One of the worst things that can happen in the construction business – in any business – is to get burned by a customer that doesn’t pay. If you’ve been in business long enough, chances are that a customer of yours will end up stiffing you on a project one day.

Obviously, writing off a bad debt is a bitter pill to swallow. But the true loss of bad debt to a company is more than just the amount of the debt itself. In fact, it’s much, much more. In this article, we’ll discuss the financial impact that bad debt has on a company, and we’ll show you why the true cost of that write-off is many times the amount of the initial loss.

Bad Debt Happens in Every Industry and in Every Economy

According to our friends at Anytime Collect, companies in the U.S. write-off an average of 4% of their accounts receivable every year. And write-offs don’t just happen during an economic downturn. Quite the opposite in fact – it’s very common for companies to get overextended during a period of fast growth. This is especially true in the credit-dependent construction industry where almost any measure of growth requires a significant amount of financing.

Construction’s Tight Margins Make Bad Debt Even Worse

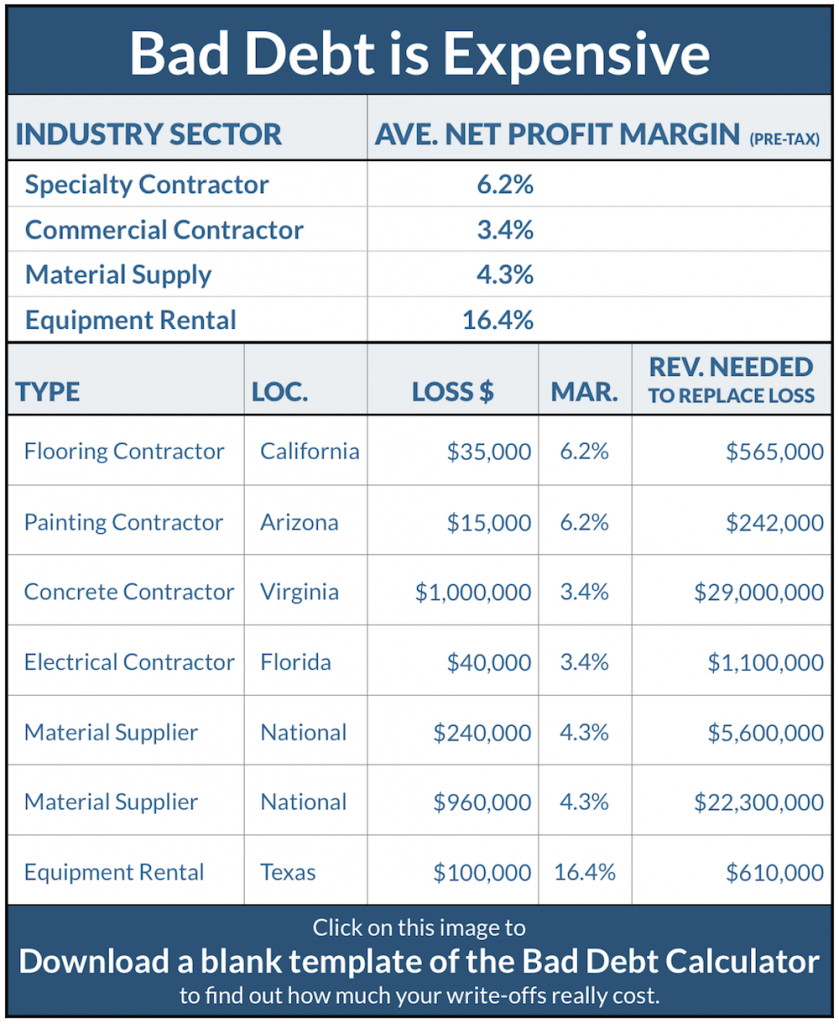

It’s probably no surprise to anyone reading this that the construction industry operates on razor-thin margins. In fact, net profit margins (before taxes) for the vast majority of sectors in the construction industry hover in the single digits.

Everyone knows that low margins makes it hard to make a buck. But low margins also make it extremely difficult for a company to recover financially from even a single case of non-payment.

To illustrate how tight margins make bad debt even more expensive, we have actual data on bad debt losses from 7 new Levelset customers. Each of these customers signed up with us in 2017, and each of them had recently written off a bad debt from a non-paying customer before they signed with us. We’re not revealing their names, but everything else about them as shown on the table below is accurate (net profit margin is based on industry averages).

It Takes a lot of Revenue to Make Up for a Write-Off

As you can see, it takes well over $200,000 of new revenue in order to generate enough cash flow just to make up for a modest write-off of $15,000. And the poor commercial concrete contractor in Virginia that had a customer stiff them for a cool million? Given the very low average margins of 3.4% for commercial contractors, it would take $29 million worth of new revenue to generate enough cash to make up for that single, million dollar loss. Wow.

Secure Your Payments to Avoid Bad Debt

While the numbers in the table above are both staggering and scary, there is some good news for companies in the construction industry. One of the most effective ways to avoid bad debts on your projects is to leverage mechanics lien rights, which are available in all 50 states, to secure your payments and virtually guarantee that you will get paid the money you’ve earned. Mechanics liens can help you get paid even in situations where the non-paying customer declares bankruptcy!