— 9 min read

Contractor Bonds vs. Insurance: What to Know

Last Updated Nov 30, 2023

As a contractor, it’s important to have the right protections in place before a project kicks off. To protect your company against third-party lawsuits, you should make sure you have the right types of insurance. You might also consider getting bonded, which protects project owners if something goes wrong.

However, choosing between a contractor bond and contractor insurance can be challenging, especially if you aren’t sure how they work. To help you choose a contractor bond vs. insurance, we’ll explain how these two things differ, who they protect, how much they cost, and how claims work for each one.

Contents

Table of contents

What is a construction bond?

A construction bond provides a third-party guarantee (usually from a corporate surety) that the contractor will perform and complete the work according to the terms and conditions of the contract.

A bond provides a guarantee to the project owner if the contractor does not adhere to the contractual agreements of the project. For the contractor, it provides financial peace of mind and ensures they won’t suffer a major financial loss if the project gets derailed.

A contract bond can protect the project owner against a variety of potential issues, such as:

- Non-payment to subcontractors

- Non-compliance with contract

- Project default

- Warranty issues

- Breaches of contract

Based on the scope of the project, you might be required to provide a bond. Here are some of the most common types of construction bonds that contractors often need to supply:

- Performance bond: A performance bond guarantees that you will complete the project based on the terms and agreements of the contract.

- Payment bond: This bond provides a conditional guarantee that you will pay subcontractors and suppliers in full for providing labor and materials necessary to complete the project.

- Maintenance bond: A maintenance bond protects the project owner from design or workmanship defects for a certain period of time after the project is done, similar to a warranty.

- Bid bond: A bid bond guarantees that the winning bidder will sign the contract and meet all contract specifications. If that does not occur, the owner can file a claim for the difference between the next lowest bid or the full bid amount (whichever is lower).

- Subdivision bond: This bond is often used when a government entity requires improvements to land during a project. It ensures that infrastructure projects are completed without financial harm to a municipality, such as sidewalks, street lights, storm drains, etc.

- License and permit bond: A license and permit bond is typically a compliance or regulatory requirement. These bonds ensure that the contractor, and their employees, will comply with the specified regulations or laws.

Learn more: A Contractor's Guide to Construction Bonds

What is construction insurance?

Construction insurance is a broad category of commercial insurance products that are applied to the work contractors do. These policies provide protection for the contractor’s company as a whole, beyond the project they are working on.

Many contractors can benefit from construction insurance because it provides financial protection in the event of a third-party lawsuit. Without insurance, you are responsible for covering the cost of the claim, including your legal fees and a settlement, using your company’s funds or your personal savings.

Construction insurance is not one-size-fits-all — there are many different coverages available. Some policies are legally required if you want to bid on a project, operate company vehicles, or sign a lease on a commercial office space, for example.

Contractors often hold several different types of construction insurance. Here are four common policies used in construction:

- General liability insurance provides financial protection against third-party claims of property damage or bodily injury that are caused by you or a subcontractor.

- Workers’ compensation insurance pays for a worker’s medical bills if they get injured or sick on the job. This policy is required in almost every state if you have at least one employee on staff.

- Professional liability insurance covers your company against claims related to poor professional advice or negligence that leads to financial loss for a client. (It is also known as errors and omissions (E&O) insurance.)

- Builder’s risk insurance provides coverage for buildings that are currently under construction, including jobsite equipment and materials installed.

Bonds vs insurance: What’s the difference?

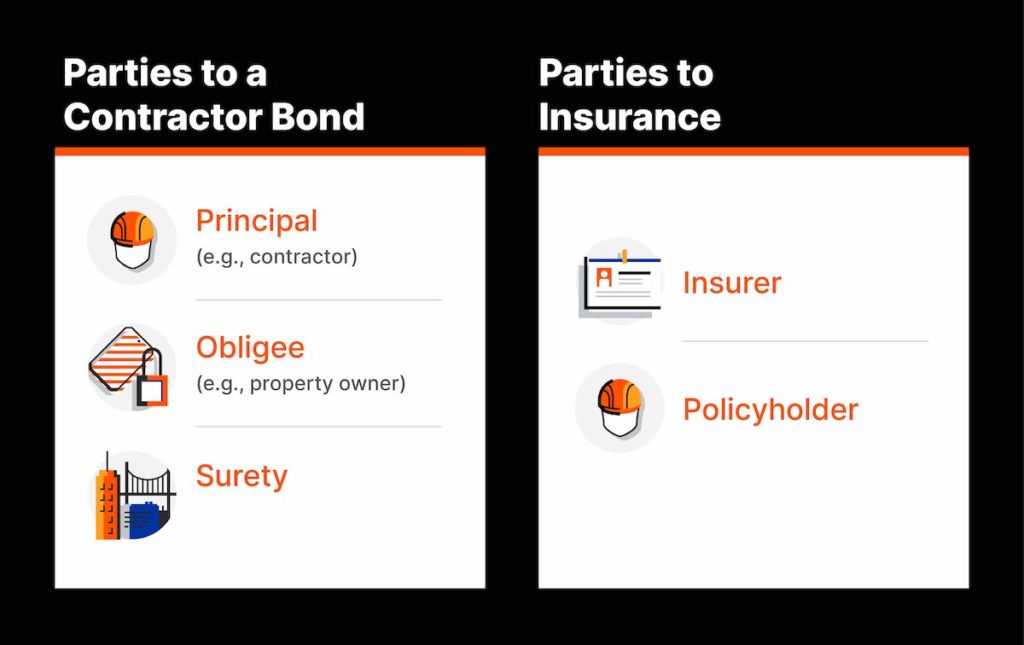

Although contractor bonds and construction insurance can both be valuable for contractors, bonds and insurance differ in a number of ways and have separate uses. There are three main differences between a bond and an insurance policy.

| Construction Bonds | Insurance | |

| Who is protected? | The project owner | The policyholder |

| Who has control? | Surety companies can have a lot of control over the process to complete the project if a default occurs | Insurance companies have no control over the project |

| Who pays for a claim? | The bond principal must pay back the surety after a claim. | The policyholder does not need to reimburse the insurance company. |

1. Who it protects

Contractor bonds protect the project owner, whereas insurance protects your business.

Let's use an example of bonds vs. insurance to illustrate this.

If you purchase a performance bond, it provides financial assurance to the owner that you will complete the project based on the specifications in the contract. If you fail to adhere to the terms of the contract, the owner can file a claim, shielding them from any financial loss.

If you hold a general liability policy, it protects your business financially from third-party lawsuits. Imagine that a client is walking through the jobsite, and they trip over the loose power cord. If the client gets injured and needs to see a doctor, they could file a claim for bodily injury. In this case, your general liability insurance would pay for the client’s medical bills, plus your legal fees if there was a lawsuit.

2. Amount of control

When it comes to claims, sureties and insurance companies have different amounts of control over how the claim is handled and how the payout is issued.

Let’s look at bonds. Depending on how the bond is written, a surety company can have almost total control over how the claim is resolved. If the claim is found to be based on proper default, the surety has a few options to resolve the claims:

- Issue a payout: If the contractor fails to uphold the agreements of their contract, the surety can pay the amount of the bond, or compensate the project owner for the cost of completion.

- Finance the remaining project cost: If the contractor is close to finishing the project, the surety may finance the remaining funds needed to finish the work.

- Hire a replacement contractor: Depending on the situation, the surety can decide to find and hire a replacement contractor to finish the project. Or, the surety may allow the owner to get a replacement contractor, and the surety will take on the additional costs.

An insurance company, on the other hand, has no control over how claims are handled.

With a construction insurance claim, “insurers conduct due diligence to determine that there is coverage under the policy for the loss and to quantify the amount to be paid out,” says Anderson. “The amount paid is net of any applicable deductibles and other coinsurance provisions of the policy.”

After a claim, the insurance company simply cuts a check for the assessed damages, whether the money goes to the insured or a third party. The claim is either approved and paid or denied — there aren’t any other options.

3. Who pays for a claim

With a surety claim, the surety company pays to resolve the claim as necessary. However, the contractor must pay back the money that the surety paid out on its behalf. That’s why it’s so important for contractors to follow their contract agreements and find solutions to avoid surety claims, which end up costing them money out-of-pocket.

For example, if a contractor fails to uphold its contractual agreements and the project owner receives a payment of $20,000 from the surety to resolve the claim, the contractor has to pay the $20,000 back to the surety. For a larger project, a surety bond could be millions of dollars (depending on the specs of the work), which would significantly increase the amount of money the contractor would have to pay out-of-pocket if the surety claim was paid out. The terms of repayment are defined in an indemnity agreement between the contractor and the surety company.

With an insurance claim, the contractor receives compensation for their legal fees and/or a settlement or judgment with the third party. The policy owner is not required to pay anything to their insurance company after the claim is settled.

However, insurance claims can impact premiums. In the event of a construction insurance claim, the policy owner may see their monthly or annual rate increase. The rate hike depends on a variety of factors, like the nature of the claim and the size of the payout.

Comparing costs

The costs of contractor bonds and contractor insurance are not fixed. They depend on a variety of factors and are unique to each individual contractor.

Bond pricing is based on the credit quality of the contractor, as well as the type of work, geography, project history, and duration of the contracts being covered. Insurance premiums, on the other hand, are generally more straightforward.

Some of the factors that underwriters consider when setting premiums include:

- Location

- Coverage limits

- Policies chosen

- Number of employees

- Company revenue

- Services provided

Whether you need a contractor bond or insurance policy, you can usually get a cost estimate from a licensed insurance agent or broker. Finding a good agency advocate is key to addressing risk mitigation and cost comparisons.

Categories:

Tags:

Written by

Elizabeth Rivelli

Elizabeth Rivelli is a freelance writer specializing in insurance and finance. Her writing has been featured in dozens of publications, including Investopedia, The Balance, Forbes, Bankrate, NextAdvisor, and Insurance.com. Elizabeth holds a degree in Communication Studies from Northeastern University. She lives in New England.

View profileExplore more helpful resources

Positioning a Balance Sheet to Help Secure Surety Bonds

In construction finance, a balance sheet is a financial document that a business creates. It lists all of the business’s assets, liabilities, and owners’ equity to give a snapshot of...

The Contractor’s Guide to Increasing Bonding Capacity

Contractors who want to work on bonded construction projects will need bonding capacity — the ability to secure a bond to help protect the owner against performance, default, financial or...

How Construction Payment Bonds Work — and Why They Matter

From the smallest home renovation to the largest public works project, the world of construction is backstopped by one fundamental principle: Trust. Owners and public agencies must be able to...

Performance Bonds for Construction Explained

Performance bonds provide a guarantee that a contractor will fulfill all of their obligations under a construction agreement. Performance bonds are a subset of contract bonds and guarantee that a...