While problems with slow payments reverberate throughout the construction industry, the truth is that some companies, roles, and project types are much more likely to get paid on time than others.

Our recent Construction Cash Flow and Payment Report took a deep look at more than 500 construction companies to figure out who is getting paid quickly — and who isn’t. While any construction business can succeed in getting paid by exercising its payment rights, the current reality is that some roles and project types are succeeding or struggling more than others.

Read on to find out who’s winning and losing in the construction payment game — and what you can do about it.

General contractors report the best payment speed

General contractors are the big winners in the construction payment space, as they are more likely to report getting paid on time than many other roles — including subcontractors, material suppliers, rental companies, and restoration contractors.

But how well do GCs really fare when it comes to payment speed? The short answer: Much better.

For example, general contractors are four times more likely than subcontractors to report always getting paid on time. If we look at general contractors and material suppliers, the contrast is even sharper: Just 1 in 100 material suppliers report always getting paid on time — compared to 1 in 5 GCs.

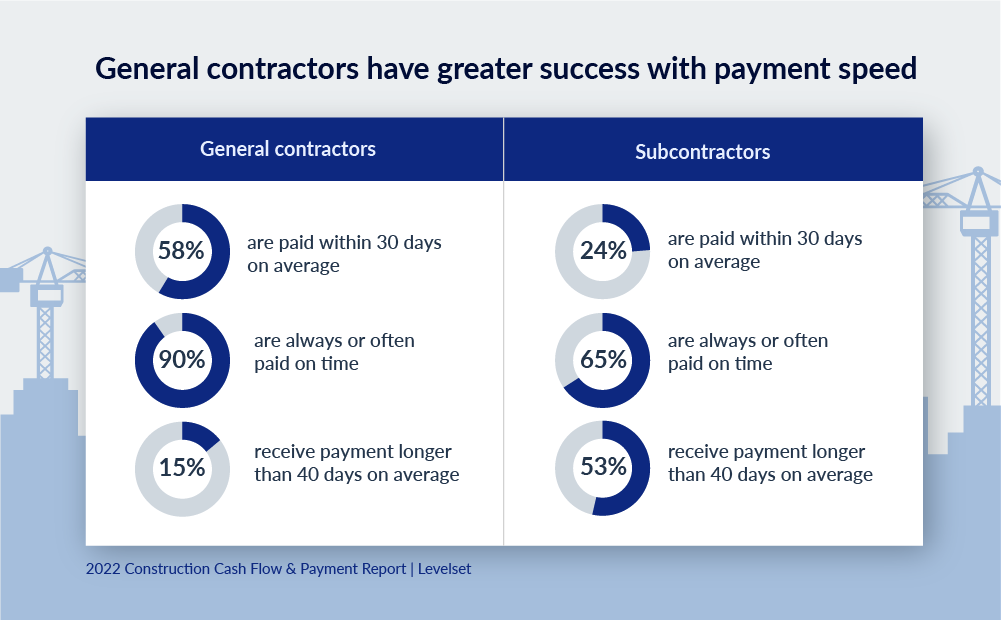

Nearly 90% of general contractors say that they’re always or often paid on time, but the same is true for only around 65% of subcontractors, material suppliers, and restoration contractors.

General contractors report faster payment speeds from their customers as well. Consider this: 58% of general contractors report getting paid within 30 days on average, but just 24% of subcontractors can say the same. In fact, around half of subcontractors, material suppliers, and rental companies report that it takes more than 40 days on average to get paid—a situation that only affects a reported 15% of GCs.

The unique spot that GCs have on the payment chain could explain their significant success in getting paid on time. Because general contractors are usually prime contractors—and have a direct relationship with the property owner—the funding for the project typically passes through them before getting dolled out to subcontractors.

That said, everyone working on a construction project deserves to get paid on time for their work, and every company can take steps to increase payment speed.

Read more: The 4 Key Habits of Large, Successful Contractors

Public projects more likely to struggle with slow payments

Survey results indicate that construction businesses that work on public projects are much less likely to report getting paid on time than those that work on private projects.

For example, companies that focus on public sector work are nearly twice as likely to report that they are almost always paid late for completed work. Meanwhile, 4 out of 5 construction businesses that specialize in private residential projects say they always or often get paid on time.

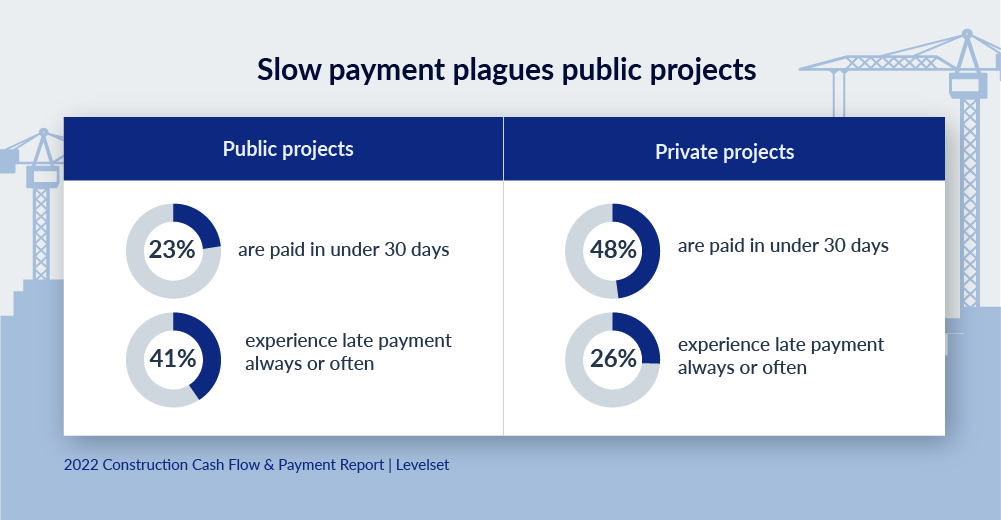

Overall, there is a large disparity in the payment speed experienced by companies working in the public sector and those working on private projects.

For instance, half of all companies working on private projects report getting paid within 30 days, but less than one-quarter of businesses working on public projects get paid in that same time span. Companies working in the public sector are also half as likely to receive a deposit upfront compared to businesses working on private residential projects.

The differences between public and private projects could factor into the payment speed disparity. Public projects often have complex payment chains, bond requirements, legal challenges, and government funding. By contrast, many private residential contracts may only involve an owner and a general contractor, reducing the scope of work as well and simplifying the payment process.

Regardless of the causes, the result is clear: Businesses who specialize in public projects are more likely to experience slower payments, so keeping on top of potential cash flow issues is paramount to success.

Read more: How to Manage Cash Flow in Construction

Find more success with payment speed

While slow payments continue to affect many construction businesses, it doesn’t have to stay that way. Companies can take proactive measures to encourage faster payments, and they can also exercise their payment rights in case of late payments.

Learning the value of preliminary notices can be a strong first step for companies looking to increase their payment speed. If late payments are a persistent problem, understanding and filing mechanics liens — or bond claims for public projects—can positively affect cash flow.

While there are clear winners and losers in the payment game as it currently exists, construction is a dynamic industry, so any business can adapt and grow to improve its payment speed.

Protect & speed up every payment

Learn how Levelset can help you easily manage your lien rights on every project to ensure your payments are always protected.