What is Retainage?

- Retainage Resources

- Top Links

Retainage FAQs

Have questions about retainage on your job, or retainage in general? This is a tricky area of law that can really impact your job, your cash, and/or your job risk. Learn everything you need to come out alive!

Map of Retainage Rules Nationwide

Retainage rules are different all across the country and the world. Use our color coded map to learn about the retainage requirements that may affect your next job.

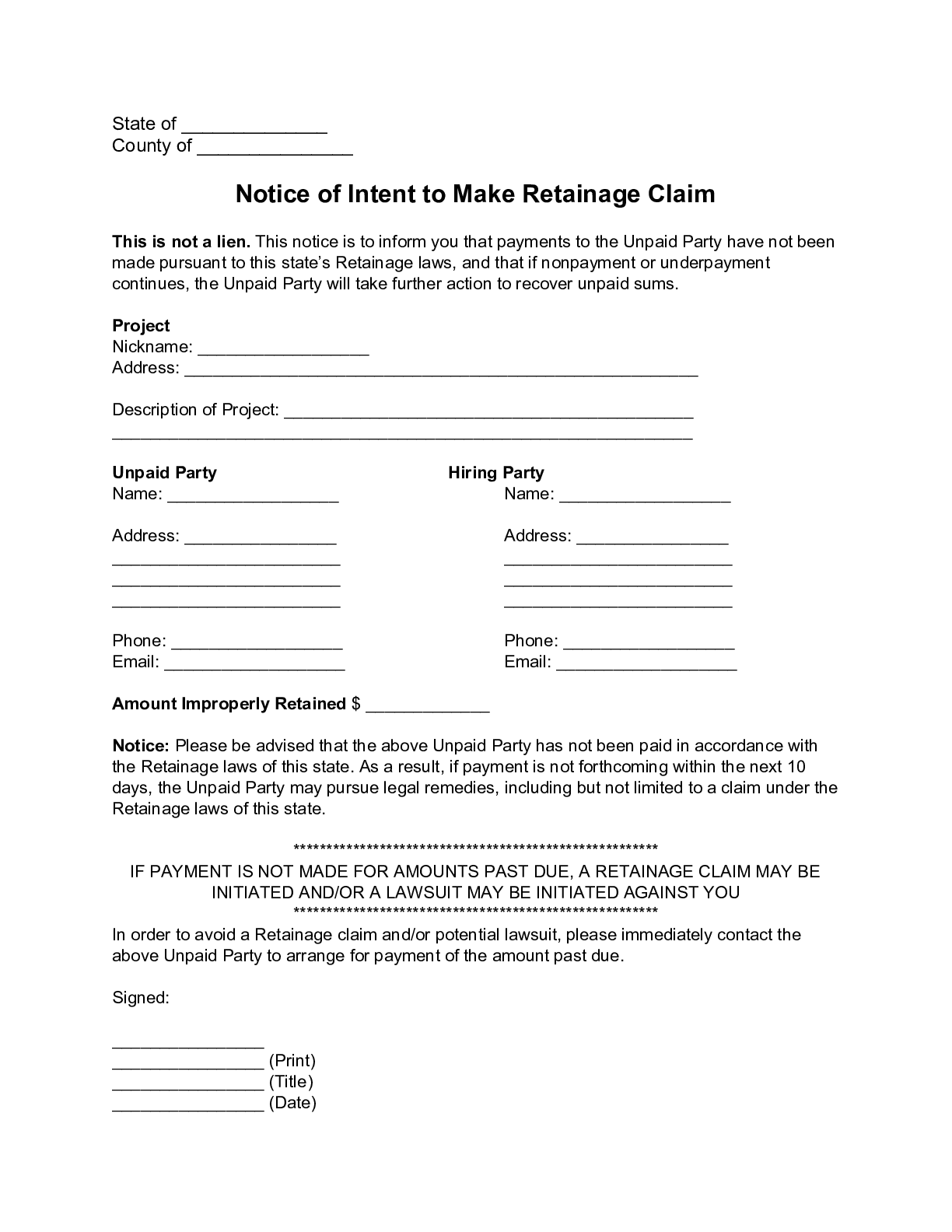

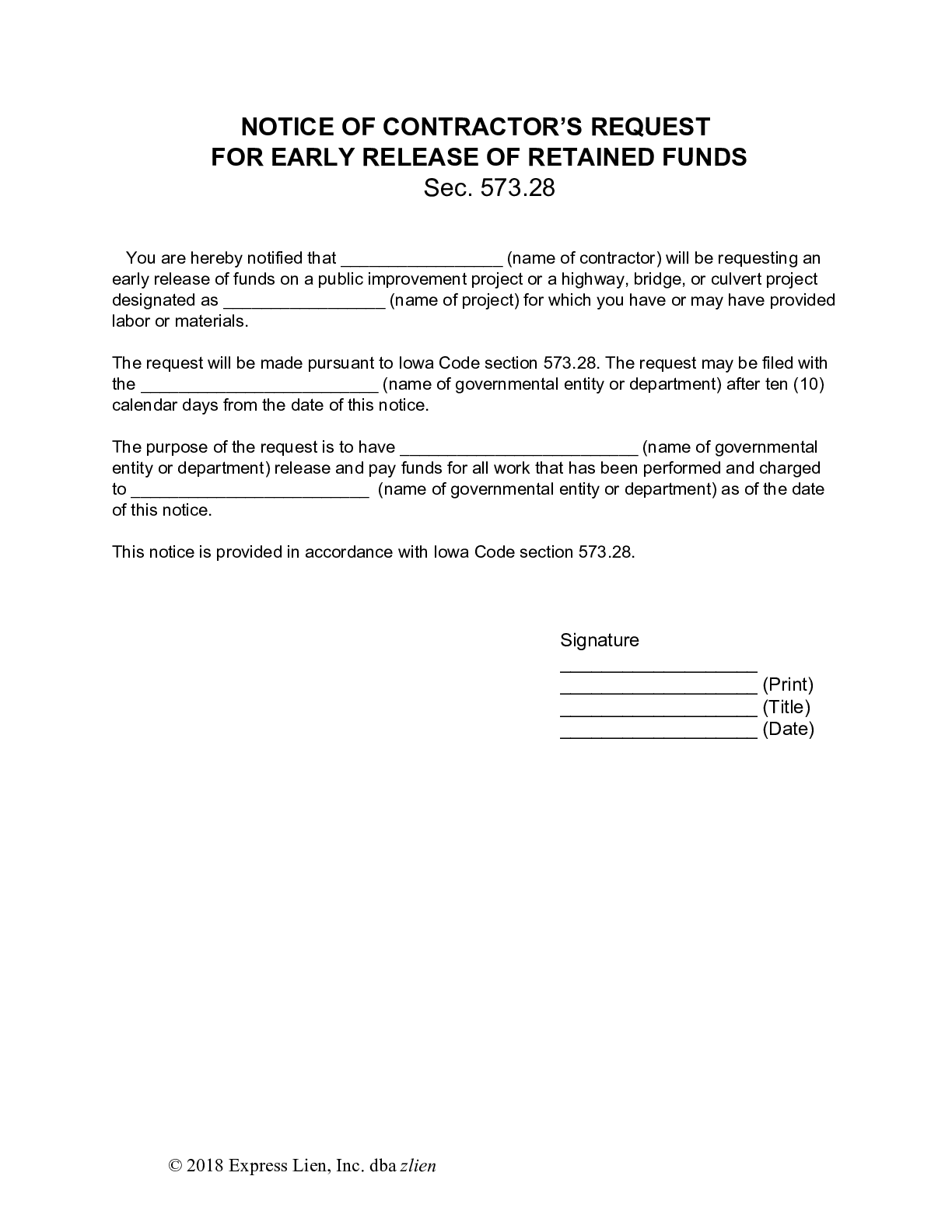

Demand Your Retainage Payment

Too often, contractors wait a long, long, long time to get paid the retainage withheld on a job. Sometimes, you need to make a specific demand to get retainage. Let's help you with this!

Retainage is an amount of money withheld from payment to a contractor or subcontractor until the end of the construction project, or a time specified in the contract. Also known as “retention,” the practice of withholding retainage is commonly used to ensure that the contractor or subcontractor finishes work completely and correctly. Retainage typically ranges from 5-10% of each progress payment.

A construction project’s retainage is set by the construction contract between the parties, in which both sides agree to some percentage withheld from each progress payment.

Read the most comprehensive explanation of retainage and how it works.

Retainage & the law

Some states have prompt payment laws that regulate how much can be withheld from contractors, while other states don’t. Some states have vague regulations, such as requiring that withholdings be “reasonable.” You need to consult the rules in your state — take a look at the retainage map to see what the rules are in your state.

In some rare circumstances, withholding money from contractors can actually be required by state law. For example, according to retainage rules in Texas, the property owner must retain 10% on private construction projects. Under New Mexico’s rules, by contrast, withholding retainage is prohibited.

Generally, withholding amounts in a construction contract that violate state-imposed limits will be rendered invalid.

The problem with retainage

However, the practice is controversial, and many argue that it compounds the construction industry’s working capital and cash flow challenges, thus creating more problems than it solves.

Retainage is commonly withheld until the end of a construction project overall, rather than the completion of a particular contractor’s work. This means that contractors or subcontractors whose work comes near the beginning of a project may have to wait months or years to collect all of the money owed to them.

Common retainage abuses

Unfortunately, it’s common for contractors and developers to abuse the retention practice in construction. This is done in two ways:

First, it’s abused to “stay ahead.” It’s a common construction practice to underpay a contractor for work done on a job. If, for example, 30% of work is completed, the developer or GC will only pay 25% of the price. And then, also take out a withholding. This is done to “stay ahead” of the subcontractor, to further protect the owner or GC. This is an abusive practice. You should check out the payment reputation and practices of your contractor to see whether anyone reports them engaging in this abusive practice.

Second, it’s abused by holding money too long or withholding high percentages. It’s common for contractors to have high amounts withheld from them (even when it’s limited!), and to have that money withheld for a very long time. Sometimes, contractors must have to make formal demands for retainage.

And there are other ways to abuse this practice, too. In one case of mismanagement of retainage, a GC tried to move retained money from one project to another, like some kind of evergreen deposit from a subcontractor!

Just like many other mechanisms related to construction payment, the retainage scheme can be abused. Accordingly, rules, requirements, and practices have been built into federal law and the laws of many states, with respect to retainage to promote its fair use and to prevent its abuse. The amount of the contract price that can be withheld and the time for which the retainage may be withheld vary by state (and federally), and be dependent on project type.