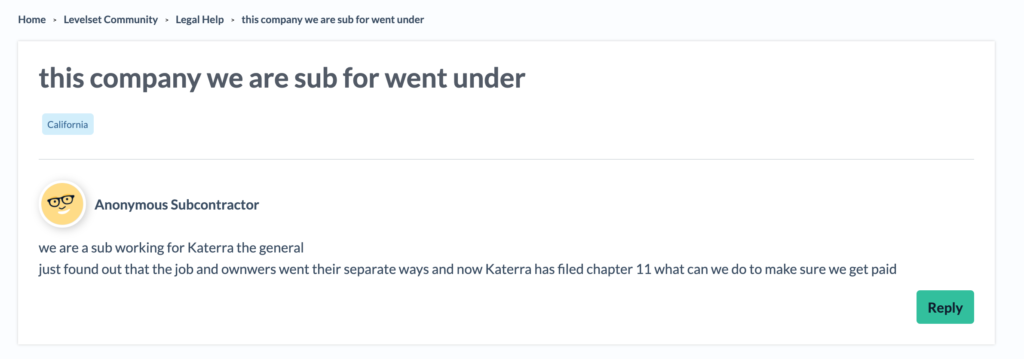

Katerra Construction, LLC filed for Chapter 11 bankruptcy on June 6, 2021, hoping to restructure its operations during a period of significant financial and legal setbacks.

This news followed an announcement by the company to its employees on June 1, 2021, stating after over a year of significant operational issues for the offsite construction-tech startup, it would cease operations “effective immediately,” ending the company’s six-year run.

With dozens of projects still active at the time of the announcement, contractors may be left in a difficult position — as work that was once “dragging out too long” may now be in serious jeopardy resulting in nonpayment.

The company has a significant amount of debt owed to individual contractors across the country in the wake of its bankruptcy — in listing only the company’s top 40 largest unsecured claims, documents note at least $73,940,808 currently owed to contractors. Overall, the company estimates that it has between $1 billion and $10 billion in total liabilities.

Katerra aimed to bring design, supply, and manufacturing into one business model and streamline the construction process, theoretically cutting costs for real estate developers. It had raised more than $2 billion from major international lenders like SoftBank.

By 2019, the company was the United States’ fifth-largest builder of apartments, according to the National Multifamily Housing Council.

Trevor Schick, head of Katerra’s construction, renovations, and supply chain, said in 2019: “Our goal is both feet-on-the-ground and executive-level talent who understand the construction industry has to change and are willing to help us do it.”

However, this was followed by a decline in the next year, which was accompanied by the US Securities and Exchange Commission launching an investigation into Katerra’s accounting practices.

“Katerra certainly pushed the envelope on construction innovation,” said Caitlin Walter, the National Multifamily Housing Council’s vice president for research. “That said, while Katerra stood out to a degree as a startup with significant funding, there are many multifamily development firms that are always innovating and trying out new processes, platforms, and techniques.”

According to reports, executives told workers that Katerra did not have enough funding to pay severance packages or unused paid time off, and that the company was exploring selling its assets and restructuring.

According to a Seattle Times report from June 1, 2021, the process of eliminating positions has already begun: 117 workers have already been laid off in Seattle, and on the same day the company informed the Colorado Department of Labor and Employment that it would be closing its office in Centennial, Colorado and letting go of 102 “carpenters, HVAC workers, estimators and project managers.”

As per an email sent to employees on June 1, 2021, the company stated that “Following a thorough review of strategic business alternatives, Katerra has determined that it must wind down the majority of its US business operations, effective immediately.”

“Unfortunately, most of our US employees will no longer be working for Katerra in the near future,” the message continued.

According to reports, executives told workers that Katerra did not have enough funding to pay severance packages or unused paid time off, and that the company was exploring selling its assets and restructuring.

In 2020, the company had over 8,000 staff members worldwide, but laid off over 400 employees in April 2020 after the COVID-19 pandemic began to impact the construction industry and Greensill — one of its lenders — went bankrupt in March 2020.

Katerra looked into Chapter 11 bankruptcy at the time in order to address its mounting debts, and the company’s board of directors voted to remove the company’s founder, Michael Marks, from his position as CEO.

A 2020 restructuring with Softbank gave Katerra $200 million in funding, avoiding its closure — at the expense of handing over a majority stake of the company to the Japanese lender. However, this was not enough to right the ship — during a presentation in May 2021, SoftBank CEO Masayoshi Son named both Katerra and Greensill as two of the lender’s biggest failures.

Despite the public messaging of a “shutdown,” the bankruptcy filing may not be the complete end of Katerra’s operations. Chapter 11 bankruptcy allows for companies to put forth a plan of reorganization so that it can continue business operations and pay its creditors over time.

According to a March 4, 2021, report, the company’s apartment renovations division engaged in misleading accounting in order to boost revenue.

Katerra’s shutdown tied to outside issues, legal battles

As the company itself noted, the pandemic caused significant issues for operations — as it did for the majority of the construction industry.

A statement from April 2, 2020, noted that “As parts of our business shut down [due to the effects of the COVID-19 pandemic], we unfortunately need to make some reductions in personnel through layoffs and furloughs.”

However, the fallout of the pandemic was not the only root of Katerra’s financial difficulties. One of the largest problems for the company in recent years was its issues with the US Securities and Exchange Commission, which began an investigation into Katerra’s accounting in 2020.

According to a March 4, 2021, report by The Information, as Katerra’s financial situation weakened, the company’s apartment renovations division engaged in misleading accounting in order to boost revenue.

The report states that “the division prepared exaggerated updates on how much renovations work had been completed so far on certain building projects.” According to sources with knowledge of the SEC probe, “Katerra employees…used the misleading project updates to front-load revenue by millions of dollars in financial reports submitted to investors.”

A law firm hired by Katerra sent a letter to then-current CEO Michael Marks in August 2020 that noted that its investigation into the situation found that “the company’s financial statements likely had been ‘intentionally misstated’ during Marks’ tenure” — an incident that led to Marks’ eventual removal.

As per The Information’s report, “Marks presided over a company that repeatedly stumbled on construction projects and failed to address warning signs” — issues that go beyond the SEC investigation.

A March 16, 2021, lawsuit filed against Katerra further cast light upon questionable legal practices, with Florida’s Autumn Lake Recreation Association, Inc. claiming that Katerra filed an incorrectly-dated lien on its property in order to assert financial power outside of legal bounds.

Notably, the company has also had at least 26 inspections or complaints to the Occupational Safety and Health Administration (OSHA) since the start of 2020.

A number of these incidents have been related to safety violations, as the company has had to pay thousands of dollars in fines during this time following complaints or referrals from workers.

However, the company has also seen a number of health violations during this time, as it was criticized for continuing to work in unsafe and “overcrowded” conditions during the ongoing pandemic.

With active projects, Katerra’s shutdown will impact more than just its own workforce

Katerra’s shutdown has already begun to affect contractors and developers — as New Jersey contractor Paul Silverman noted, “There are going to be a lot of developers who are delayed dramatically” by the news.

This is particularly worrying as the company’s website still lists 43 significant projects that are currently under construction, with no specification of what may happen to them as the company shuts down. These include a wide range of projects — from a 262-unit apartment building in Virginia to a $75 million classroom building for the University of Washington.

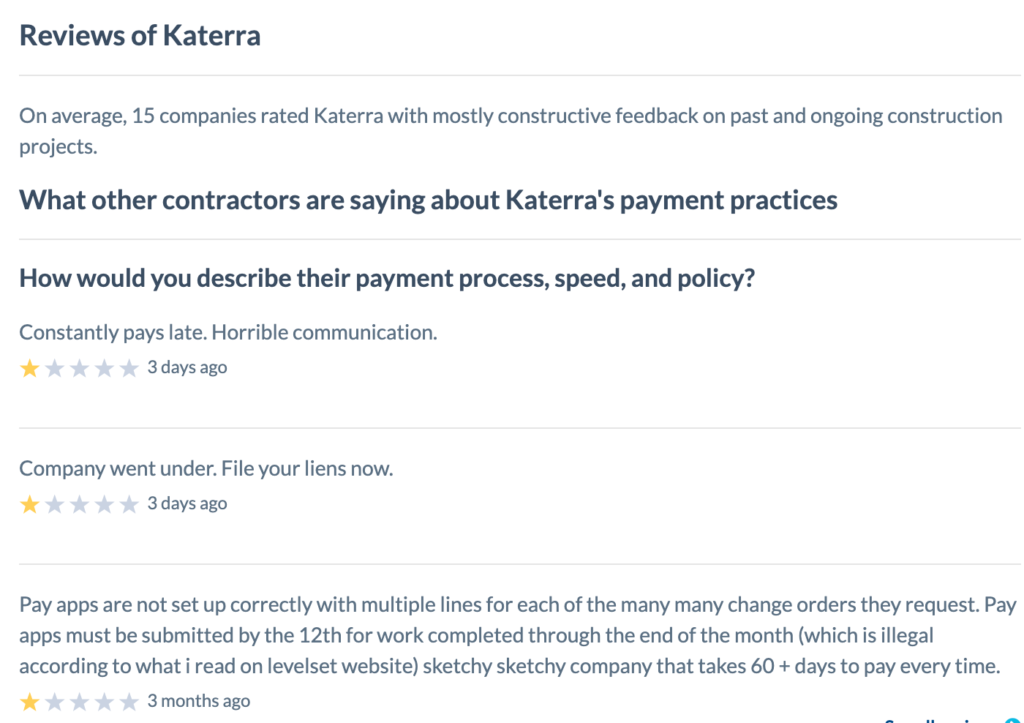

According to reviews submitted to Levelset, subcontractors and suppliers have already encountered issues with Katerra, with some saying the company “Constantly pays late” and exhibits “Horrible communication.” Other contractors have displayed concern over the state of payment on Katerra’s ongoing projects, as some local Katerra branches may splinter off while others will shutter.

Specifically, subcontractors whose projects are affected by Katerra’s shuttering may have to consider legal means with which to ensure their payment.

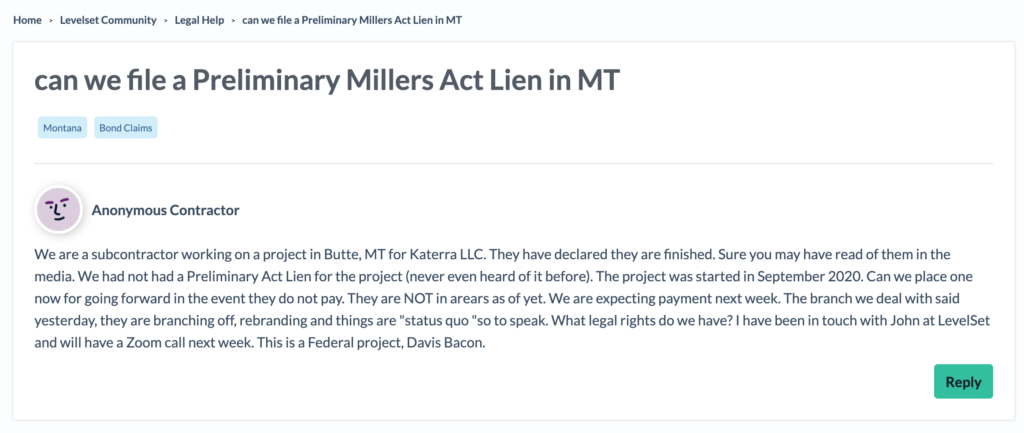

Recent requests by subcontractors working on Katerra projects for legal help on the Levelset website have questioned whether the Katerra situation may require a mechanics lien claim or a Miller Act claim.

Mechanics liens are legal claims for unpaid construction work, and they allow a contractor to gain a security interest in a project’s property in the event of nonpayment. Often, filing a lien is enough to secure payment, and thus lien foreclosure is relatively rare. However, this step can be necessary after other options have been exhausted.

Generally, anyone who provides labor or materials to a property can file a mechanics lien over slow payment or nonpayment.

However, this only extends to privately-owned property. Contractors who are instead working on US government projects can use the Miller Act to protect themselves against nonpayment. This process is similar to filing a mechanics lien, as the federal government requires general contractors to post payment bonds that guarantee payment for a project’s subcontractors and suppliers.

In the event of nonpayment, subcontractors can submit a Miller Act claim against the bond rather than against the government’s property. Through this process, the Miller Act provides that any party who “furnishes labor or material” on a project is entitled to a level of protection. “First tier” and “second tier” subcontractors — those who contract with a project’s general contractor or a “first tier” subcontractor — specifically have rights under the Miller Act.