On Friday, March 27th, President Trump signed the COVID-19 stimulus bill, known as the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This law provides significant support, resources, and $350 billion in loans and grants to construction businesses. In this article, we’ll cover what contractors and suppliers need to know about the small business loan program, including who qualifies, and how to apply for an SBA loan.

Cash flow is essential to construction businesses – now more than ever. The coronavirus will continue to impact construction for some time, and businesses need as much cash as they can get their hands on. While some states and cities have designated construction an “essential business,” the future is uncertain. If you are looking for cash to help get you through the downturn, take advantage of every option available.

Update 6/20/20 – SBA relaxes PPP requirements

The SBA Paycheck Protection Program (PPP) still has nearly $100 billion available for small businesses. In mid-June, the US Treasury announced new, more relaxed policies for the program. The updated policy extends the application and repayment deadlines, reduces the percentage required for payroll expenses, and the deadline to hire back laid off workers.

Update 4/27/20 – SBA reopens loan program with new funds

On Friday, April 24th, President Trump signed a bill to provide an additional $370 billion in support for small businesses, including $310 billion for the SBA’s Paycheck Protection Program, which ran out of money on April 13th. According to the SBA, they will “resume accepting Paycheck Protection Program applications from participating lenders on Monday, April 27, 2020 at 10:30am EDT.”

While the program is open to small businesses in a variety of industries, it has been particularly popular among construction businesses, many of which are reporting job delays or cancellations. According to a survey by the Associated General Contractors (AGC), 75% of contractors say they applied for an SBA loan in the initial window. More than half of the construction businesses that applied had already received the money.

“This program has already delivered funds to nearly half of the survey respondents,” said Ken Simonson, chief economist at the AGC. “Many of them have already brought back furloughed workers or added employees, even though more clients are halting and canceling projects.”

Contractors that are interested in the program should apply as soon as possible. Keep reading to learn more about the program, and how to apply.

SBA Paycheck Protection Loans: Cash for construction during coronavirus

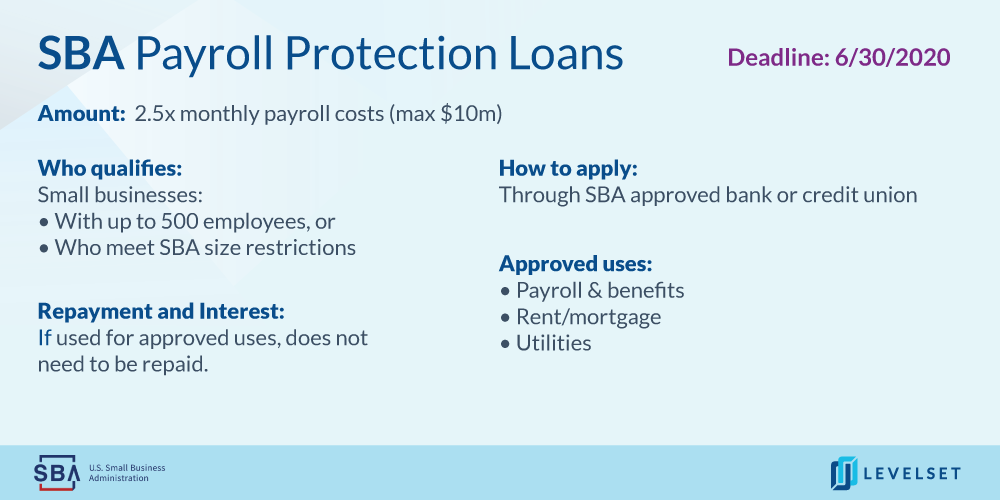

In response to the coronavirus pandemic, the CARES Act created a special loan program through the US Small Business Administration (SBA), known as the Paycheck Protection Program (PPP). This loan program is an expansion of the existing SBA 7(a) loan program. View the latest PPP fact sheet from the US Treasury.

The SBA Paycheck Protection Program provides $350 billion in forgivable loans to eligible small businesses, including contractors and suppliers that qualify. If businesses use the money to pay their workers and meet certain other expenses, the loan will be forgiven. As long as you keep workers on the payroll, and spend the loan money on the right things – and document everything! – the loan effectively becomes a grant.

However, Payroll Protection Loans are only one of several programs available to help construction businesses get cash right now. The SBA has other loans and debt relief available to help small businesses weather the coronavirus crisis.

Are construction businesses eligible for an SBA loan?

Size requirements

In order to apply for an SBA loan under the Paycheck Protection Program, your construction business must be any of the following:

- Under the SBA size standards

- A business with fewer than 500 employees

- A sole proprietorship

- Operated by an individual as an independent contractor

- Operated by a self-employed individual who regularly carries on any trade or business

- A Tribal business concern that meets the SBA size standard

- Registered as a 501(c)(3) with fewer than 500 employees

- Registered as a 501(c)(19) Veterans Organization that meets the SBA size standard

After the bill was passed, the SBA indicated that construction businesses would need to have fewer than 500 employees and meet the SBA size standards. However, on April 6th, the US Treasury Department clarified that businesses do not need to meet both guidelines. A construction company with more than 500 employees can qualify if their annual revenue is under the SBA’s thresholds.

For the construction industry, the SBA size standard varies depending on the NAICS industry code for the construction business. For example, electrical contractors must have annual revenue of less than $15 million. In contrast, a “Highway, Street, and Bridge” construction company can have annual revenue up to $36.5 million.

As noted above, a company’s annual revenue doesn’t matter if they have under 500 employees.

In business before February 15

The SBA Paycheck Protection Program is only available to small businesses who had employees on the payroll before February 15, 2020.

How much can a construction business borrow?

Businesses that qualify can borrow 2.5x their average monthly payroll costs, up to a maximum of $10 million.

How to calculate your payroll costs

Add up your:

- Salaries, wages, commissions, etc.

- Cash tips or equivalent

- Medical, vacation, parental, family, and sick leave payments

- Allowances for dismissal or separation

- Group healthcare benefits

- Retirement benefits

- State/local tax on employee compensation

And subtract any:

- Individual employee salaries in excess of $100,000 (prorated for the period February 15, to June 30, 2020)

- Payroll taxes, income taxes, and railroad retirement taxes

- Compensation for an employee whose primary residence is outside of the US

- Qualified sick leave wages for which a credit is allowed under section 7001 of the Families First Coronavirus Response Act (Public Law 116–5 127); or qualified family leave wages for which a credit is allowed under section 7003 of the Families First Coronavirus Response Act

Multiply that sum by 2.5 to calculate the amount you’re eligible to borrow (up to a maximum of $10 million).

How to apply for an SBA Paycheck Protection Loan

Contact a lender

You can apply “through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating.”

Most major banks already participate in the SBA 7(a) program, including:

The SBA currently has a network of 1,800 lenders across the US, but they expect to fast-track approval for thousands more. The federal government is eager to get the money into the economy as quickly as possible. View a list of the 100 top SBA 7(a) lenders.

According to Treasury Secretary Steve Mnuchin, SBA Paycheck Protection loans will be available starting Friday, April 3rd.

Contact your bank or lending institution and ask about the SBA Paycheck Protection Loan program. Or apply through Levelset directly – we work with lending institutions to give you access to SBA loans, lines of credit, invoice factoring, and more. Apply now with a single application.

Fill out an SBA loan application

- DBA or Tradename (if applicable)

- Business Legal Name

- Business Primary Address Business

- Tax Identification Number (TIN), Employer Identification Number (EIN), or Social Security Number (SSN)

- Business Phone

- Primary Contact Email Address

- Average Monthly Payroll

- Number of Jobs

- Purpose of the loan (Payroll, Rent/Mortgage Interest, Utilities, Other)

Download the Paycheck Protection Loan application form

Bring supporting documents

When you visit the bank, you will likely need to provide documents that support your average monthly payroll calculations, and the number of jobs your construction business supports. It’s a good idea to bring the previous year’s tax returns, financial statements, and any other documents that support your request. The more supporting documentation you can provide, the more quickly the bank can verify and approve your loan.

- Payroll tax reports (including Forms 941, 940, state income and unemployment tax filing reports) for 2019 and the first quarter of 2020 (if available)

- Payroll reports for the last 12 months, including paid time off (PTO)

- Records of the health insurance premiums you have paid for all employees (including the business owners) for the last 12 months

- Records of retirement plan funding for the last 12 months

Make a good faith certification

When you apply for a Paycheck Protection Loan, you will also need to provide a “good faith certification” to the lender that:

- The uncertainty of current economic conditions makes the loan request necessary to support ongoing operations

- You will use the loan proceeds to retain workers and maintain payroll or make mortgage, lease, and utility payments

- You don’t have a pending loan application that duplicates of the purpose and amounts applied for here

- From Feb. 15, 2020 to Dec. 31, 2020, you have not already received a loan that duplicates the purpose and amounts applied for here

Those last two basically ask you to certify that you haven’t applied for – or received – the same money twice. Important note: You can be criminally prosecuted for providing false information on an SBA loan application.

If you are an independent contractor, sole proprietor, or self-employed, you will also need to provide tax or other income & expense documents.

Deadline to apply

The deadline to apply for a Paycheck Protection Loan is currently June 30, 2020.

What can I use an SBA Paycheck Protection Loan for?

In order for the loan to become a grant (so you don’t need to pay it back), you will need to spend the money on certain expenses. Because the primary intention of this money is to save workers’ jobs, the costs are generally limited to those that directly support employees.

These are the allowable expenses under the CARES Act:

- Payroll costs, including paid sick, medical, or family leave, group healthcare, and insurance premiums

- Employee salaries

- Mortgage payments

- Rent (including rent under a lease agreement)

- Utilities, and

- Any other debt obligations that were incurred before the covered period.

According to the SBA, “due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll.”

Loan forgiveness

As long as your business doesn’t reduce employment, and uses the Paycheck Protection loan funds for the intended purpose, the loan will be forgiven. You will not be required to pay it back.

Any funds not used for approved expenses are subject to an interest rate of 0.5%, and must be repaid within 2 years.

What if I already laid off workers or cut salaries?

According to the US Chamber of Commerce, as long as you hire them back within 30 days of the CARES Act enactment, you can qualify for the full loan forgiveness. Since President Trump signed the CARES Act on March 27th, that gives you until April 26th to restaff your construction business.

Other SBA loans for construction businesses

The Paycheck Protection Loan program was created by the coronavirus stimulus bill, known as the CARES Act. But it’s not the only help that the Small Business Administration offers to construction companies and other small businesses. The SBA offers other loans to small businesses through separate programs.

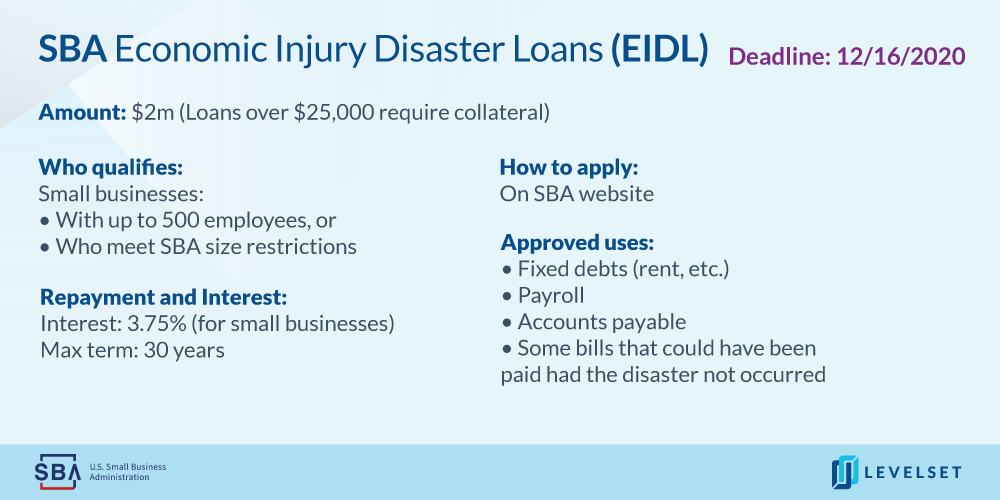

SBA Economic Injury Disaster Loans (EIDL): Up to $2 million

The SBA Disaster Assistance program for coronavirus (COVID-19) provides low-interest loans of up to $2 million to help businesses recover from “substantial economic injury.”

The EIDL program has the same eligibility requirements as the Paycheck Protection Loan program; you must have fewer than 500 employees, or otherwise meet the SBA’s size requirements.

Interest on Economic Injury Disaster Loans is capped at 3.75% APR for small businesses. The loan can be repaid over a maximum of 30 years.

This loan also comes with a cash advance of up to $10,000 within 3 days of application, which does not need to be repaid.

How to apply for an EIDL loan

Fill out an Economic Injury Disaster Loan application on the SBA website.

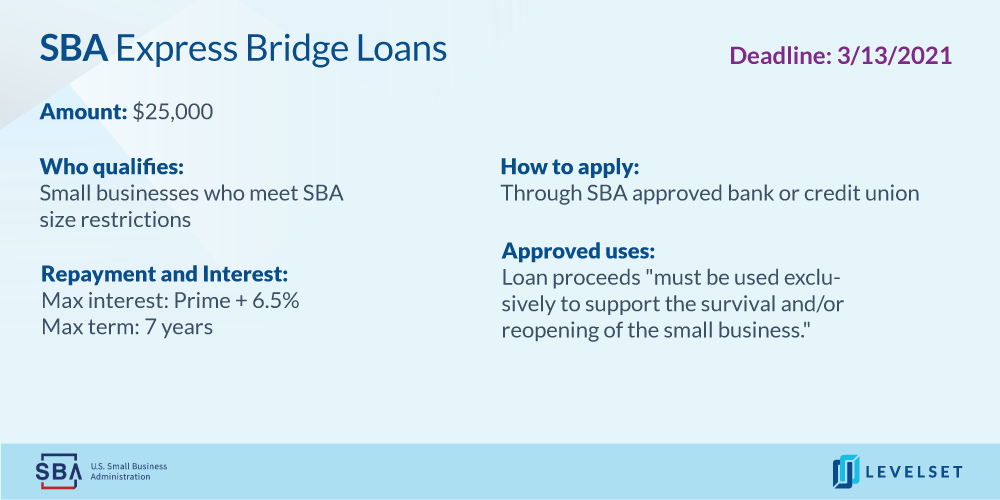

SBA Express Bridge Loans: Up to $25k

The SBA’s Express Bridge Loan Pilot Program allows small businesses who currently have a business relationship with an SBA Express Lender to borrow up to $25,000 with less paperwork.

Small businesses in any state, territory, and the District of Columbia that have been adversely impacted by the COVID19 emergency are eligible to apply.

Lender may charge up to 6.5% + the prime rate, regardless of the maturity of the loan. The maximum Express Bridge Loan term is 7 years.

How to apply for an Express Bridge Loan

Find an Express Bridge Loan Lender by connecting with your local SBA District Office.

Can I apply for multiple loans at once?

Yes, you can apply to multiple SBA programs simultaneously. (However, you cannot submit multiple applications to the same loan program.)

Construction businesses: Take advantage of all cash options

Cash is king in the construction industry – and it’s even more powerful right now. The coronavirus stimulus bill and SBA loans may be dominating the news, but there are lots of other avenues for construction businesses to get cash. It will be important to understand your options – and take advantage of every opportunity that you can. The more cash you have on hand during times of uncertainty, the better your construction business will be able to handle the rocky road ahead.