(a) On all public construction contracts which are let by a board or governing body of the State government or any political subdivision thereof, except contracts let by the Department of Transportation pursuant to G.S. 136-28.1, the balance due prime contractors shall be paid in full within 45 days after respective prime contracts of the project have been accepted by the owner, certified by the architect, engineer or designer to be completed in accordance with terms of the plans and specifications, or occupied by the owner and used for the purpose for which the project was constructed, whichever occurs first. However, when the architect or consulting engineer in charge of the project determines that delay in completion of the project in accordance with terms of the plans and specifications is the fault of the contractor, the project may be occupied and used for the purposes for which it was constructed without payment of any interest on amounts withheld past the 45 day limit.

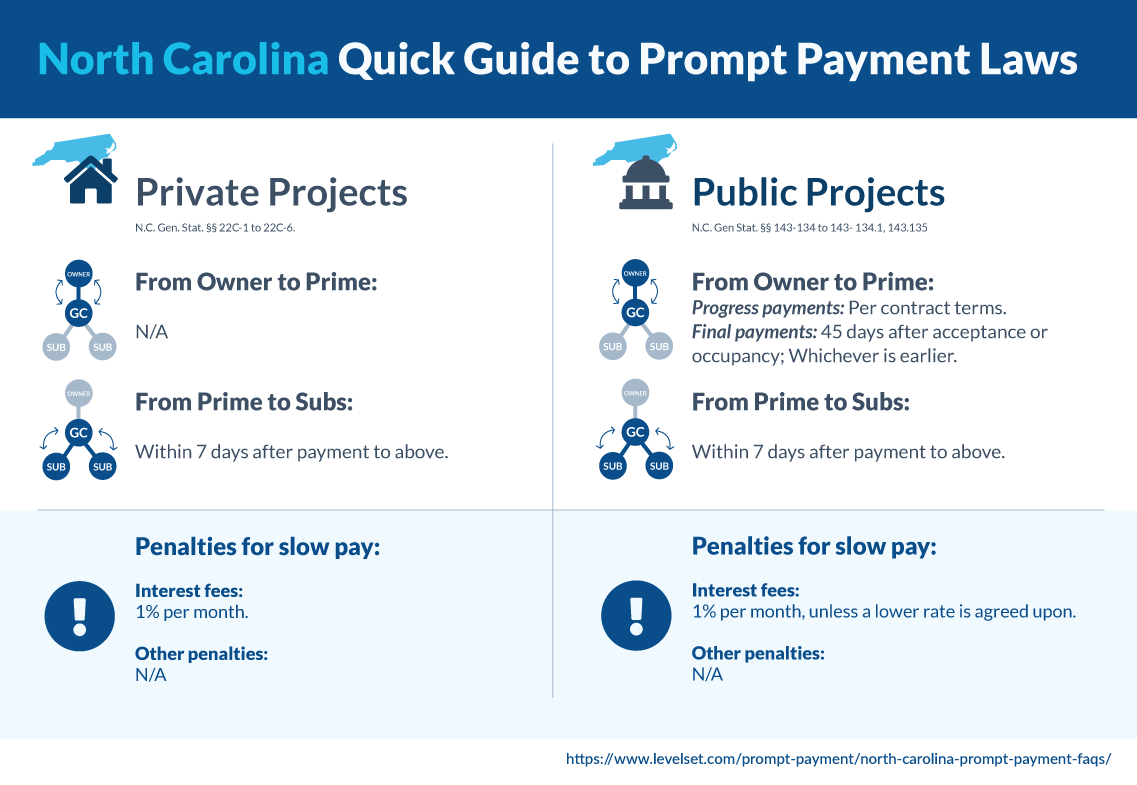

No payment shall be delayed because of the failure of another prime contractor on the project to complete his contract. Should final payment to any prime contractor beyond the date the contracts have been certified to be completed by the designer or architect, accepted by the owner, or occupied by the owner and used for the purposes for which the project was constructed, be delayed by more than 45 days, the prime contractor shall be paid interest, beginning on the 46th day, at the rate of one percent (1%) per month or fraction thereof unless a lower rate is agreed upon on the unpaid balance as may be due. In addition to the above final payment provisions, periodic payments due a prime contractor during construction shall be paid in accordance with the provisions of this section and the payment provisions of the contract documents that do not conflict with this section, or the prime contractor shall be paid interest on any unpaid amount at the rate stipulated above for delayed final payments. The interest shall begin on the date the payment is due and continue until the date on which payment is made. The due date may be established by the terms of the contract. Funds for payment of the interest on state-owned projects shall be obtained from the current budget of the owning department, institution, or agency. Where a conditional acceptance of a contract exists, and where the owner is retaining a reasonable sum pending correction of the conditions, interest on the reasonable sum shall not apply.

(b) Within seven days of receipt by the prime contractor of each periodic or final payment, the prime contractor shall pay the subcontractor based on work completed or service provided under the subcontract. If any periodic or final payment to the subcontractor is delayed by more than seven days after receipt of periodic or final payment by the prime contractor, the prime contractor shall pay the subcontractor interest, beginning on the eighth day, at the rate of one percent (1%) per month or fraction thereof on the unpaid balance as may be due.

(b1) No retainage on periodic or final payments made by the owner or prime contractor shall be allowed on public construction contracts in which the total project costs are less than one hundred thousand dollars ($100,000). Retainage on periodic or final payments on public construction contracts in which the total project costs are equal to or greater than one hundred thousand dollars ($100,000) is allowed as follows:

(1) The owner shall not retain more than five percent (5%) of any periodic payment due a prime contractor.

(2) When the project is fifty percent (50%) complete, the owner, with written consent of the surety, shall not retain any further retainage from periodic payments due the contractor if the contractor continues to perform satisfactorily and any nonconforming work identified in writing prior to that time by the architect, engineer, or owner has been corrected by the contractor and accepted by the architect, engineer, or owner. If the owner determines the contractor’s performance is unsatisfactory, the owner may reinstate retainage for each subsequent periodic payment application as authorized in this subsection up to the maximum amount of five percent (5%). The project shall be deemed fifty percent (50%) complete when the contractor’s gross project invoices, excluding the value of materials stored off-site, equal or exceed fifty percent (50%) of the value of the contract, except the value of materials stored on-site shall not exceed twenty percent (20%) of the contractor’s gross project invoices for the purpose of determining whether the project is fifty percent (50%) complete.

(3) A subcontract on a contract governed by this section may include a provision for the retainage on periodic payments made by the prime contractor to the subcontractor. However, the percentage of the payment retained:

(i) shall be paid to the subcontractor under the same terms and conditions as provided in subdivision (2) of this subsection and

(ii) subject to subsection (b3) of this section, shall not exceed the percentage of retainage on payments made by the owner to the prime contractor. Subject to subsection (b3) of this section, any percentage of retainage on payments made by the prime contractor to the subcontractor that exceeds the percentage of retainage on payments made by the owner to the prime contractor shall be subject to interest to be paid by the prime contractor to the subcontractor at the rate of one percent (1%) per month or fraction thereof.

(4) Within 60 days after the submission of a pay request and one of the following occurs, as specified in the contract documents, the owner with written consent of the surety shall release to the contractor all retainage on payments held by the owner:

(i) the owner receives a certificate of substantial completion from the architect, engineer, or designer in charge of the project; or

(ii) the owner receives beneficial occupancy or use of the project. However, the owner may retain sufficient funds to secure completion of the project or corrections on any work. If the owner retains funds, the amount retained shall not exceed two and one-half times the estimated value of the work to be completed or corrected. Any reduction in the amount of the retainage on payments shall be with the consent of the contractor’s surety.

(5) The existence of any third-party claims against the contractor or any additive change orders to the construction contract shall not be a basis for delaying the release of any retainage on payments.

(b2) Full payment, less authorized deductions, shall also be made for those trades that have reached one hundred percent (100%) completion of their contract by or before the project is fifty percent (50%) complete if the contractor has performed satisfactorily. However, payment to the early finishing trades is contingent upon the owner’s receipt of an approval or certification from the architect of record or applicable engineer that the work performed by the subcontractor is acceptable and in accordance with the contract documents. At that time, the owner shall reduce the retainage for such trades to five-tenths percent (0.5%) of the contract. Payments under this subsection shall be made no later than 60 days following receipt of the subcontractor’s request or immediately upon receipt of the surety’s consent, whichever occurs later. Early finishing trades under this subsection shall include structural steel, piling, caisson, and demolition. The early finishing trades for which line-item release of retained funds is required shall not be construed to prevent an owner or an owner’s representative from identifying any other trades not listed in this subsection that are also allowed line-item release of retained funds. Should the owner or owner’s representative identify any other trades to be afforded line-item release of retainage, the trade shall be listed in the original bid documents. Each bid document shall list the inspections required by the owner before accepting the work, and any financial information required by the owner to release payment to the trades, except the failure of the bid documents to contain this information shall not obligate the owner to release the retainage if it has not received the required certification from the architect of record or applicable engineer.

(b3) Notwithstanding subdivisions (2) and (3) of subsection (b1) of this section, and subsection (b2) of this section, following fifty percent (50%) completion of the project, the owner shall be authorized to withhold additional retainage from a subsequent periodic payment, not to exceed five percent (5%) as set forth in subdivision (1) of subsection (b1) of this section, in order to allow the owner to retain two and one-half percent (2.5%) total retainage through the completion of the project. In the event that the owner elects to withhold additional retainage on any periodic payment subsequent to release of retainage pursuant to subsection (b2) of this section, the general contractor may also withhold from the subcontractors remaining on the project sufficient retainage to offset the additional retainage held by the owner, notwithstanding the actual percentage of retainage withheld by the owner of the project as a whole.

(b4) Neither the owner’s nor contractor’s release of retainage on payments as part of a payment in full on a line-item of work under subsection (b2) of this section shall affect any applicable warranties on work done by the contractor or subcontractor, and the warranties shall not begin to run any earlier than either the owner’s receipt of a certificate of substantial completion from the architect, engineer, or designer in charge of the project or the owner receives beneficial occupancy.

(b5) The State or any political subdivision of the State may allow contractors to bid on bonded projects with and without retainage on payments.

(b6) Nothing in subsections (b1), (b2), (b3), and (b4) of this section shall operate to prevent any agency or any political subdivision of the State from complying with the requirements of a federal contract or grant when the requirements of the federal contract or grant conflict with subsections (b1), (b2), (b3), or (b4) of this section. Each bid document must specify when federal preemption of this section shall apply.

(c) Repealed by Session Laws 2007-365, s. 1, effective January 1, 2008.

(d) Nothing in this section shall prevent the prime contractor at the time of application and certification to the owner from withholding application and certification to the owner for payment to the subcontractor for unsatisfactory job progress; defective construction not remedied; disputed work; third party claims filed or reasonable evidence that claim will be filed; failure of subcontractor to make timely payments for labor, equipment, and materials; damage to prime contractor or another subcontractor; reasonable evidence that subcontract cannot be completed for the unpaid balance of the subcontract sum; or a reasonable amount for retainage not to exceed the initial percentage retained by the owner.

(e) Nothing in this section shall prevent the owner from withholding payment to the contractor in addition to the amounts authorized by this section for unsatisfactory job progress, defective construction not remedied, disputed work, or third-party claims filed against the owner or reasonable evidence that a third-party claim will be filed.

Summary

Article Name

North Carolina Prompt Payment Law

Description

Summary of North Carolina Prompt Payment requirements and laws for North Carolina construction projects including free forms, FAQs, resources and more.

Author

Scott Wolfe Jr.

Publisher Name

Levelset

Publisher Logo