What is a mechanics lien?

- Resources & Links

File Online

Ready to pull the trigger and get your cash? Filing a lien online is easy and fast, and helps make sure you get it all done right. Get your lien filed in less than 5 minutes, right here.

FAQs

Liens can be confusing for property owners and construction professionals. Get answers to some of the most frequently asked questions.

Map of Deadlines & Rules

Quickly see the construction lien rules, deadlines, and requirements in your state with this color-coded US Map.

Deadline calculator

Use the lien deadline calculator to find out if you can file a mechanics lien, and whether you need to send a notice. Enter project dates and information to identify the deadlines and required notices in your state.

Free Forms

Download free mechanics lien forms for any state and any project. These fill-able PDFs are easy to use and have been created by construction attorneys to meet the legal requirements.

Watch: How to file

Watch a video that breaks down the process to file a mechanics lien in any state. Does state law allow you to file a mechanics lien? Did you send the required notices? And are you within your lien deadline?

Find your state rules

Choose a state from the drop-down menu to learn the specific rules, requirements, and deadlines for mechanics liens.

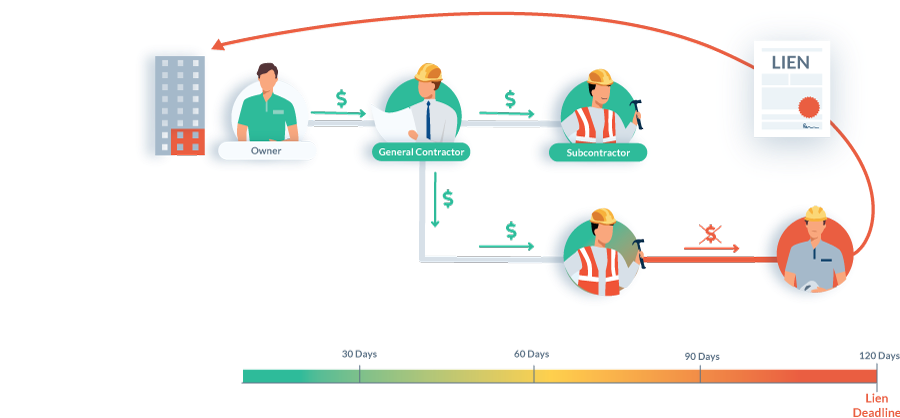

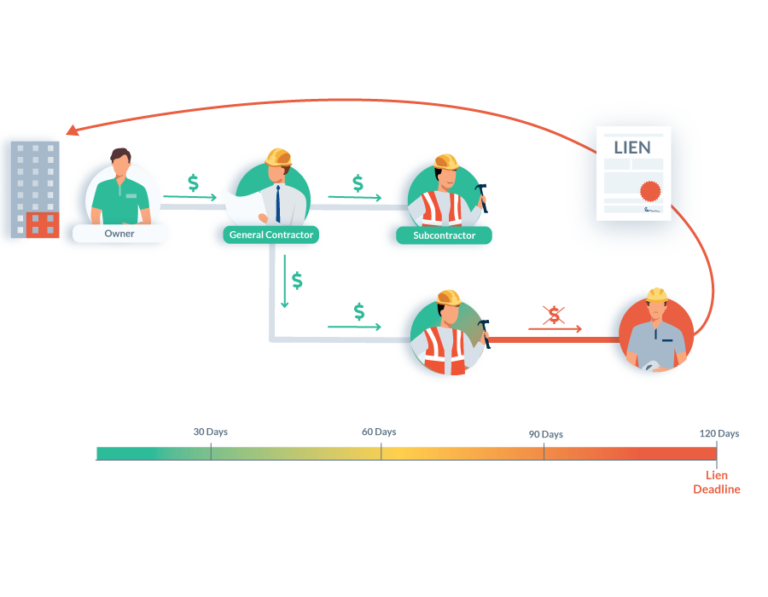

A mechanics lien is a legal claim on a home or other property, filed by an unpaid contractor or material supplier. The lien attaches to real property, providing the unpaid party with a security interest in the property itself. If the claim is not settled, the lien may lead to foreclosure, forcing the sale of the property to satisfy the debt.

Often called a construction lien, it may also be referred to as a materialman’s lien (when filed by a supplier) or an artisan’s lien (when filed by a design professional or tradesman).

Mechanics liens are typically only available on private construction projects, like residential, commercial, or industrial projects. (On public projects, unpaid parties are typically able to recover payment by filing a bond claim.)

How do mechanics liens work?

When a construction business performs labor or provides materials to a building project, they generally have the right to file a mechanics lien if they don’t receive payment. When a contractor files a mechanics lien, they gain a security interest in the home or property. The lien clouds the real estate title, making it difficult for the homeowner or property owner to sell it until the lien claim is paid.

Mechanics liens are very effective at spurring payment because they put financial pressure on the property owner and/or project lender.

Who can file a mechanics lien?

In general, anyone who makes a permanent improvement to real property can file a mechanics lien. Each state has their own laws that define who has the right to file a lien. Typically, general contractors, subcontractors, material suppliers, and laborers have lien rights. Some states also extend this protection to equipment lessors, architects, engineers, and other design professionals.

However, the right to file a lien is not absolute. In most states, contractors and suppliers must provide a preliminary notice at the start of the project and/or a notice of intent prior to filing a lien. Failure to provide a required notice by the statutory deadline can cause a contractor to lose their right to claim a lien.

How to file a mechanics lien

If a potential claimant meets all of the criteria required by the state, filing a mechanics lien generally involves three steps: completing the lien form, filing it with the county recorder, and serving notice on the property owner. For a detailed breakdown of the process, see: How to file a mechanics lien in any state.

Keep in mind, many states have strict notice requirements that must be met before a lien claim can be filed, whether it be a preliminary notice sent at the outset of the project, monthly notice requirements (in states like Texas & Tennessee), or a notice of intent to lien requirement sent prior to filing. Be sure to educate yourself on your state’s specific requirements.

1. Complete a valid mechanics lien form

Each state has its own rules about the information and formatting required on the lien claim itself. The claimant must complete the form accurately, including details about the property location, the amount owed, a description of work or materials provided, and other relevant information.

Download a free mechanics lien form for any state. All of our forms are prepared by construction attorneys to meet each state’s legal requirements.

2. Record the lien with the county

The claimant must file their completed lien form in the recorder’s office in the county where the property is located. Lien filing fees can varies widely, from just $5 to hundreds of dollars, depending on the county. Typically, a lien claim can be filed in-person, by mail, or electronically in some locations.

Find a county recorder office to get contact information, filing fees, and more.

3. Serve notice to the property owner

After filing a lien (or sometimes simultaneously), the claimant typically needs to notify the property owner. This is known as “serving the lien.” Some states also require the lien to be served on the property owner, the prime contractor and the construction lender, if one exists. Notice is typically served by certified mail, though some states have more complex requirements.