There comes the point in time when every construction subcontractor considers trading smaller general contractors for working with larger outfits like Michels Corp. Aligning your business with a large, nationally recognized GC could mean seemingly endless jobs and incredible growth. But before taking that big step, you want to be sure your companies are compatible.

Before you even consider bidding on a project with Michels Corp, you want to make sure your companies will jive. Between projects, company histories, and company atmospheres, there’s a lot to know. That’s why Levelset put together this subcontractor’s guide to working with Michels Corp. Keep reading to learn more about working with this transportation and power delivery giant.

Michels Corp: Company overview

Michels Corp began doing business as a gas pipeline contractor in 1959. Their primary role was to construct delivery systems for utilities in the Wisconsin area. They quickly moved to telephone construction and outside plant construction projects, and then to sewer and water delivery.

By the mid-70s, Michels began working in aggregates and operating more than 100 limestone quarries and gravel pits in Wisconsin.

By the late 80s, Michels started taking major drilling projects, specializing in horizontal drilling and pipeline pull-backs. With a few well-planned acquisitions, Michels broke into electrical plant construction by the mid-90s. The turn of the century saw Michels Corp expanding to concrete paving, rounding out the company’s specialties and capabilities to what they are today.

Michels Corp is consistently ranked near the top ENR’s Top 400 Contractors. In both 2019 and 2020, Michels Corp ranked number 27.

The company operates over 40 offices in North America, including the US and Canada.

Michels Corp’s specialties include:

- Communication

- Construction materials

- Foundations

- Pipelines and facilities

- Power delivery

- Railway work

- Sewer and water

- Transportation

- Trenchless digging

Before working with Michels Corp

Before you consider working with a new contractor, you should do as much background investigation as possible. It’s helpful to consider this process like prequalification. After all, the GC is going to prequalify you; you might as well do the same.

Prequalifying a GC might be new to your company’s practices so you might not be sure just how to go about it. Luckily, Levelset wants to make the process as simple as possible, so we offer this step-by-step guide for prequalifying any general contractor you might be interested in:

- Dig into the company’s payment history

- Review the company’s credit history

- Read subcontractor reviews

- Check out a sample subcontract, if available

- Familiarize yourself with the company’s payment process

Now, you need to understand that when you’re digging into a company’s history, you’re bound to find some red flags or alarming details. A company like Michels, with its 60-plus year history, is bound to have a few blemishes on its track record. After all, construction is a tough business, and a slighted sub or employee might be quick to leave a negative review or two on the internet.

If something comes up in a company’s history, reach out to the company and ask about it. Sometimes a company being upfront and honest about an issue will tell you more about working with them than a negative review on the internet.

Michels Corp Payment Profile

The point of this subcontractor guide is to provide subcontractors with as much information as possible so they can make a smart decision before partnering with a GC. To help further that mission, we use Contractor Payment Profiles. These reports highlight a contractor’s payment practices, past disputes, liens, and payment speeds, providing a clear look at what it’s like to work with them.

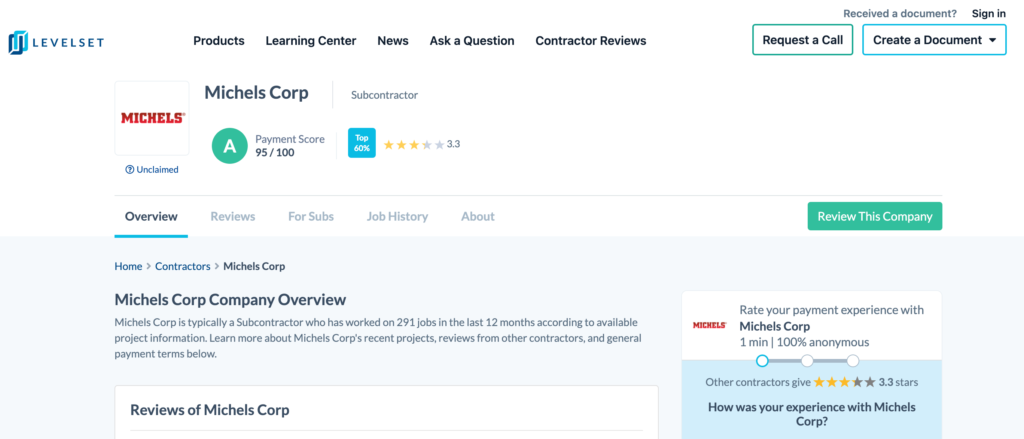

At the time of writing this guide, Michels Corp has a payment score of 95/100, giving the company an A rating. Few companies that rank as high as Michels Corp does on ENR’s Top 400 score this well.

The payment profile score highlights a company’s payment practices and compares them against data from thousands of other contractors. They serve as a benchmark for subs to shop through general contractors before partnering with one. If you’d like to know more about how we calculate these scores, click here.

Michels Corp’s payment disputes

Most general contractors the size of Michels Corp have a few disputes worth mentioning. These disputes might be reports of slow payment or liens filed against projects managed by the company. At the time of writing this guide, Michels Corp has none in the last 12 months.

Does that mean that all of Michels Corp’s projects go off without a hitch, or that all of the subcontractors on their projects are getting paid on time, every time? Not necessarily, but any payment disputes on the projects have been so minor that no subs have reported them or even threatened to file a lien. That’s a good sign for a company of this size.

Recent subcontractor reviews

When Levelset compiles data from subcontractors in order to assemble these Payment Profiles, we also ask questions about a company’s payment practices.

Admittedly, the review volume is quite limited. But, when asked, “How would you describe their payment process, speed, and policy?” one subcontractor responded, “slow payment every time.”

That might be contradictory to the shining Payment Score, but it does help paint a more well-rounded picture of working with Michels Corp. It’s certainly not a perfect outfit, but with only one review, Michels Corp does appear to take subcontractor relationships seriously.

Getting paid with Michels Corp

Even with a great score and very few poor reviews, it’s important to understand that no general contractor is perfect. Things come up. For that reason, it’s important to know as much as possible about Michels Corp’s payment policies before issues arise.

Before work starts

Before you start working with a large outfit like Michels, there will be some required documents and information to provide. Usually, these documents include:

- Your W-9

- The signed subcontract

- Insurance certificates

- Any bonding information related to the project

It’s usually the project manager’s job to meet with you and inform you of the above requirements and any others they might have.

First Payments

Michels Corp has over 40 offices and handles a lot of projects. Like most other large contractors, it probably prefers to keep its paperwork as uniform as possible. Using documents like AIA billing, G702 payment applications, and G703 continuation sheets gives each office a standardized paperwork system to follow.

When the PM reaches out to you about requirements, be sure to bend their ear a bit. You want to find out when payment apps are due. Generally, this is either the 1st, 5th, 15th, or 20th of each month, but find out from the project manager so you can be sure.

Progress payments

Depending on what your role is on a Michels Corp project, you could be on the job for months or even years. Waiting to get paid until the project is over just won’t do. Instead, you should be using progress payments, as they’ll help keep the cash flowing and the lights on while the project is underway.

While you’re sending in your payment application, be sure to include an updated schedule of values to streamline the process.

Project Closeout

General contractors and project management all have their own methods for closeout, but there are some universally standard documents. They include:

- Punch lists

- Certificates of occupancy

- Certificates of substantial completion

- Lien waivers

- Inspection certificates

A word of caution: Closeout can be very exciting, as it’s the last step before you receive final payments, including the retainage held back through the project. But, don’t rush it. Read each document carefully and completely. This is the stage where lien waivers start popping up. Signing a lien waiver for a payment you have not yet received is an excellent way to throw your lien rights out the window.

3 tips to getting paid on every construction project

Construction is full of disputes, issues, and delays. These problems pop up regularly, and there’s always a chance of a payment snafu. The following tips will help ensure you’re able to minimize these delays and their effects on your projects.

1. Send preliminary notices

If you want to avoid payment issues, you should be sending preliminary notices on all of your projects. In some states, sending a preliminary notice is a requirement for retaining your rights to file a mechanics lien in the event of a non-payment. Be sure to check your state’s requirements so you understand the deadlines that apply.

But even if you work in a state that does not require preliminary notices to protect your rights, you should be sending them anyway. These documents serve as a professional introduction to the GC and paying parties on a project. They can also keep your company name fresh in their minds when writing the checks.

2.It’s all about visibility

Preliminary notices aren’t the only documents that can bring attention to your company. Sending invoice reminders, notices of intent to lien, and demand letters can conveniently refresh the general contractor’s memory when it comes time to cut the checks.

3. Maintain your right to file a mechanics lien

While making money is vital to ensuring success as a construction company, it’s just as essential to protect it. Maintaining your right to a mechanics lien on all of your projects needs to be a priority. If an owner or general contractor doesn’t pay you, you’ll be able to file a lien against the project property. A lien can make the property less liquid which is never a good thing on a construction project.

Filing a mechanics lien is the fastest way to get paid when a payment dispute arises. But because they’re so compelling, states have strict requirements contractors must meet to protect their rights. Be sure to understand the mechanics lien laws in your project’s state in order to keep your money safeguarded in a payment dispute.