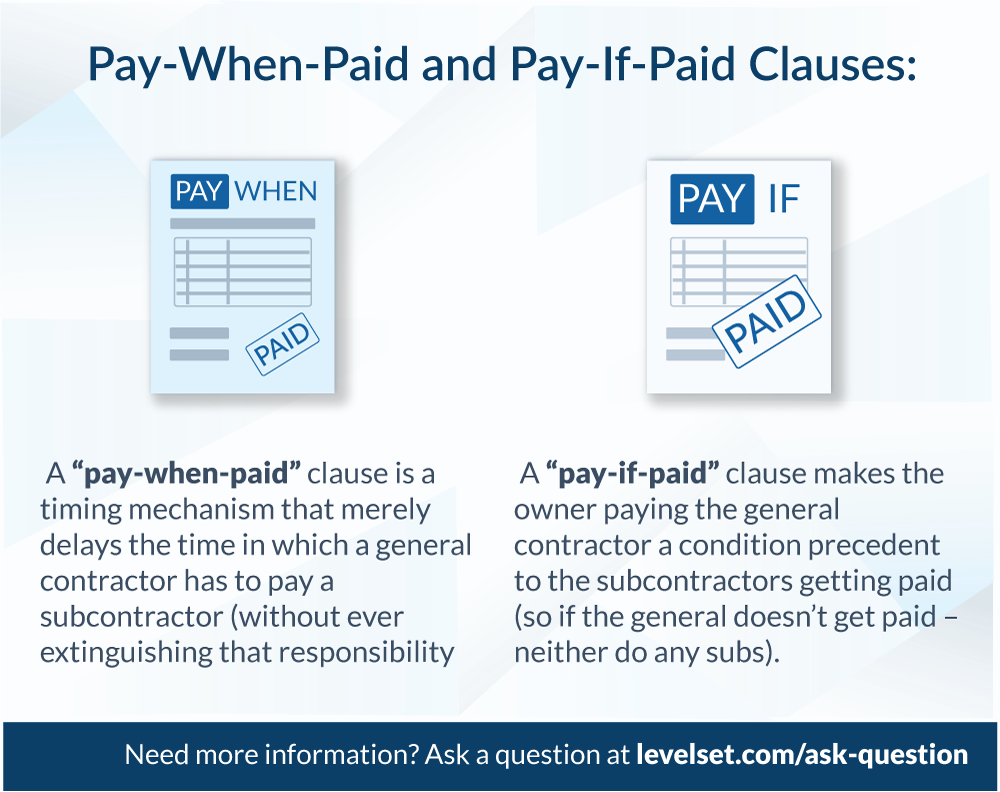

The primary difference between these clauses is that a “pay when paid” clause is a timing mechanism that merely delays the time in which a general contractor has to pay a subcontractor. It doesn’t extinguish that responsibility.

Each state’s interpretation of pay-when-paid and pay-if-paid clauses are different. However, we can make a few generalizations that highlight the primary difference between a pay when paid clause and a pay if paid clause. (Yes, changing one little word – “when” vs “if” – can make a world of difference for both general contractors and subcontractors.)

A “pay if paid” clause makes the owner paying the general contractor a condition precedent to the subcontractors getting paid (so if the general doesn’t get paid, neither do any subs).

Explained another way, it’s all about who ultimately bears the risk of owner nonpayment. In contracts with “pay when paid” clauses, the general contractor bears the risk that the owner will never pay them. In essence, even if the owner never pays the general, the general will have a little more time but will eventually have to find a way to pay the subcontractors or be liable for damages in a breach of contract lawsuit.

Pay if paid clauses work the exact opposite way, shifting financial risk from the owner to parties beneath them. In these cases, the subcontractor bears the risk of owner nonpayment. If the owner never pays the general contractor, then the general has no obligation ever to pay the subcontractors.

Pay When Paid: Timing the payment

Generally speaking, a “pay when paid” clause is a timing mechanism for payment. In other words, it says that the contractor will pay the subcontractor within a certain amount of days after receiving payment from the owner.

That is, the language that a contractor will pay his sub when he receives payment from the property owner is not interpreted to string that time out indefinitely. If the contractor is not paid by the owner, this payment clause does not absolve the contractor from his obligation to pay his subs.

This almost seems counter-intuitive when reading the plain language. If I personally make a promise to give somebody money when I get money from somebody else, I would expect that, until I receive that money, I would not be obligated to pay the person I promised to pay. Courts have rejected this approach.

While pay-when-paid clauses can be detrimental to subcontractors and material suppliers, they are not the be-all-end-all. They only decide when you will be paid, not if you will be paid.

As added protection, most courts hold that, even when a party agrees to certain timing, payment is due down the payment chain within a “reasonable amount of time.” In other words, GCs can’t withhold payment forever, even if they have not been paid themselves.

Pay If Paid: Shifting risk to subcontractor

If GCs were finding themselves in debt, then it seems the pay when paid clause didn’t entirely achieve its objective. Enter the Pay-If-Paid clause.

The sole objective of this contingent payment clause is to shift financial risk down the chain. A pay-if-paid provision states that a general contractor does not have to pay her subcontractor unless she is paid by the property owner.

The bad news for subcontractors and suppliers: Under these circumstances, you could be left unpaid for a job well done.

States that prohibit pay if paid clauses

The good news: most state governments have your back. In the states listed below, pay-if-paid provisions have been outlawed, meaning a court will not enforce them.

- California

- Kansas

- Illinois

- Indiana

- Nevada

- Montana

- North Carolina

- New York

- South Carolina

- Utah

- Wisconsin

In most other states, in order for a pay-if-paid clause to be upheld, courts require clear and specific language—the phrase “pay if paid” is not enough.

Here’s an example of sufficient language: “The parties herein explicitly agree that this provision is meant to shift the risk of non-payment.”

Check out our 50-state guide to Pay If Paid clauses to see each state’s policy.

How contingent payment clauses affect mechanics lien rights

Ultimately, neither payment clause affects a contractor’s right to file a mechanics lien. Even in some states where pay-if-paid clauses are accepted in court, they may not be enforceable in cases where a mechanics lien has been filed.

Under these circumstances, a pay-if-paid clause may be enforceable as a defense against a breach of contract lawsuit (or other similar claims), but would not stop recovery of payment by enforcement of a mechanics lien.

It’s important to track your mechanics lien deadlines closely, to ensure that you’re able to file a claim when payment is delayed. If the GC hasn’t received payment from the owner yet, and your lien filing deadline is approaching, you have the right to file a lien claim to lock down your payment.