For many subcontractors, working with a large and reputable general contractor like Turner Construction Company is a great financial and professional opportunity. However, even projects with the nation’s top construction companies aren’t immune to the construction industry’s notorious cash flow issues.

The construction industry is unpredictable, and slow payment times are all too common. Before you sign a subcontract with Turner, it’s important that you do your research to make sure you understand their payment history, prequalification process, and payment process. Familiarizing yourself with the GC before you work with them is one of the best ways to maximize your chances of getting paid on time.

About Turner Construction

Turner Construction was founded by Henry Turner at the turn of the century, almost 117 years ago today. Since their humble beginnings Turner has grown into the second-largest construction services company in the nation and one of the largest construction companies in the world. Turner places second on ENR’s 2020 Top 400 Contractors list with a revenue of $13.2 billion in 2019.

Turner is based out of North America and operates in 20 countries. Their expansive network of local offices spans 26 states and two Canadian provinces, British Columbia and Ontario.

Turner Construction specializes in a wide number of industries, including aviation, commercial, healthcare, infrastructure, industrial, sports, residential, and hotels. Their services include design and build, procurement, building information modeling, and lean construction.

A few of their notable projects include:

- Akamai Technologies Global HQ – $517M

- Harvard University Science & Engineering Complex – $1B

- The Columbus Crew MLS Stadium – $232.9M

- Cambridge Nanotechnology Facility – $350M

Turner has also completed multiple high-dollar projects in other countries.

Before Working with Turner

General contractors often have their prospective subcontractors go through pre-qualification to make sure they’re the right fit for the job. As a subcontractor, doing the same thing on your end is a great way to find out whether or not the general contractor is the right fit for you.

Before working with Turner Construction as a subcontractor, it’s important to make sure the project is right for you. Pre-qualifying each general contractor you work with (and every project you work on) is a great way to start off on the right foot.

You can break the pre-qualification process down into five steps:

- Review the GC’s payment history on their past projects

- Find a copy of the GC’s credit history

- Read GC reviews from other subcontractors

- Learn about the GC’s payment process

- Find copies of their subcontracts

Review Turner Construction’s Payment Profile

The best place to begin pre-qualification process is on Turner Construction’s payment profile.

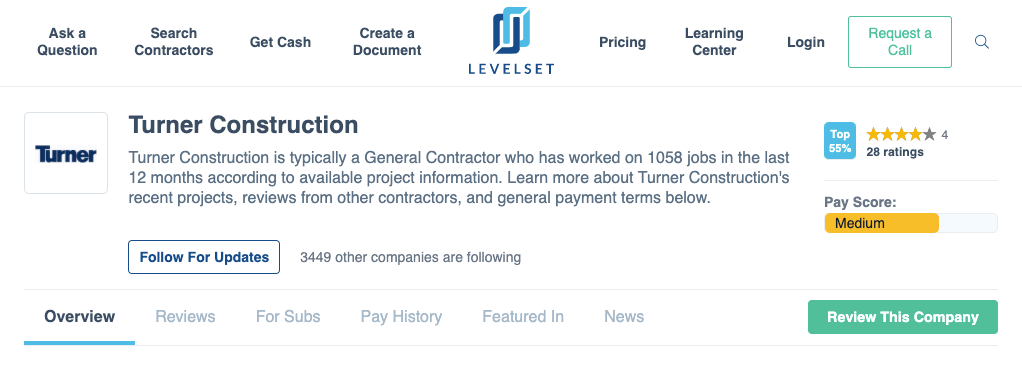

Turner currently has a “medium” pay score (on a scale from low to high). Pay score is calculated with the GC’s recent payment history, comparing it to thousands of other GCs across the country. Learn more about how payment scores are calculated.

Turner Construction’s payment practices have been rated 3.9 out of five stars, with the company receiving mostly positive feedback from 27 companies. This puts them in the top 55% of GCs.

The most recent review gives Turner five stars, saying, “Turner Construction in their California office was quick to pay and easy to work with. I highly recommend them.”

The most negative review, from eight months ago, gives Turner one star: “Job is 99% complete and has not paid a single dime.”

Recent Payment Disputes

If you take a look at Turner’s payment history, you’ll find several threats of lien and active mechanics lien filings against the general contractor. Keep in mind, however, that not every instance of non-payment is the GC’s fault, and not every claimant was directly contracted by Turner.

A construction project for a biomedical development called “Gateway of Pacific” went belly-up in recent months. Four contractors have filed liens against Turner with one contractor, Pacific Structures, finding themselves in the midst of a breach of contract with the GC.

A construction project involving downtown Dallas’s tallest residential building was overseen by Turner Construction. Located at 1445 Ross Ave., the project unfortunately went awry and a contractor has claimed $278.2K in unpaid wages after being contracted directly by Turner.

Getting Prequalified to Work With Turner Construction

Turner Construction’s website features a Become a Subcontractor page that offers information for subs to begin the process of working with the general contractor.

To start Turner’s prequalification process, subcontractors need to create an account. You’ll need to enter some company details, including your Federal Employer Identification Number (FEIN) and legal company name (as it appears on your W9 form).

After creating an account, subcontractors can log in to the Partner Portal to complete the application. During the process, you’ll be required to upload company documentation:

- Copy of W-9

- List of company license numbers

- List of state sales tax numbers

- List of state unemployment insurance numbers

- List of insurance agreements

- List of current projects

- List of recently completed projects

- Current financial statement

- Bank information

- Dun and Bradstreet information

- Surety information

- 3 supplier references

- 3 contractor references

- Independent verification letter supporting your EMR for last 3 years

- OSHA 300 logs from last 3 years

- Insurance information

Need help? Email the help desk at Turner Construction.

Turner Construction’s Payment Process for Subcontractors

Once approved, subcontractors can elect to join the Turner Accelerated Payment Program, a partnership with 3rd party financing companies designed to speed up payments to subcontractors.

The program is not free. Subcontractors must pay a “nominal fee,” which covers “the interest expense, the cost of operating the payment financing facility, and the risks of delayed payment to Turner.”

While Turner doesn’t guarantee specific payment speeds through the program, they estimate that “subcontractors will be paid within five days of pay application approval by the client.”

Turner estimates that subcontractors who choose to forego the accelerated payment program will get paid nearly 2 months after invoicing.

Before the Job Begins

After you’re prequalified, Turner will require some additional information from you before work on the project can begin. Generally, this will include:

- Proof of insurance

- Your W9

- The subcontract

- Any bond information

Applying for First Payment

When you apply for your first payment, always make sure your payment application is as complete and accurate as possible. The most common types of pay apps are the AIA billing forms, which include the G702 and G703 forms.

Making a mistake on pay apps could cause delays in your first and subsequent payments.

Applying for Progress Payments

Applying for progress payments with a large general contractor usually involves providing them with information such as a recent schedule of values, a pay application, any lien waivers, and all other documents as specified by your contract with Turner.

Applying for Final Payment

Applying for your final payment with a general contractor like Turner usually involves a standard close-out process.

The project administrator will provide you with the information you need to provide in order to apply for your final payment.

3 Subcontractor Tips to Get Paid on Turner Construction Projects

Regardless of whether or not the GC you’re contracted with pays quickly, there are several steps you can take to increase your chances of getting paid on time on every construction project.

1. Always send preliminary notice

There are a number of benefits to sending preliminary notice on every project, whether or not it’s required. Because they improve communication with the parties in charge of your payment, these documents can prioritize your invoice. They can even prevent the need to file a mechanics lien.

Preliminary notices are required before filing a mechanics lien in most states, so sending one helps you make sure your lien rights are intact.

2. Review any lien waivers

Lien waivers are commonly exchanged on construction projects. They’re generally signed in exchange for payment, and they waive the subcontractors right to file a mechanics lien. Because signing one can give up your right to file a lien, you should carefully review the lien waiver with a construction attorney if you’re presented with one.

3. Make sure your mechanics lien rights are secure

Lastly, always take the necessary steps to ensure your lien rights are intact. This varies in each state, so study the mechanics lien requirements in the state where you’re working.

Usually, maintaining your lien rights involves sending the proper notices over the course of the project, having a valid license for the work you’re doing, and filing all the required paperwork and meeting all the prescribed deadlines for that paperwork.

Mechanics liens are widely used by contractors of all sizes to secure an unpaid debt. They hinder the property’s sale until the contractor is paid, and foreclosure of a mechanics lien results in a lawsuit or the forced sale of the property in order to satisfy the debt.