Depending on the size of a construction project, there can be anywhere from five to forty or more subcontractors working, and progress billing, on a job. Of course, everyone may not bill at the same time. But multiply even half that number by several projects, and it quickly adds up. It can be difficult to track who billed what if you are relying on your own brain power to store the data. In this article, we’ll review some tips and tricks for collecting payment applications and tracking them on jobs – and making sure nothing slips through the cracks.

On big or complex projects, a general contractor or property owner may require that everyone submit a pay application in the construction contract. And there are a lot of reasons why that’s a good idea. Pay apps can increase consistency of invoicing and help you keep a handle on project cash flow. But with so many payment documents to manage, one slip-up can interrupt the payment process and invite a mechanics lien.

The danger of losing a payment application

There are so many things that can go wrong on a construction project, payments shouldn’t be one of them. Let’s face it: Everyone works so they can get paid. If you take away payment, most people will walk off the job. It is important to keep the money flowing to subcontractors and suppliers, so they stay happy and working.

If pay applications or invoices are lost or misfiled, and progress payments are delayed, no one is happy. A tracking and filing system makes it more likely for payments to be made on time, which leaves everyone with a smile. Speeding up the pay process is everyone’s goal.

When payments are delayed for an extended period, suppliers and subcontractors could file a mechanics lien on the property. This doesn’t look good for anyone. Prompt payment to subcontractors can reduce the chance that they will file a lien.

Even the best of us can lose an invoice in a stack of documents, or accidentally delete an email. It’s no fun to admit that you had the invoice all along and you are the cause of someone’s payment delay. One way to remedy this is to have a structured “path” that a pay application (and the documents that come with it) takes from the time it comes into your office. Then you always know where things are and what payments are in process.

All of this adds up to better relationships with your subcontractors and suppliers. It bears repeating: A paid sub is a happy sub.

Challenges with pay applications

One challenge we can all identify with is the danger of lost pay applications. They come in by mail, fax, and email, and at such a rapid pace that it can be tough to keep up. Different people may receive them, such as field personnel, project managers, and supervisors. It can be a challenge to make sure they end up in one place and aren’t lost or misplaced during the process.

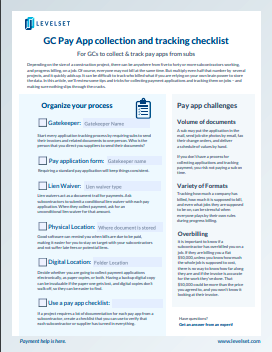

Volume of documents

Payment applications will often include a number of documents. It’s common for some of those documents to come in different forms. A sub may put the application in the mail, send job site photos by email, fax their change orders, and deliver a schedule of values by hand. If you don’t have a process for collecting applications and tracking payment, you risk not paying a sub on time.

Variety of formats

Unless the contract terms say otherwise, subs and suppliers will often send in their own pay application or invoice form. Some include information about the subcontract amount and the progress of the work to date. Others are just a simple invoice for an amount, with little or no description at all. Sometimes they don’t even say what job they are for! Tracking how much a company has billed, how much it is supposed to bill, and even what jobs they are supposed to be on, can be stressful when everyone plays by their own rules during progress billing.

Overbilling

Speaking of contracts, it is important to know if a subcontractor has overbilled you on a job. If they are billing you a flat $50,000, unless you know how much the whole job is supposed to cost, there is no way to know how far along they are and if the invoice is accurate for the work they’ve done. That $50,000 could be more than the price you agreed to, and you won’t know it looking at their invoice.

Tips to organize your pay application process

Pay applications are a packet of information, usually containing an application form, invoice, back-up documents, lien waivers, and payroll reports, if required. If someone is sending you their invoice in the mail, then following it up with lien waivers and payroll reports by separate emails three days later, how do you get it all together so you know you have what you need to bill the owner? Making sure all the components have been sent is important for the flow of the job, and the progress payments.

Establish a gatekeeper

Start the pay application tracking process by requiring subs to send their invoices and related documents to one person. Direct your subcontractors and suppliers to send their documents to this person, and be clear on the format or formats. If you want it sent by email or postmail, spell it out in the contract. If there is one place for all the payment-related documents to go, there is less chance that something will be misplaced, and it is much easier to search in just one location.

Require a standard pay application form

If you can, include a contract provision that requires your subcontractors to use a standard payment application. You can create your own or download Levelset’s free pay application template, which covers all of the bases.

There are also several common pay application forms in the construction industry (such as AIA documents or ConsensusDocs), but subcontractors may not be happy about having to purchase a form every billing period.

If you create your own application, make sure the form includes the contract amount, percent complete, any retainage (if you’re withholding), and previous amounts billed so you can verify the information. It is a little more work for them, but it will make collecting & reviewing them much easier for you.

Always use lien waivers

Lien waivers act as a document trail for payments. Ask subcontractors to submit a conditional lien waiver with each pay application. When they collect payment, ask for an unconditional lien waiver for that amount. Don’t know the difference? Watch this video on the 4 types of lien waivers.

Get better software

It can be helpful to use a software system of some kind to track your expenses and income on your projects. You can use an Excel spreadsheet if you’re comfortable with it, but as you work on more and bigger projects, you may want the flexibility of bookkeeping software like Quickbooks to help make your life easier.

If your software system has a tool for tracking purchase orders or subcontracts, use it. These tools allow you to enter an invoice against a PO or subcontract, then produce a report showing what the remaining balance is left on the PO or contract. This will help prevent billing over the contract amount and allows you to always be aware of the progress of the work.

When entering invoices in your accounting software, use the due date field to help organize your invoices. Software can remind you when bills are due to be paid, making it easier for you to stay on target with your subcontractors and not suffer late fees or potential liens.

Create a filing system

Decide whether you are going to collect payment applications electronically, as paper copies, or both. Having a backup digital copy can be invaluable if the paper one gets lost, and digital copies don’t walk off, so they can be easier to find. Keeping both is a good option because you have physical copies in case the digital goes down and digital copies in case the paper gets lost.

When it comes to filing documents, both digital and paper copies, set up folders for each project you are working on. Everything for that job goes in that folder. You will never have to wonder where to look for something. This is handy if you pay your bills by the job. You can just grab the file with all the invoices in it and have everything you need at your fingertips.

Use a pay app checklist

If a project requires a lot of documentation for each pay app from a subcontractor, create a checklist that you can use to verify that each subcontractor or supplier has turned in everything. This is especially helpful for subs that send documents in different formats or at different times. Staple the checklist to the pay application, and mark items off as they come in. You can also use this checklist to verify things like insurance expiration dates and licensing status.

Before the project starts

Here are some quick steps you can take to get your pay application tracking process off to a good start when a new project begins:

- Identify all the subcontractors and major suppliers that will be on the project.

- When sending out subcontracts, include all the pay application forms and forms for other backup that they will need to send in.

- Set up PO or subcontract tracking in your bookkeeping software.

- Set up your digital or paper file structure.

With these strategies, you can collect, track, and process pay applications faster. By reducing the chance of mistakes and lost pay app documents, you can reduce the risk of non-payments. Keep the system simple, and make sure everyone knows how it works. That goes for everyone on the project, from your internal document gatekeeper to your subs. Make sure everyone knows what their roles and responsibilities are, and hold them to it.